Adamis Pharmaceuticals Corporation (ADMP): Price and Financial Metrics

ADMP Price/Volume Stats

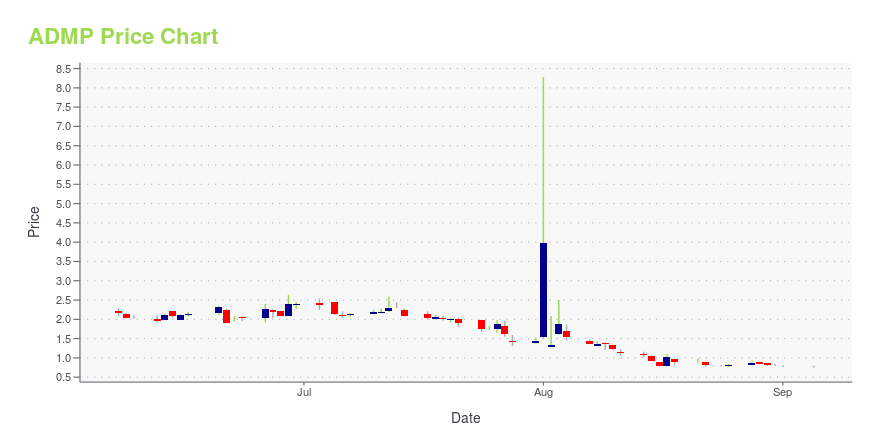

| Current price | $0.78 | 52-week high | $26.18 |

| Prev. close | $0.77 | 52-week low | $0.75 |

| Day low | $0.75 | Volume | 119,800 |

| Day high | $0.79 | Avg. volume | 811,695 |

| 50-day MA | $1.54 | Dividend yield | N/A |

| 200-day MA | $7.60 | Market Cap | 7.25M |

ADMP Stock Price Chart Interactive Chart >

Adamis Pharmaceuticals Corporation (ADMP) Company Bio

Adamis Pharmaceuticals Corporation, a specialty biopharmaceutical company, engages in developing and commercializing products in the therapeutic areas of allergy and respiratory disease. The company is based in San Diego, California.

Latest ADMP News From Around the Web

Below are the latest news stories about ADAMIS PHARMACEUTICALS CORP that investors may wish to consider to help them evaluate ADMP as an investment opportunity.

Adamis Pharmaceuticals Changes Name to DMK Pharmaceuticals to Reflect New Strategic FocusCompany to begin trading under new ticker symbol “DMK” on September 8, 2023SAN DIEGO, Sept. 07, 2023 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP), a commercial-stage biopharmaceutical company, today announced the company changed its name to DMK Pharmaceuticals Corporation in order to better reflect its new strategic focus on advancing small molecules for the treatment of substance use disorders. In conjunction with the name change, the company’s common stock is expected |

Adamis Pharmaceuticals Reports Second Quarter 2023 Financial Results and Provides Corporate UpdateSAN DIEGO, Aug. 21, 2023 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP), a commercial-stage biopharmaceutical company, today announced financial results for the second quarter ended June 30, 2023, and provided an update on recent corporate developments. Q2 2023 Corporate Highlights In May, the Company closed the merger with DMK Pharmaceuticals Corporation (DMK), a private, clinical-stage biotechnology company at the forefront of endorphin-inspired drug design focused on de |

Adamis Pharmaceuticals Announces Closing of $8.0 Million Public OfferingSAN DIEGO, Aug. 04, 2023 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP), a commercial-stage biopharmaceutical company, today announced the closing of its public offering of 5,930,000 units, with each unit consisting of one share of common stock (or pre-funded warrant in lieu thereof) and one warrant to purchase one share of common stock. Each unit was sold at a public offering price of $1.35. The common warrants are immediately exercisable at a price of $1.35 per share and |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayWe're starting off the day with a breakdown of all the biggest pre-market stock movers worth reading about on Thursday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayIt's time for another breakdown of the biggest pre-market stock movers as we check out all of the latest news for Wednesday! |

ADMP Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -51.85% |

| 3-year | -98.93% |

| 5-year | -99.06% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -72.02% |

| 2021 | 24.72% |

| 2020 | -30.74% |

| 2019 | -68.87% |

Continue Researching ADMP

Here are a few links from around the web to help you further your research on Adamis Pharmaceuticals Corp's stock as an investment opportunity:Adamis Pharmaceuticals Corp (ADMP) Stock Price | Nasdaq

Adamis Pharmaceuticals Corp (ADMP) Stock Quote, History and News - Yahoo Finance

Adamis Pharmaceuticals Corp (ADMP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...