Accenture PLC Cl A (ACN): Price and Financial Metrics

ACN Price/Volume Stats

| Current price | $328.46 | 52-week high | $387.51 |

| Prev. close | $330.12 | 52-week low | $278.69 |

| Day low | $325.21 | Volume | 2,438,200 |

| Day high | $329.81 | Avg. volume | 2,947,021 |

| 50-day MA | $303.64 | Dividend yield | 1.56% |

| 200-day MA | $329.86 | Market Cap | 205.84B |

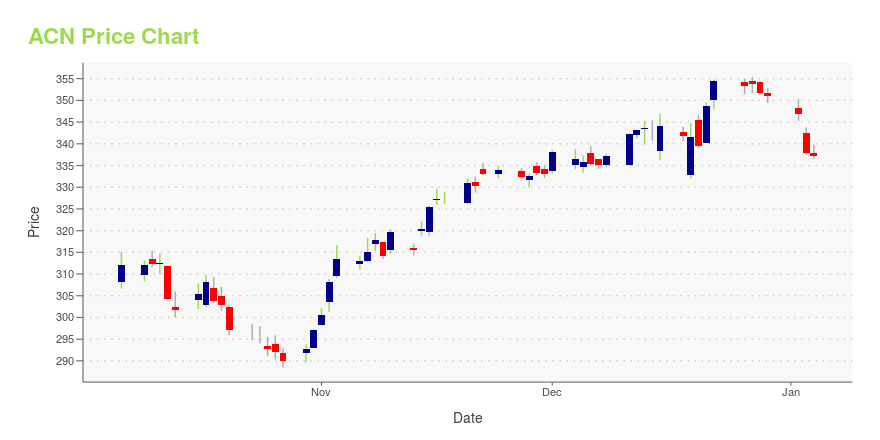

ACN Stock Price Chart Interactive Chart >

Accenture PLC Cl A (ACN) Company Bio

Accenture plc is an Irish-domiciled multinational company that provides consulting and processing services. A Fortune Global 500 company, it reported revenues of $44.33 billion in 2020 and had 537,000 employees. In 2015, the company had about 150,000 employees in India, 48,000 in the US, and 50,000 in the Philippines. Accenture's current clients include 91 of the Fortune Global 100 and more than three-quarters of the Fortune Global 500. (Source:Wikipedia)

Latest ACN News From Around the Web

Below are the latest news stories about ACCENTURE PLC that investors may wish to consider to help them evaluate ACN as an investment opportunity.

25 Cheapest Online Business Degree Programs Heading Into 2024In this article, we will be looking at the 25 cheapest online business degree programs heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Cheapest Online Business Degree Programs Heading Into 2024. Human Resources: Career Spotlight Joining the human resources industry is a popular career choice […] |

25 Best Online Accounting Degree Programs Heading Into 2024In this article, we will be looking at the 25 best online accounting degree programs heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Best Online Accounting Degree Programs Heading Into 2024. Accounting Services Market and Job Outlook Accounting services entail a diverse range of services […] |

Why Tesla may be one of the Magnificent Seven to avoidTech has been the talk of Wall Street in 2023 as the Magnificent Seven - Amazon (AMZN), Apple (AAPL), Alphabet (GOOG,GOOGL), Nvidia (NVDA), Meta (META), Microsoft (MSFT), and Tesla (TSLA), hold almost 30% of the value of the S&P 500 (^GSPC). But could that change in 2024? Washington Crossing Advisors Senior Portfolio Manager Chad Morganlander joins Yahoo Finance for the latest edition of Good Buy or Goodbye where he provides insight for investing in the tech sector heading into 2024. The stock Morganlander argues is a good buy is Accenture (ACN). Morganlander says Accenture will benefit from other companies investing in AI and tech advancements that will need their services. Morganlander also claims the company has increased in bookings and revenue growth and points to long-term growth ... |

Here's Why You Should Hold on to Accenture (ACN) Stock NowAccenture (ACN) has a disciplined acquisition strategy focused on channelizing its business in high-growth areas, adding skills and capabilities, and deepening industry and functional expertise. |

15 Prominent NYSE Stocks That Hit 52-Week Highs This WeekIn this article, we will take a look at the 15 prominent NYSE stocks that hit 52-week highs this week. To skip our analysis of the recent trends, and market activity, you can go directly to see the 5 Prominent NYSE Stocks That Hit 52-Week Highs This Week. The Wall Street ended another week in […] |

ACN Price Returns

| 1-mo | 8.30% |

| 3-mo | 7.11% |

| 6-mo | -10.75% |

| 1-year | 4.69% |

| 3-year | 7.32% |

| 5-year | 79.55% |

| YTD | -5.28% |

| 2023 | 33.60% |

| 2022 | -34.75% |

| 2021 | 60.67% |

| 2020 | 26.04% |

| 2019 | 51.21% |

ACN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ACN

Here are a few links from around the web to help you further your research on Accenture plc's stock as an investment opportunity:Accenture plc (ACN) Stock Price | Nasdaq

Accenture plc (ACN) Stock Quote, History and News - Yahoo Finance

Accenture plc (ACN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...