Acutus Medical Inc. (AFIB): Price and Financial Metrics

AFIB Price/Volume Stats

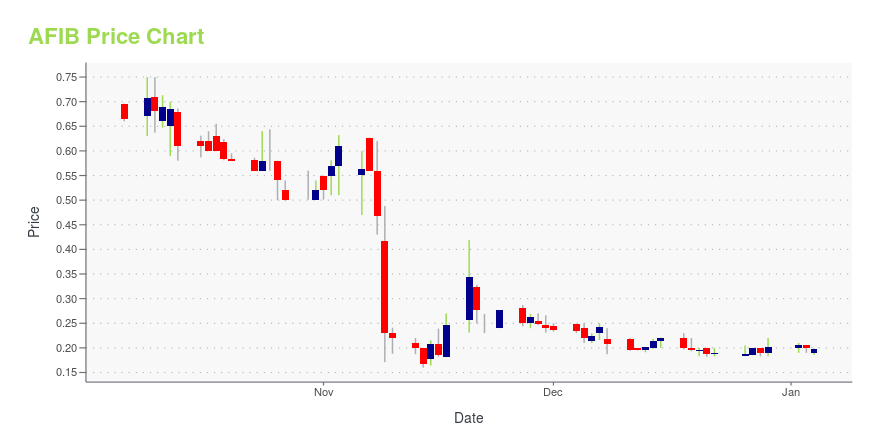

| Current price | $0.03 | 52-week high | $0.79 |

| Prev. close | $0.03 | 52-week low | $0.03 |

| Day low | $0.03 | Volume | 5,090 |

| Day high | $0.04 | Avg. volume | 1,230,949 |

| 50-day MA | $0.04 | Dividend yield | N/A |

| 200-day MA | $0.20 | Market Cap | 906.52K |

AFIB Stock Price Chart Interactive Chart >

Acutus Medical Inc. (AFIB) Company Bio

Acutus Medical develops medical technologies to treat complex cardiac arrhythmia. The company's platform displays the heart’s true activation pattern, turning the chaos of a complex arrhythmia into a clear vision for electrophysiologists. Acutus Medical is a privately funded company founded in 2011 and based in Carlsbad, California. Its products are co-developed in the U.S. and Europe with an exceptional team of medical scientists, biomedical engineers, and other professionals.

Latest AFIB News From Around the Web

Below are the latest news stories about ACUTUS MEDICAL INC that investors may wish to consider to help them evaluate AFIB as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time to start Tuesday trading with a breakdown of the biggest pre-market stock movers worth keeping an eye on this morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start the day with a breakdown of the biggest pre-market stock movers worth keeping an eye on for Thursday! |

Acutus laying off 65% of employees to focus solely on Medtronic heart device dealThe company has decided to exit the mapping and ablation business and focus its remaining cash on the Medtronic partnership. |

Acutus Medical Inc (AFIB) Reports Substantial Revenue Growth in Q3 2023 Despite Negative Gross ...Improvements in Operating Efficiency and Strategic Partnerships Drive Performance |

Acutus Medical Reports Third Quarter 2023 Financial ResultsCARLSBAD, Calif., Nov. 08, 2023 (GLOBE NEWSWIRE) -- Acutus Medical, Inc. (“Acutus” or the “Company”) (Nasdaq: AFIB) today reported results for the third quarter of 2023. Recent Highlights: Third quarter revenue of $5.2 million grew 44% year-over-year, led by strong growth in distribution revenue from sales of left-heart access products to MedtronicRegistered significant year-over-year reductions in both GAAP and non-GAAP operating expenses and cash burn, resulting from disciplined focus on expen |

AFIB Price Returns

| 1-mo | -29.25% |

| 3-mo | -81.98% |

| 6-mo | -87.12% |

| 1-year | -95.52% |

| 3-year | -99.80% |

| 5-year | N/A |

| YTD | -85.14% |

| 2023 | -82.44% |

| 2022 | -66.28% |

| 2021 | -88.16% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...