Affimed N.V. (AFMD): Price and Financial Metrics

AFMD Price/Volume Stats

| Current price | $5.12 | 52-week high | $8.95 |

| Prev. close | $5.10 | 52-week low | $2.23 |

| Day low | $5.09 | Volume | 93,900 |

| Day high | $5.23 | Avg. volume | 364,190 |

| 50-day MA | $5.49 | Dividend yield | N/A |

| 200-day MA | $5.16 | Market Cap | 77.96M |

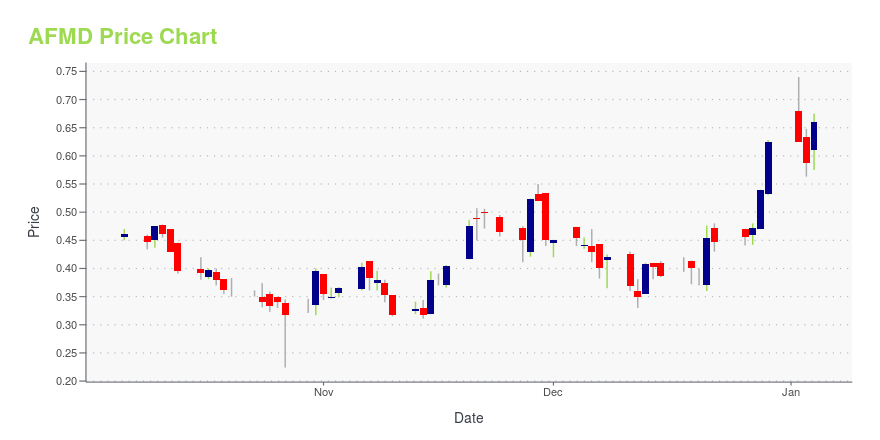

AFMD Stock Price Chart Interactive Chart >

Affimed N.V. (AFMD) Company Bio

Affimed NV is a clinical-stage biopharmaceutical company focused on discovering and developing highly targeted cancer immunotherapies. The company was founded in 2000 and is based in Heidelberg, Germany.

Latest AFMD News From Around the Web

Below are the latest news stories about AFFIMED NV that investors may wish to consider to help them evaluate AFMD as an investment opportunity.

3 Penny Stocks That Are Too Compelling to IgnoreWhile the topic of top penny stocks to buy may arouse controversy similar to apocryphal literature with spiritual implications. |

Affimed Announces Positive Data for AFM24 in Combination with the PD-L1 Checkpoint Inhibitor Atezolizumab in Heavily Pre-treated EGFR-Wildtype Non-Small Cell Lung Cancer PatientsData update from AFM24-102 Phase 1/2a combination study includes 15 heavily pre-treated patients from the EGFR-wildtype non-small cell lung cancer (NSCLC) expansion cohort Responses observed in 4 of 15 patients, including 1 confirmed partial response (PR), 1 unconfirmed complete response (CR) awaiting confirmation, 2 unconfirmed PRs awaiting confirmation; an additional 7 of 15 patients exhibiting stable disease (SD) leading to a disease control rate of 73%Tumor shrinkage observed in 7 of 15 (47% |

Affimed Announces Updated Phase 1/2 Data from Acimtamig in Combination with Allogeneic NK in Hodgkin Lymphoma Patients Who Failed Prior Chemotherapy and Are Double-Refractory to Brentuximab Vedotin (BV) and Checkpoint Inhibitors (CPIs)In 32 patients with relapsed/refractory (r/r) Hodgkin lymphoma (HL) treated at the recommended phase 2 dose level (RP2D), the objective response rate (ORR) was 97% and the complete response (CR) rate was 78%In this cohort median EFS was 9.8 months with 84% patients alive at 12 months, and median duration of response (DoR) was 8.8 monthsPatients were heavily pretreated (median of 7 prior lines), all had previously received CPIs and BV, and were refractory to their most recent line of therapyPatie |

Affimed to Host Investor Conference Call Highlighting Clinical Data for Acimtamig (AFM13) and AFM24Review clinical data of acimtamig in combination with cord-blood derived NK cells presented at ASH 2023; provide progress update on the LuminICE-203Review clinical data for AFM24 in solid tumorsConference call/webcast on Monday, December 11, 2023 at 1:30 p.m. PST / 4:30 p.m. EST / 22:30 CET MANNHEIM, Germany, Dec. 04, 2023 (GLOBE NEWSWIRE) -- Affimed N.V. (Nasdaq: AFMD) (“Affimed”, or the “Company”), a clinical-stage immuno-oncology company committed to giving patients back their innate ability |

Affimed N.V. (NASDAQ:AFMD) Q3 2023 Earnings Call TranscriptAffimed N.V. (NASDAQ:AFMD) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Good day, everyone, and welcome to Affimed N.V. Third Quarter 2023 Earnings and Business Update Conference Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there’ll be a question-and-answer session. [Operator Instructions]. Please be advised that today’s […] |

AFMD Price Returns

| 1-mo | -8.08% |

| 3-mo | 1.79% |

| 6-mo | -9.86% |

| 1-year | -10.18% |

| 3-year | -92.27% |

| 5-year | -82.88% |

| YTD | -18.08% |

| 2023 | -49.60% |

| 2022 | -77.54% |

| 2021 | -5.15% |

| 2020 | 112.41% |

| 2019 | -11.90% |

Continue Researching AFMD

Want to see what other sources are saying about Affimed NV's financials and stock price? Try the links below:Affimed NV (AFMD) Stock Price | Nasdaq

Affimed NV (AFMD) Stock Quote, History and News - Yahoo Finance

Affimed NV (AFMD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...