AgileThought, Inc. (AGIL): Price and Financial Metrics

AGIL Price/Volume Stats

| Current price | $0.20 | 52-week high | $4.68 |

| Prev. close | $0.08 | 52-week low | $0.06 |

| Day low | $0.15 | Volume | 216,685,400 |

| Day high | $0.27 | Avg. volume | 2,777,381 |

| 50-day MA | $0.13 | Dividend yield | N/A |

| 200-day MA | $1.33 | Market Cap | 10.32M |

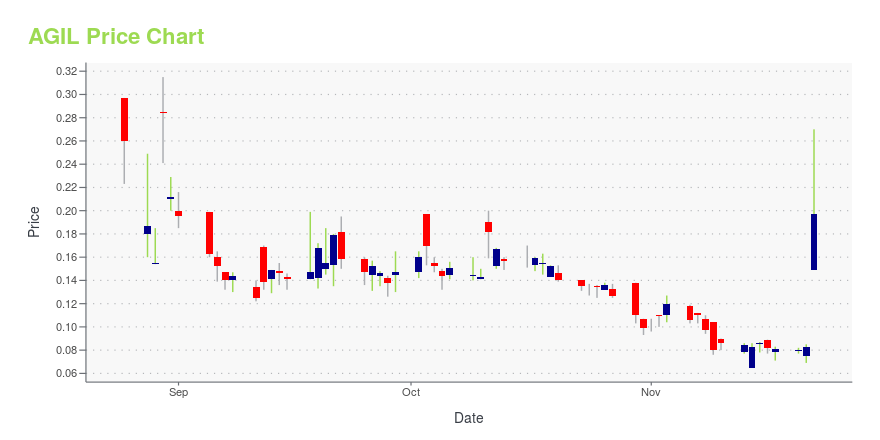

AGIL Stock Price Chart Interactive Chart >

AgileThought, Inc. (AGIL) Company Bio

AgileThought, Inc. provides digital transformation and custom software services in the United States and Latin America. It offers product management consulting; organizational transformation, application engineering and DevOps, data analytics, application modernization, commercial and omnichannel; and AI and machine learning services. The company also provides cloud architecture and migration; automation, UX and UI design, and digital workplace; and DevOps and application optimization, multi cloud, and lifecycle management support services. It serves professional, healthcare and pharmacy, financial, energy, utility, and consumer packaged goods sectors. AgileThought, Inc. was founded in 2004 and is headquartered in Irving, Texas.

Latest AGIL News From Around the Web

Below are the latest news stories about AGILETHOUGHT INC that investors may wish to consider to help them evaluate AGIL as an investment opportunity.

Why Is AgileThought (AGIL) Stock Up 69% Today?AgileThought stock is rocketing higher on Wednesday as investors in AGIL react to heavy trading of the company's shares without clear news. |

Why Is Beachbody (BODY) Stock Down 10% Today?Beachbody stock is falling on Wednesday after shares of BODY went through a reverse split to boost its trading price. |

Why Is Guess? (GES) Stock Down 11% Today?Guess? |

Why Is Wheeler Real Estate IT (WHLR) Stock Up 31% Today?Wheeler Real Estate IT is rising on Wednesday as shares of WHLR stock see heavy trading despite a lack of news this morning. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic on Wednesday as we check out all of the biggest movements happening this morning! |

AGIL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -77.01% |

| 3-year | -98.00% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -11.02% |

| 2021 | -53.35% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...