Advaxis, Inc. (ADXS): Price and Financial Metrics

ADXS Price/Volume Stats

| Current price | $0.00 | 52-week high | $1.49 |

| Prev. close | $0.14 | 52-week low | $0.00 |

| Day low | $0.00 | Volume | 633 |

| Day high | $0.00 | Avg. volume | 16,875 |

| 50-day MA | $0.25 | Dividend yield | N/A |

| 200-day MA | $0.62 | Market Cap | 51.16K |

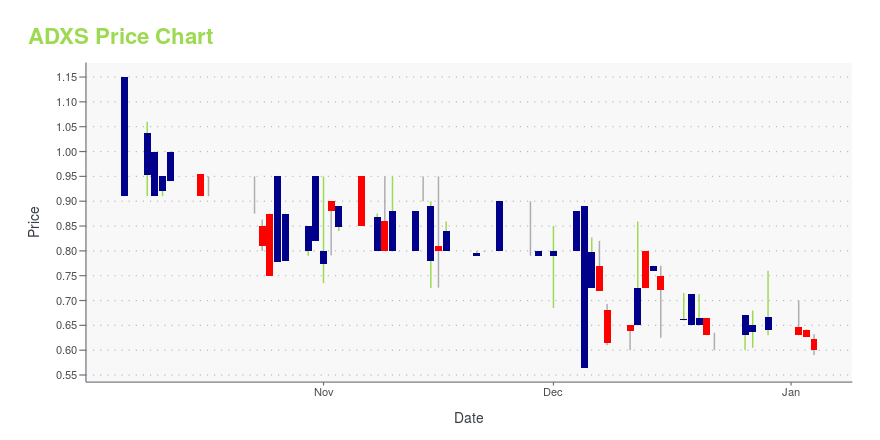

ADXS Stock Price Chart Interactive Chart >

Advaxis, Inc. (ADXS) Company Bio

Advaxis Inc. is a clinical-stage biotechnology company developing multiple cancer immunotherapies based on its proprietary Lm Technology. The company was founded in 2002 and is based in Princeton, New Jersey.

Latest ADXS News From Around the Web

Below are the latest news stories about AYALA PHARMACEUTICALS INC that investors may wish to consider to help them evaluate ADXS as an investment opportunity.

Ayala Pharmaceuticals Announces AL102 Receives Orphan Drug Designation for Desmoid TumorsREHOVOT, Israel and MONMOUTH JUNCTION, N.J., Nov. 06, 2023 (GLOBE NEWSWIRE) -- Ayala Pharmaceuticals, Inc. (OTCQX: ADXS), a clinical-stage oncology company, today announced that the U.S. Food and Drug Administration (FDA) has granted Orphan Drug Designation to AL102, a Gamma Secretase Inhibitor (GSI), for the treatment of desmoid tumors (DT). AL102 is an investigational small molecule GSI, currently being evaluated in the Phase 3 RINGSIDE study in DT. Orphan drug designation is granted by the FD |

Ayala Pharmaceuticals Presents Updated AL102 Results from Phase 2 Clinical Trial in Desmoid Tumors at ESMO Congress 2023AL102 1.2 mg once daily treatment achieved Overall Response Rate of 83% in the evaluable population AL102 1.2 mg once daily treatment resulted in 88% reduction in tumor volume and 85% reduction in T2W signal intensity REHOVOT, Israel and MONMOUTH JUNCTION, N.J., Oct. 23, 2023 (GLOBE NEWSWIRE) -- Ayala Pharmaceuticals, Inc. (OTCQX: ADXS), a clinical-stage oncology company, today announced that new data from the RINGSIDE study evaluating its lead investigational candidate AL102 for the treatment o |

Ayala Pharmaceuticals Announces Closing of Merger with BiosightREHOVOT, Israel & MONMOUTH JUNCTION, N.J., Oct. 19, 2023 (GLOBE NEWSWIRE) -- Ayala Pharmaceuticals, Inc. (OTCQX: ADXS), a clinical-stage oncology company, today announced the closing of its merger with Biosight, Ltd. (“Biosight”), pursuant to which Ayala acquired Biosight. The combined company will operate under the name Ayala Pharmaceuticals, Inc., and its shares will continue to trade on the OTCQX under Ayala’s current ticker symbol (“ADXS”). “We are pleased to close the merger with Biosight w |

Ayala Pharmaceuticals Announces Second Quarter 2023 Financial Results and Provides Corporate UpdateSuccessful End-of-Phase 2 meeting with FDA regarding AL102 for the treatment of desmoid tumors Enrollment in the Phase 3 segment of RINGSIDE trial evaluating AL102 continuing globally as planned Definitive merger agreement with Biosight, expected to close near end of Q3 2023 REHOVOT, Israel and MONMOUTH JUNCTION, N.J., Aug. 10, 2023 (GLOBE NEWSWIRE) -- Ayala Pharmaceuticals, Inc. (OTCQX: ADXS), a clinical-stage oncology company, today announced second-quarter 2023 financial results and provided |

Ayala Pharmaceuticals Announces Abstracts on AL102 and AL101 Accepted for Presentation at ESMO Congress 2023REHOVOT, Israel and MONMOUTH JUNCTION, N.J., Aug. 01, 2023 (GLOBE NEWSWIRE) -- Ayala Pharmaceuticals, Inc. (OTCQX: ADXS), a publicly-traded clinical-stage oncology company, today announced that it will present posters on its gamma secretase inhibitors AL102 and AL101 at the European Society for Molecular Oncology (ESMO) Congress 2023, to be held in Madrid, Spain 20-24 October 2023. Poster Presentation DetailsTitle:Phase 2 Results from the RINGSIDE Phase 2/3 Trial of AL102 for Treatment of Desmoi |

ADXS Price Returns

| 1-mo | 0.00% |

| 3-mo | 0.00% |

| 6-mo | 0.00% |

| 1-year | 0.00% |

| 3-year | 0.00% |

| 5-year | 0.00% |

| YTD | 0.00% |

| 2023 | -44.42% |

| 2022 | -90.36% |

| 2021 | -55.38% |

| 2020 | -59.34% |

| 2019 | -69.91% |

Continue Researching ADXS

Here are a few links from around the web to help you further your research on Advaxis Inc's stock as an investment opportunity:Advaxis Inc (ADXS) Stock Price | Nasdaq

Advaxis Inc (ADXS) Stock Quote, History and News - Yahoo Finance

Advaxis Inc (ADXS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...