AcelRx Pharmaceuticals, Inc. (ACRX): Price and Financial Metrics

ACRX Price/Volume Stats

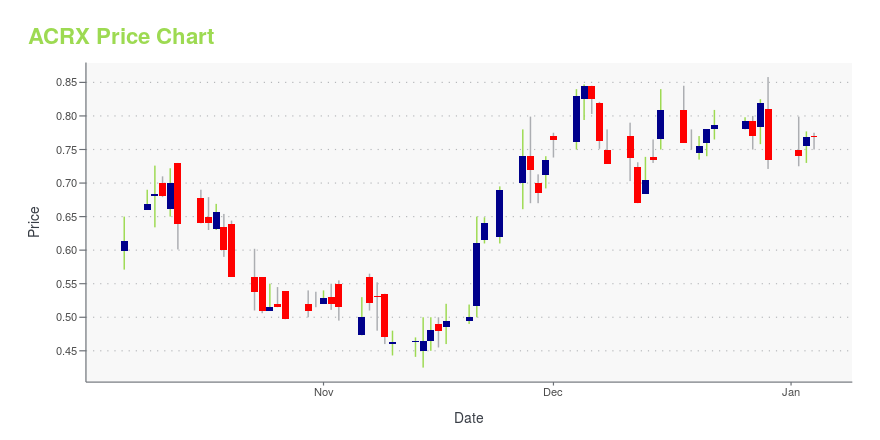

| Current price | $0.86 | 52-week high | $2.78 |

| Prev. close | $0.80 | 52-week low | $0.43 |

| Day low | $0.78 | Volume | 243,500 |

| Day high | $0.88 | Avg. volume | 137,683 |

| 50-day MA | $0.67 | Dividend yield | N/A |

| 200-day MA | $0.82 | Market Cap | 14.58M |

ACRX Stock Price Chart Interactive Chart >

AcelRx Pharmaceuticals, Inc. (ACRX) Company Bio

AcelRx Pharmaceuticals, Inc., a specialty pharmaceutical company, develops and commercializes therapies for the treatment of acute pain. The company was founded in 2005 and is based in Redwood City, California.

Latest ACRX News From Around the Web

Below are the latest news stories about ACELRX PHARMACEUTICALS INC that investors may wish to consider to help them evaluate ACRX as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the trading week with a look at the biggest pre-market stock movers worth watching for Monday morning! |

AcelRx Pharmaceuticals, Inc. (NASDAQ:ACRX) Q3 2023 Earnings Call TranscriptAcelRx Pharmaceuticals, Inc. (NASDAQ:ACRX) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Welcome to the AcelRx third quarter 2023 financial results conference call. This call is being webcasted live via the events page of the Investors section of AcelRx’s website at www.acelrx.com. This call is property of AcelRx, and any recording, reproduction or transmission […] |

AcelRx Reports Third Quarter 2023 Financial Results and Provides Corporate UpdateAcelRx Pharmaceuticals, Inc. (Nasdaq: ACRX), (AcelRx), a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings, today reported its third quarter 2023 financial results and provided a corporate update. |

AcelRx to Host KOL Panel Discussion on Current Anticoagulant Use in Dialysis and the Upcoming Niyad™ Clinical StudyAcelRx Pharmaceuticals, Inc. (Nasdaq: ACRX), (AcelRx), a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings, today announced that it will host a virtual Key Opinion Leader (KOL) panel discussion on its lead candidate Niyad™ (nafamostat) for use as an anticoagulant in dialysis circuits. The panel will feature two thought-leaders in the nephrology and critical care fields who are also co-authors on a re |

AcelRx to Host Third Quarter 2023 Financial Results Call and Webcast on November 8, 2023AcelRx Pharmaceuticals, Inc. (Nasdaq: ACRX), (AcelRx), a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings, today announced that it will release third quarter 2023 financial results after market close on Wednesday, November 8, 2023, then host a live webcast and conference call at 4:30 p.m. Eastern Standard Time/1:30 p.m. Pacific Standard Time to discuss the results and provide an update on the Compan |

ACRX Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -10.42% |

| 3-year | -96.39% |

| 5-year | -98.24% |

| YTD | 17.01% |

| 2023 | -67.48% |

| 2022 | -79.83% |

| 2021 | -54.82% |

| 2020 | -41.23% |

| 2019 | -8.66% |

Continue Researching ACRX

Want to see what other sources are saying about Acelrx Pharmaceuticals Inc's financials and stock price? Try the links below:Acelrx Pharmaceuticals Inc (ACRX) Stock Price | Nasdaq

Acelrx Pharmaceuticals Inc (ACRX) Stock Quote, History and News - Yahoo Finance

Acelrx Pharmaceuticals Inc (ACRX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...