Advent Technologies Holdings, Inc. (ADN): Price and Financial Metrics

ADN Price/Volume Stats

| Current price | $4.50 | 52-week high | $27.72 |

| Prev. close | $4.90 | 52-week low | $2.70 |

| Day low | $3.50 | Volume | 106,014 |

| Day high | $4.73 | Avg. volume | 39,550 |

| 50-day MA | $3.56 | Dividend yield | N/A |

| 200-day MA | $6.57 | Market Cap | 9.37M |

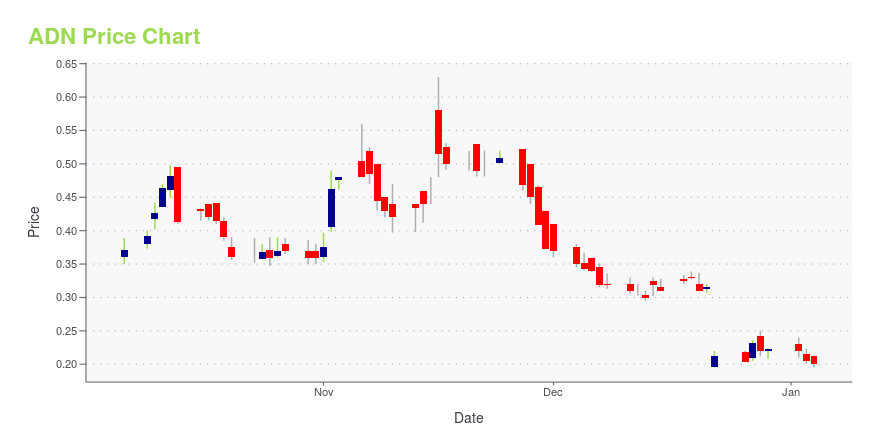

ADN Stock Price Chart Interactive Chart >

Advent Technologies Holdings, Inc. (ADN) Company Bio

Advent Technologies Holdings, Inc. operates as a holding company. The Company, through its subsidiaries, provides of high-temperature proton exchange membranes (HT-PEM) and HT-pEM based membrane electrode assemblies (MEA), which are components used in fuel cells and other electrochemistry applications such as electrolyzers, flow batteries, and IoT sensors.

Latest ADN News From Around the Web

Below are the latest news stories about ADVENT TECHNOLOGIES HOLDINGS INC that investors may wish to consider to help them evaluate ADN as an investment opportunity.

Advent Technologies Announces $2 Million Registered Direct Offering of Common StockBOSTON, December 22, 2023--Advent Technologies Holdings, Inc. (NASDAQ: ADN) ("Advent" or the "Company"), an innovation-driven leader in the fuel cell and hydrogen technology sectors, today announced that it has entered into securities purchase agreements with institutional and accredited investors to purchase 10,000,000 shares of common stock in a registered direct offering at a per share purchase price of $0.20, resulting in gross proceeds of $2,000,000. |

Advent Technologies Launches Portable Clean Power Solution for Construction and EV Charging ApplicationsBOSTON, December 20, 2023--Advent Technologies Holdings, Inc. (NASDAQ: ADN), an innovation-driven leader in the fuel cell and hydrogen technology space, is pleased to unveil the SereneP, a cutting-edge product line set to redefine portable power solutions with a particular focus on construction and EV charging applications. |

Advent Technologies Secures €1.8 Million Frame Contract with Volta Energy for the Supply of Methanol-Powered Fuel Cell UnitsBOSTON, December 18, 2023--Advent Technologies Holdings, Inc. (NASDAQ: ADN) ("Advent" or the "Company"), an innovation-driven leader in the fuel cell and hydrogen technology sectors, is pleased to announce the signing of a new frame contract with Volta Energy. Volta Energy, a Dutch company founded by brothers Roel and Luc Bleumer, specializes in the development of hybrid mobile power products and offers total mobile energy supply solutions to sectors such as construction, festivals, and events. |

Advent Technologies Secures Additional New Contract worth $2.8 Million from U.S. Department of Defense for its Portable Fuel Cell SystemBOSTON, December 14, 2023--Advent Technologies Holdings, Inc. (NASDAQ: ADN), an innovation-driven leader in the fuel cell and hydrogen technology space, is delighted to announce that its subsidiary, Advent Technologies, LLC, has secured an additional new $2.8 million contract with the U.S. Department of Defense (DoD). This milestone achievement augments Advent’s $2.2 million contract that was announced on September 7, 2023, which focuses on finalizing the design of the Honey Badger 50™ ("HB50") |

Advent Technologies Granted 180-Day Extension by NASDAQ to Regain Compliance with Minimum Bid RequirementBOSTON, November 22, 2023--Advent Technologies Holdings, Inc. (NASDAQ: ADN) ("Advent"), an innovation-driven leader in the fuel cell and hydrogen technology space, today announced that it has received a notification letter from Nasdaq Stock Market LLC ("Nasdaq") that the Company has been granted an additional 180-day compliance period, or until May 20, 2024, to regain compliance with Nasdaq’s minimum bid price rule. |

ADN Price Returns

| 1-mo | 63.64% |

| 3-mo | -1.06% |

| 6-mo | -15.73% |

| 1-year | -82.35% |

| 3-year | -98.09% |

| 5-year | N/A |

| YTD | -32.68% |

| 2023 | -87.69% |

| 2022 | -74.18% |

| 2021 | -53.05% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...