Autodesk Inc. (ADSK): Price and Financial Metrics

ADSK Price/Volume Stats

| Current price | $296.83 | 52-week high | $326.62 |

| Prev. close | $292.16 | 52-week low | $223.03 |

| Day low | $292.30 | Volume | 1,058,616 |

| Day high | $296.88 | Avg. volume | 1,626,779 |

| 50-day MA | $297.99 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 63.52B |

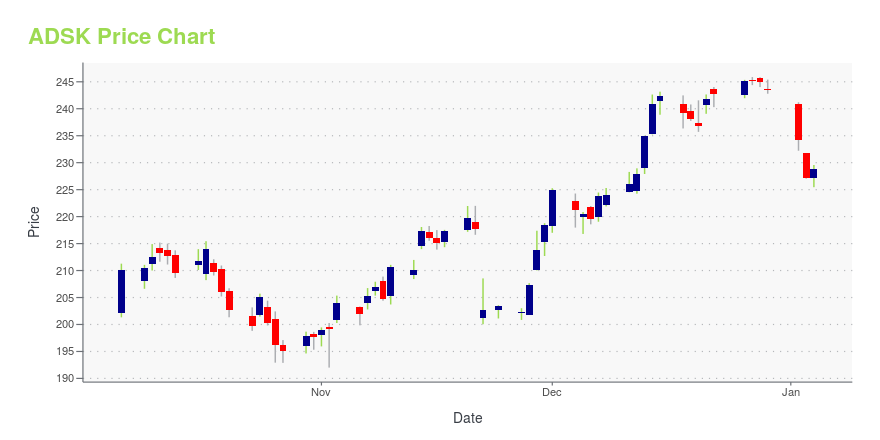

ADSK Stock Price Chart Interactive Chart >

Autodesk Inc. (ADSK) Company Bio

Autodesk, Inc. is an American multinational software corporation that makes software products and services for the architecture, engineering, construction, manufacturing, media, education, and entertainment industries. Autodesk is headquartered in San Rafael, California, and features a gallery of its customers' work in its San Francisco building. The company has offices worldwide. Its U.S. offices are located in the states of California, Oregon, Colorado, Texas, Michigan, New Hampshire and Massachusetts. Its Canada offices are located in the provinces of Ontario, Quebec, and Alberta. (Source:Wikipedia)

ADSK Price Returns

| 1-mo | 0.56% |

| 3-mo | N/A |

| 6-mo | 1.85% |

| 1-year | 22.25% |

| 3-year | 60.66% |

| 5-year | 24.88% |

| YTD | 0.43% |

| 2024 | 21.39% |

| 2023 | 30.29% |

| 2022 | -33.54% |

| 2021 | -7.91% |

| 2020 | 66.43% |

Continue Researching ADSK

Want to see what other sources are saying about Autodesk Inc's financials and stock price? Try the links below:Autodesk Inc (ADSK) Stock Price | Nasdaq

Autodesk Inc (ADSK) Stock Quote, History and News - Yahoo Finance

Autodesk Inc (ADSK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...