ADDvantage Technologies Group, Inc. (AEY): Price and Financial Metrics

AEY Price/Volume Stats

| Current price | $0.36 | 52-week high | $14.90 |

| Prev. close | $0.60 | 52-week low | $0.32 |

| Day low | $0.32 | Volume | 1,028,300 |

| Day high | $0.50 | Avg. volume | 1,862,110 |

| 50-day MA | $2.21 | Dividend yield | N/A |

| 200-day MA | $4.35 | Market Cap | 539.28K |

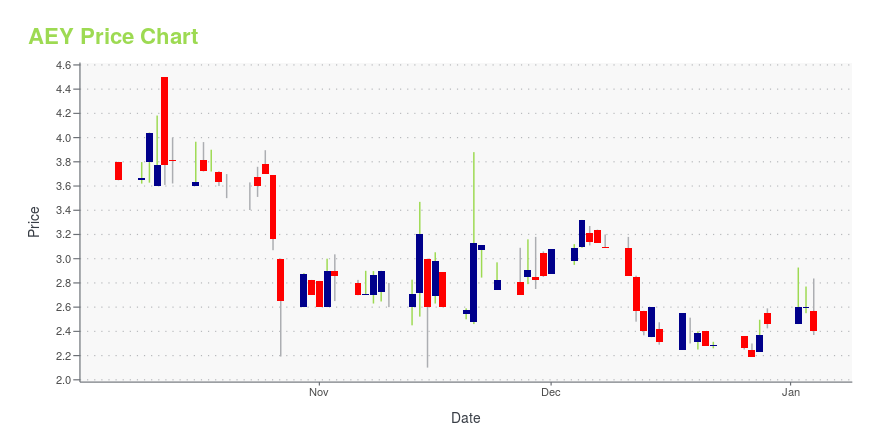

AEY Stock Price Chart Interactive Chart >

ADDvantage Technologies Group, Inc. (AEY) Company Bio

ADDvantage Technologies Group, Inc., through its subsidiaries, distributes and services electronics and hardware for the telecommunications industry in the United States, Canada, Central America, Asia, Europe, Mexico, South America, and internationally. The company operates through two segments, Wireless Infrastructure Services and Telecommunications. The Wireless Infrastructure Services segment provides turn-key wireless infrastructure services for U.S. wireless carriers, communication tower companies, national integrators, and original equipment manufacturers. This segment also offers installation, upgradation, and maintenance of technology on cell sites; and the construction of new small cells for 5G. The Telecommunications segment provides central office equipment that include optical transport, switching, and data center equipment for communication networks; customer premise equipment, such as integrated access devices, channel banks, Internet protocol private branch exchange phones, and routers; and decommissioning services for surplus and obsolete telecom equipment. The company was formerly known as ADDvantage Media Group, Inc. and changed its name to ADDvantage Technologies Group, Inc. in December 1999. ADDvantage Technologies Group, Inc. was incorporated in 1989 and is headquartered in Carrollton, Texas.

Latest AEY News From Around the Web

Below are the latest news stories about ADDVANTAGE TECHNOLOGIES GROUP INC that investors may wish to consider to help them evaluate AEY as an investment opportunity.

ADDvantage Technologies Regains Compliance with Nasdaq Minimum Bid Price RequirementCARROLLTON, Texas, Dec. 04, 2023 (GLOBE NEWSWIRE) -- ADDvantage Technologies Group, Inc. (NASDAQ: AEY) (“ADDvantage Technologies” or the “Company”) today announced that on December 1, 2023, it received a notification letter (the “Notification Letter”) from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it had regained compliance with the minimum bid price requirement set forth in the Nasdaq Listing Rule 5550(a)(2) (the “Nasdaq Capital M |

ADDvantage Technologies Group, Inc. (NASDAQ:AEY) Q3 2023 Earnings Call TranscriptADDvantage Technologies Group, Inc. (NASDAQ:AEY) Q3 2023 Earnings Call Transcript November 17, 2023 Operator: Good afternoon and welcome to the ADDvantage Technologies Group Fiscal 2023 Third Quarter Financial Results Conference Call. All participants will be in listen-only mode. [Operator Instructions] Please note this event is being recorded. I would now like to turn the conference […] |

ADDvantage Technologies Group, Inc. Completes 1-for-10 Reverse Stock Split as Part of Nasdaq Compliance PlanCARROLLTON, Texas, Nov. 16, 2023 (GLOBE NEWSWIRE) -- ADDvantage Technologies Group, Inc. (NASDAQ: AEY) (“ADDvantage Technologies” or the “Company”) today announced that on November 16, 2023, ADDvantage Technologies Group, Inc. effected a one-for-10 (1:10) reverse stock split of all issued and outstanding shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) effective as of 12:01 a.m. Eastern Time on November 16, 2023 (the “Reverse Stock Split”), vide a Certificate |

ADDvantage Technologies Reports Financial Results for the Quarter Ended September 30, 2023CARROLLTON, Texas, Nov. 14, 2023 (GLOBE NEWSWIRE) -- ADDvantage Technologies Group, Inc. (NASDAQ: AEY) (“ADDvantage Technologies” or the “Company”) today reported financial results for the three and nine months ended September 30, 2023, the third quarter of 2023. “We have taken proactive steps to reduce our fixed costs by $2 million this year in response to industry-wide headwinds in both segments,” commented Joe Hart, Chief Executive Officer. “Simultaneously, we are aggressively expanding our F |

ADDvantage Technologies Announces 1-for-10 Reverse Stock Split as Part of Nasdaq Compliance PlanCARROLLTON, Texas, Nov. 09, 2023 (GLOBE NEWSWIRE) -- ADDvantage Technologies Group, Inc. (NASDAQ: AEY) (“ADDvantage Technologies” or the “Company”) today announced that it will effect a 1-for-10 reverse stock split of its common stock, $0.01 par value per share (the “Common Stock”), where every ten issued and outstanding shares of Common Stock will be converted into one share of Common Stock (the “Reverse Stock Split”). The Reverse Stock Split is expected to take effect as of 12:01 a.m., Eastern |

AEY Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -82.04% |

| 1-year | -94.00% |

| 3-year | -98.39% |

| 5-year | -97.89% |

| YTD | -85.37% |

| 2023 | -83.03% |

| 2022 | -16.18% |

| 2021 | -42.14% |

| 2020 | 21.54% |

| 2019 | 71.43% |

Continue Researching AEY

Want to do more research on Addvantage Technologies Group Inc's stock and its price? Try the links below:Addvantage Technologies Group Inc (AEY) Stock Price | Nasdaq

Addvantage Technologies Group Inc (AEY) Stock Quote, History and News - Yahoo Finance

Addvantage Technologies Group Inc (AEY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...