Aclarion, Inc., (ACON): Price and Financial Metrics

ACON Price/Volume Stats

| Current price | $0.32 | 52-week high | $11.50 |

| Prev. close | $0.31 | 52-week low | $0.27 |

| Day low | $0.30 | Volume | 236,000 |

| Day high | $0.33 | Avg. volume | 1,970,704 |

| 50-day MA | $0.30 | Dividend yield | N/A |

| 200-day MA | $2.10 | Market Cap | 2.66M |

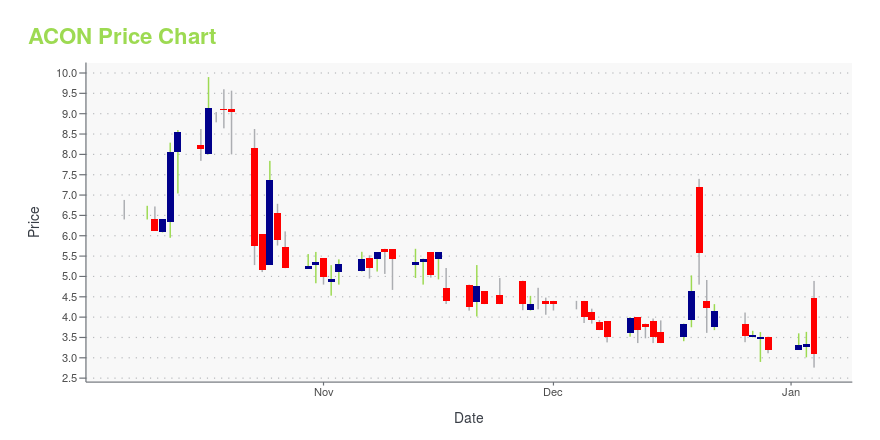

ACON Stock Price Chart Interactive Chart >

Aclarion, Inc., (ACON) Company Bio

Aclarion, Inc., a healthcare technology company, develops software application for magnetic resonance spectroscopy (MRS) in the United States. It offers NOCISCAN-LS Post-Processor suite comprising NOCICALC-LS that receives and processes the acquired disc MRS data to calculate levels of degenerative pain biomarkers; and NOCIGRAM-LS, a clinical decision support software. The company was formerly known as Nocimed, Inc. and changed its name to Aclarion, Inc. in December 2021. Aclarion, Inc. was founded in 2008 and is based in San Mateo, California.

Latest ACON News From Around the Web

Below are the latest news stories about ACLARION INC that investors may wish to consider to help them evaluate ACON as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start off Thursday with a breakdown of the biggest pre-market stock movers worth keeping an eye on this morning! |

Aclarion Announces Key Commercial Milestone With Completion of 1,000 Nociscan ExamsPace of Nociscan orders accelerated 2.5x for the last 250 scans compared to the first 250 scans Further acceleration of scan volumes expected as MRIs are activated for the recently completed panel of 10 Key Opinion Leader (KOL) surgeons All commercial Nociscans to date have been completed on Siemens MRI scanners with additional acceleration of volumes expected as Philips scanners are onboarded BROOMFIELD, CO, Nov. 27, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire -- Aclarion, Inc., (“Aclarion” or th |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's time to start the final day of trading this week with a breakdown of the biggest pre-market stock movers for Friday morning! |

Aclarion Announces Achievement of Goal to Enroll 10 Leading Spine Surgery Key Opinion Leaders (KOLs) to Support Nociscan AdoptionRecruitment of a panel of leading KOL surgeons who believe Nociscan can improve the diagnosis and treatment of discogenic low back pain is a critical step to establishing Nociscan as standard of care. Aclarion’s KOL panel represents spine surgeons at some of the largest and most influential academic centers and private practices in the country, including leaders of national societies that advocate for protocols to improve clinical treatments. The Company intends to activate MRIs for each KOL sur |

Aclarion Expands Immediate Nociscan Access Into New York City With Tenth Key Opinion Leader Surgeon Advisor Addition Roger Hartl, MDDr. Hartl is the Hansen-MacDonald Professor of Neurological Surgery and Director of Spinal Surgery at the Weill Cornell Brain and Spine Center in New York, and the co-director of New York-Presbyterian Och Spine. Dr. Hartl becomes Aclarion’s 2nd KOL to get access to an MRI center authorized to perform Nociscans, adding NYC to Denver as the second active KOL site. Aclarion will report on Nociscan volumes to date before the end of the year and add this key metric to quarterly reporting beginning in |

ACON Price Returns

| 1-mo | 3.76% |

| 3-mo | -5.04% |

| 6-mo | -88.73% |

| 1-year | -96.49% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -90.00% |

| 2023 | -65.52% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...