Afya Limited - Class A Common Shares (AFYA): Price and Financial Metrics

AFYA Price/Volume Stats

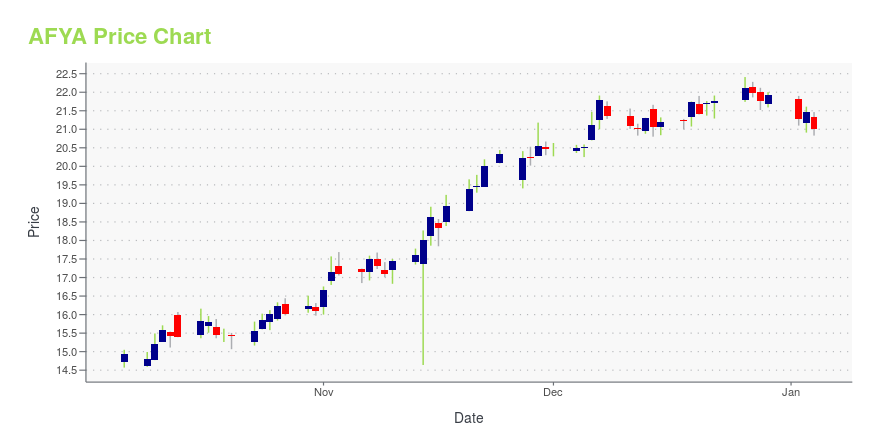

| Current price | $18.05 | 52-week high | $22.48 |

| Prev. close | $17.72 | 52-week low | $14.27 |

| Day low | $17.80 | Volume | 125,630 |

| Day high | $18.18 | Avg. volume | 130,159 |

| 50-day MA | $17.46 | Dividend yield | N/A |

| 200-day MA | $18.78 | Market Cap | 1.69B |

AFYA Stock Price Chart Interactive Chart >

Afya Limited - Class A Common Shares (AFYA) Company Bio

Afya Ltd. is a medical education group in Brazil. It delivers an end-to-end physician-centric ecosystem that serves and empowers students to be lifelong medical learners through their medical residency preparation, post-graduate programs and continuing medical education activities. The company operates through the following two segments: Education Services and Residency Preparatory & Specialization Programs. The Education Services segment provides educational services through undergraduate and graduate courses related to medicine, other health sciences and other undergraduate programs. The Residency Preparatory & Specialization Programs segment provides residency preparatory courses and medical post-graduate specialization programs, delivering printed and digital content, an online medical education platform and practical medical training. Afya was founded on March 22, 2019 and is headquartered in Nova Lima, Brazil.

Latest AFYA News From Around the Web

Below are the latest news stories about AFYA LTD that investors may wish to consider to help them evaluate AFYA as an investment opportunity.

PRDO or AFYA: Which Is the Better Value Stock Right Now?PRDO vs. AFYA: Which Stock Is the Better Value Option? |

PRDO vs. AFYA: Which Stock Is the Better Value Option?PRDO vs. AFYA: Which Stock Is the Better Value Option? |

The Rise of EdTech: 3 Stocks Transforming EducationThe education industry is due for an innovative turn, and these edtech stocks are up to the task of making that happen |

Wall Street Analysts Think Afya (AFYA) Is a Good Investment: Is It?Based on the average brokerage recommendation (ABR), Afya (AFYA) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying? |

Afya (AFYA) Is Considered a Good Investment by Brokers: Is That True?Based on the average brokerage recommendation (ABR), Afya (AFYA) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying? |

AFYA Price Returns

| 1-mo | 5.49% |

| 3-mo | 0.61% |

| 6-mo | -11.13% |

| 1-year | 16.83% |

| 3-year | -21.11% |

| 5-year | -35.88% |

| YTD | -17.69% |

| 2023 | 40.40% |

| 2022 | -0.57% |

| 2021 | -37.91% |

| 2020 | -6.71% |

| 2019 | N/A |

Loading social stream, please wait...