AGCO Corporation (AGCO): Price and Financial Metrics

AGCO Price/Volume Stats

| Current price | $103.52 | 52-week high | $136.42 |

| Prev. close | $101.84 | 52-week low | $92.75 |

| Day low | $102.74 | Volume | 562,200 |

| Day high | $104.70 | Avg. volume | 748,022 |

| 50-day MA | $102.27 | Dividend yield | 1.17% |

| 200-day MA | $113.29 | Market Cap | 7.72B |

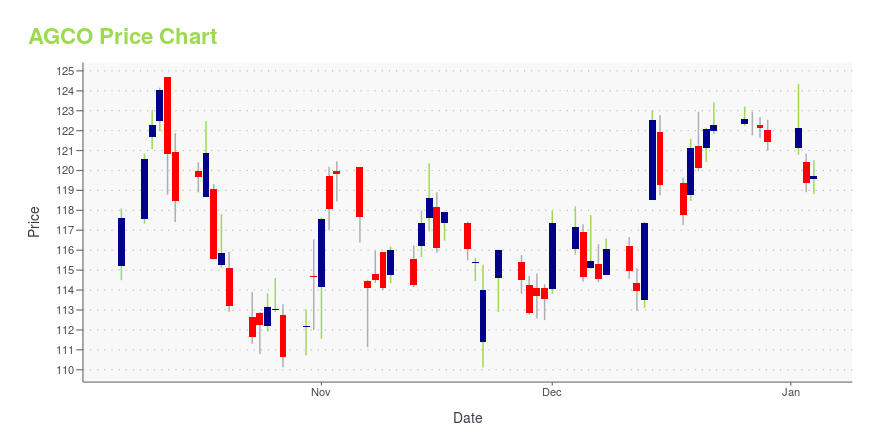

AGCO Stock Price Chart Interactive Chart >

AGCO Corporation (AGCO) Company Bio

AGCO is focused on the design, manufacture and distribution of agricultural machinery, including a range of agricultural equipment and related replacement parts, including tractors, combines, hay tools, sprayers, and forage equipment. The company was founded in 1990 and is based in Duluth, Georgia.

Latest AGCO News From Around the Web

Below are the latest news stories about AGCO CORP that investors may wish to consider to help them evaluate AGCO as an investment opportunity.

Is It Time To Consider Buying AGCO Corporation (NYSE:AGCO)?AGCO Corporation ( NYSE:AGCO ), is not the largest company out there, but it saw a decent share price growth of 11% on... |

AGCO Names Lee Pemberton 2023 Operator of the YearDULUTH, Ga., December 13, 2023--AGCO named Lee Pemberton of Makin’ Trax Contractors the 2023 Operator of the Year at the ARA Expo in Orlando, FL, on November 29, 2023. |

Those who invested in AGCO (NYSE:AGCO) five years ago are up 145%When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really... |

17 Most Profitable Crops to Grow in the USIn this article, we will be analyzing the agriculture sector in the US and covering the 17 most profitable crops to grow in the country. If you wish to skip our detailed analysis, you can move directly to the 5 Most Profitable Crops to Grow in the US. Outlook of the US Agriculture Sector As […] |

3 Stocks at the Forefront of Precision Agriculture TechnologyIf you’re looking for agriculture stocks to buy, those involved in precision agriculture should be at the top of your list. |

AGCO Price Returns

| 1-mo | 4.34% |

| 3-mo | -8.97% |

| 6-mo | -13.58% |

| 1-year | -19.32% |

| 3-year | -6.17% |

| 5-year | 61.71% |

| YTD | -12.35% |

| 2023 | -7.90% |

| 2022 | 24.99% |

| 2021 | 16.16% |

| 2020 | 34.77% |

| 2019 | 40.02% |

AGCO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AGCO

Want to do more research on Agco Corp's stock and its price? Try the links below:Agco Corp (AGCO) Stock Price | Nasdaq

Agco Corp (AGCO) Stock Quote, History and News - Yahoo Finance

Agco Corp (AGCO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...