Autodesk Inc. (ADSK): Price and Financial Metrics

ADSK Price/Volume Stats

| Current price | $240.86 | 52-week high | $279.53 |

| Prev. close | $242.23 | 52-week low | $192.01 |

| Day low | $239.99 | Volume | 1,267,128 |

| Day high | $245.34 | Avg. volume | 1,709,120 |

| 50-day MA | $232.38 | Dividend yield | N/A |

| 200-day MA | $233.17 | Market Cap | 51.91B |

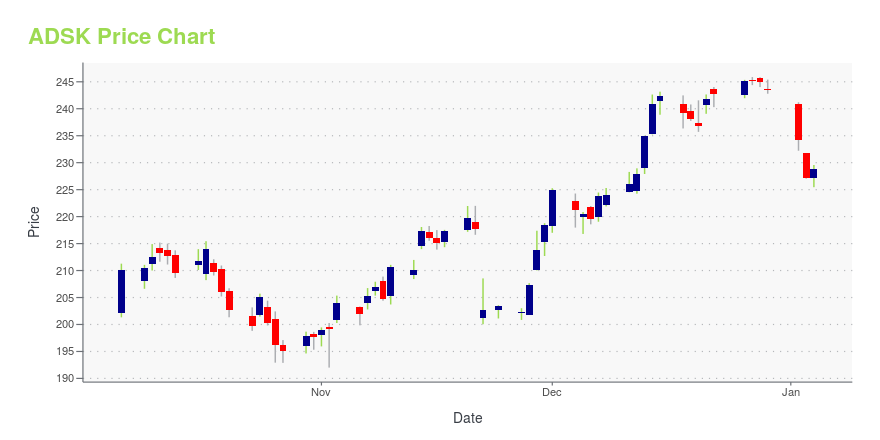

ADSK Stock Price Chart Interactive Chart >

Autodesk Inc. (ADSK) Company Bio

Autodesk, Inc. is an American multinational software corporation that makes software products and services for the architecture, engineering, construction, manufacturing, media, education, and entertainment industries. Autodesk is headquartered in San Rafael, California, and features a gallery of its customers' work in its San Francisco building. The company has offices worldwide. Its U.S. offices are located in the states of California, Oregon, Colorado, Texas, Michigan, New Hampshire and Massachusetts. Its Canada offices are located in the provinces of Ontario, Quebec, and Alberta. (Source:Wikipedia)

Latest ADSK News From Around the Web

Below are the latest news stories about AUTODESK INC that investors may wish to consider to help them evaluate ADSK as an investment opportunity.

Intuit (INTU) Up 9% Since Last Earnings Report: Can It Continue?Intuit (INTU) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Got $1,000? Here Are 3 Stocks That Could Make You Rich in 20242024 could be a great year for this trio of stocks. |

Autodesk Inc Director Stacy Smith Sells 5,000 SharesOn December 22, 2023, Stacy Smith, a Director at Autodesk Inc (NASDAQ:ADSK), sold 5,000 shares of the company's stock, according to a recent SEC Filing. |

Why Is Autodesk (ADSK) Up 16.8% Since Last Earnings Report?Autodesk (ADSK) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Investing in Autodesk (NASDAQ:ADSK) five years ago would have delivered you a 88% gainThe simplest way to invest in stocks is to buy exchange traded funds. But in our experience, buying the right stocks... |

ADSK Price Returns

| 1-mo | -0.99% |

| 3-mo | 10.52% |

| 6-mo | -4.82% |

| 1-year | 14.99% |

| 3-year | -21.86% |

| 5-year | 43.38% |

| YTD | -1.08% |

| 2023 | 30.29% |

| 2022 | -33.54% |

| 2021 | -7.91% |

| 2020 | 66.43% |

| 2019 | 42.65% |

Continue Researching ADSK

Want to see what other sources are saying about Autodesk Inc's financials and stock price? Try the links below:Autodesk Inc (ADSK) Stock Price | Nasdaq

Autodesk Inc (ADSK) Stock Quote, History and News - Yahoo Finance

Autodesk Inc (ADSK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...