Acorn Energy (ACFN): Price and Financial Metrics

ACFN Price/Volume Stats

| Current price | $8.79 | 52-week high | $10.99 |

| Prev. close | $8.85 | 52-week low | $4.00 |

| Day low | $8.75 | Volume | 796 |

| Day high | $8.79 | Avg. volume | 2,097 |

| 50-day MA | $9.55 | Dividend yield | N/A |

| 200-day MA | $7.08 | Market Cap | 21.86M |

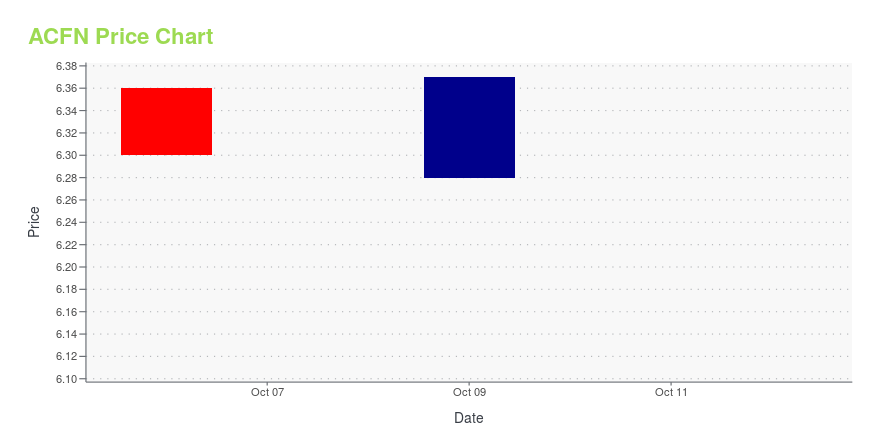

ACFN Stock Price Chart Interactive Chart >

Acorn Energy (ACFN) Company Bio

Acorn Energy, Inc., through its subsidiaries, develops and markets wireless remote monitoring and control systems for various markets in the United States and internationally. It operates through two segments, Power Generation (PG) Monitoring and Cathodic Protection (CP) Monitoring. The PG segment provides wireless remote monitoring and control systems, and services for critical assets, which include stand-by power generators, compressors, pumps, pumpjacks, light towers, turbines, and other industrial equipment; and Internet of Things applications. The CP segment offers remote monitoring of cathodic protection systems on gas pipelines for gas utilities and pipeline companies. The company was incorporated in 1986 and is based in Wilmington, Delaware.

Latest ACFN News From Around the Web

Below are the latest news stories about ACORN ENERGY INC that investors may wish to consider to help them evaluate ACFN as an investment opportunity.

Acorn Energy, Inc. (PNK:ACFN) Q3 2023 Earnings Call TranscriptAcorn Energy, Inc. (PNK:ACFN) Q3 2023 Earnings Call Transcript November 11, 2023 Operator: Good morning, and welcome to the Acorn Energy 2023 Third Quarter Conference Call. [Operator Instructions] As a reminder, today’s conference is being recorded. Now I will turn the conference over to Tracy Clifford, CFO of Acorn Energy and COO of its OmniMetrix […] |

Acorn Q3 EPS Rises to $0.01 vs. Loss of ($0.08) on 17% Revenue Increase; Signs Generator Dealer Agreement That Could Drive Significant Growth in 2024Investor Call Today at 11am ET – Dial-in # 1-844-834-0644WILMINGTON, Del., Nov. 09, 2023 (GLOBE NEWSWIRE) -- Acorn Energy, Inc. (OTCQB: ACFN), a provider of remote monitoring and control solutions for backup power generators, gas pipelines, air compressors and other mission- critical assets, announced results for its third quarter ended September 30, 2023 (Q3’23). Acorn generated positive net income and operating cash flow on Q3’23 revenue growth of 17%. Acorn also announced a significant new re |

Acorn, Provider of Remote Monitoring, Control and Electrical Grid Demand Response Solutions for Backup Generators, Hosts Q3 Investor Call Thur., Nov. 9th at 11am ETWILMINGTON, Del., Nov. 01, 2023 (GLOBE NEWSWIRE) -- Acorn Energy, Inc. (OTCQB: ACFN), a provider of remote monitoring and control solutions for stand-by power generators, gas pipelines, air compressors, and other critical equipment, will host its third quarter conference call, Thursday, November 9th at 11:00 a.m. ET. Jan Loeb, President & CEO, and Tracy Clifford, CFO of Acorn & COO of OmniMetrix, will review Acorn’s results and outlook and answer investor questions. Financial results will be rel |

Remote Monitoring and Control Solutions Provider Acorn Announces 1-for-16 Reverse Stock Split Intended to Make its Shares Accessible to a Broader Range of InvestorsWILMINGTON, Del., Sept. 07, 2023 (GLOBE NEWSWIRE) -- Acorn Energy, Inc. (OTCQB: ACFN), a provider of remote monitoring and control solutions for stand-by power generators, gas pipelines, air compressors and other critical industrial equipment, announced that its Board of Directors has approved a reverse split of its Common Stock at a ratio of 1-for-16. The reverse split is intended to increase the market price of the Company's Common Stock and make Acorn’s shares accessible to a broader range of |

Acorn Hosts Annual Stockholder Meeting and Management Q&A in Person and via Zoom on Tuesday, September 12th at 1pm ETBALTIMORE and WILMINGTON, Del., Sept. 06, 2023 (GLOBE NEWSWIRE) -- Acorn Energy, Inc. (OTCQB: ACFN), a provider of remote monitoring and control solutions for stand-by power generators, gas pipelines, air compressors and other critical industrial assets, will hold its 2023 Annual Meeting of Stockholders at 1:00 PM ET on Tuesday, September 12, 2023 at 2800 Quarry Lake Drive, Suite 130, Baltimore, Maryland 21209. The meeting will also be accessible via Zoom for investors who register in advance by |

ACFN Price Returns

| 1-mo | -9.85% |

| 3-mo | -2.33% |

| 6-mo | 44.10% |

| 1-year | 80.12% |

| 3-year | -11.29% |

| 5-year | 69.04% |

| YTD | 44.33% |

| 2023 | 8.75% |

| 2022 | -44.44% |

| 2021 | 71.34% |

| 2020 | -0.62% |

| 2019 | 44.25% |

Continue Researching ACFN

Want to do more research on Acorn Energy Inc's stock and its price? Try the links below:Acorn Energy Inc (ACFN) Stock Price | Nasdaq

Acorn Energy Inc (ACFN) Stock Quote, History and News - Yahoo Finance

Acorn Energy Inc (ACFN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...