Aethlon Medical, Inc. (AEMD): Price and Financial Metrics

AEMD Price/Volume Stats

| Current price | $1.29 | 52-week high | $8.44 |

| Prev. close | $1.27 | 52-week low | $1.10 |

| Day low | $1.23 | Volume | 130,847 |

| Day high | $1.35 | Avg. volume | 148,213 |

| 50-day MA | $2.18 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 3.34M |

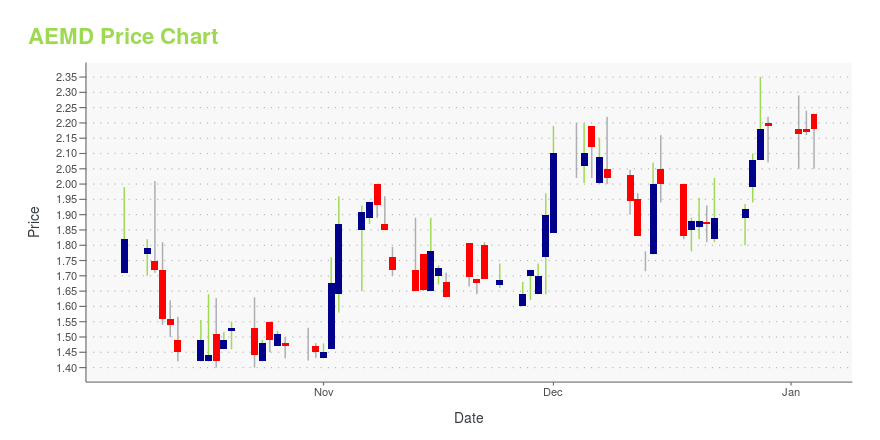

AEMD Stock Price Chart Interactive Chart >

Aethlon Medical, Inc. (AEMD) Company Bio

Aethlon Medical, Inc., a medical technology company, focuses on developing products to diagnose and treat life and organ threatening diseases in the United States. The company is developing Aethlon Hemopurifier, a clinical-stage immunotherapeutic device that removes exosomes and life-threatening viruses from the human circulatory system. It is also developing TauSome, an exosomal biomarker candidate to diagnose chronic traumatic encephalopathy in living individuals. Aethlon Medical, Inc. has a collaboration with the University of Pittsburgh for studies related to head and neck cancer. The company is based in San Diego, California.

AEMD Price Returns

| 1-mo | -25.86% |

| 3-mo | N/A |

| 6-mo | -75.71% |

| 1-year | -61.29% |

| 3-year | -98.46% |

| 5-year | -99.23% |

| YTD | -81.25% |

| 2024 | -60.73% |

| 2023 | -20.48% |

| 2022 | -85.19% |

| 2021 | -24.70% |

| 2020 | 156.49% |

Continue Researching AEMD

Want to do more research on Aethlon Medical Inc's stock and its price? Try the links below:Aethlon Medical Inc (AEMD) Stock Price | Nasdaq

Aethlon Medical Inc (AEMD) Stock Quote, History and News - Yahoo Finance

Aethlon Medical Inc (AEMD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...