ADiTx Therapeutics Inc. (ADTX): Price and Financial Metrics

ADTX Price/Volume Stats

| Current price | $1.35 | 52-week high | $68.08 |

| Prev. close | $1.38 | 52-week low | $1.30 |

| Day low | $1.31 | Volume | 185,282 |

| Day high | $1.44 | Avg. volume | 455,204 |

| 50-day MA | $1.72 | Dividend yield | N/A |

| 200-day MA | $3.68 | Market Cap | 2.69M |

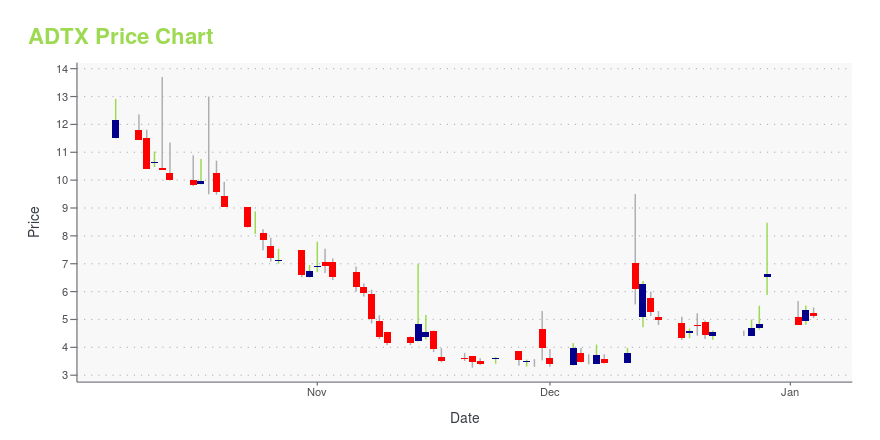

ADTX Stock Price Chart Interactive Chart >

ADiTx Therapeutics Inc. (ADTX) Company Bio

ADiTx Therapeutics, Inc. is a preclinical stage, life sciences company which engages in the development of nucleic acid (DNA)-based technologies to minimize rejection of transplanted organs by human recipients as well as address autoimmune diseases and allergies. The firm have worldwide license for commercializing a nucleic acid-based technology, named Apoptotic DNA Immunotherapy (ADi), which utilizes a novel approach that mimics the way the body naturally induces tolerance to its own tissue. The company was founded by Leonard L. Bailey, Shahrokh Shabahang, and Amro Albanna on September 28, 2017 and is headquartered in Loma Linda, CA.

Latest ADTX News From Around the Web

Below are the latest news stories about ADITXT INC that investors may wish to consider to help them evaluate ADTX as an investment opportunity.

Why Is Aditxt (ADTX) Stock Up 70% Today?Aditxt stock is rising higher on Thursday as investors react to heavy trading of ADTX shares despite a lack of news today. |

Why Is Connexa Sports Technologies (CNXA) Stock Up 31% Today?Connexa Sports Technologies stock is rising on a new 5.9% CNXA shareholder and a secondary offering from one of its investors. |

Why Is Redhill Biopharma (RDHL) Stock Down 27% Today?Redhill Biopharma stock is falling on Thursday as shares of RDHL give up some of the gains they made throughout the week. |

Why Is Vivos Therapeutics (VVOS) Stock Down 35% Today?Vivos Therapeutics stock is falling on Thursday but that's only after VVOS shares experienced a massive rally on Wednesday! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time for a breakdown of the biggest pre-market stock movers as we check out all of the hottest news on Thursday morning! |

ADTX Price Returns

| 1-mo | -2.88% |

| 3-mo | -43.51% |

| 6-mo | -65.47% |

| 1-year | -91.35% |

| 3-year | -99.97% |

| 5-year | N/A |

| YTD | -79.64% |

| 2023 | -85.64% |

| 2022 | -95.69% |

| 2021 | -74.23% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...