AGM Group Holdings Inc. (AGMH): Price and Financial Metrics

AGMH Price/Volume Stats

| Current price | $0.06 | 52-week high | $2.19 |

| Prev. close | $0.03 | 52-week low | $0.02 |

| Day low | $0.05 | Volume | 733,356,574 |

| Day high | $0.08 | Avg. volume | 32,397,877 |

| 50-day MA | $0.23 | Dividend yield | N/A |

| 200-day MA | $1.07 | Market Cap | 1.53M |

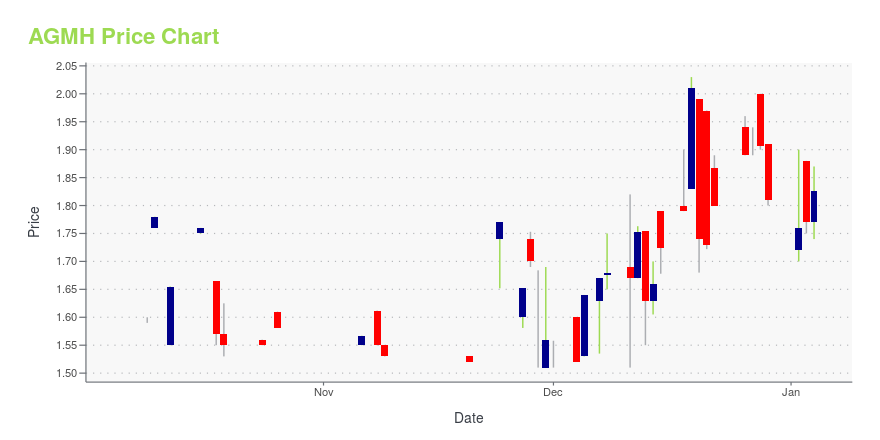

AGMH Stock Price Chart Interactive Chart >

AGM Group Holdings Inc. (AGMH) Company Bio

AGM Group Holdings Inc. is a financial technology company and financial solutions provider. The Company mainly provides brokers and institutional clients with trading platform solutions and technologies. The Company operates mainly through three businesses, including online trading and computer support service business, which provides online trading platform application and computer program technical support and solution services; forex trading brokerage business, as well as program trading application technology and management service business. The Company operates its businesses in both the United Stated and global markets.

AGMH Price Returns

| 1-mo | -14.29% |

| 3-mo | -95.56% |

| 6-mo | -96.63% |

| 1-year | -94.44% |

| 3-year | -97.27% |

| 5-year | -99.64% |

| YTD | -96.03% |

| 2024 | -16.57% |

| 2023 | 9.70% |

| 2022 | -31.25% |

| 2021 | -84.29% |

| 2020 | -9.77% |

Continue Researching AGMH

Want to do more research on Agm Group Holdings Inc's stock and its price? Try the links below:Agm Group Holdings Inc (AGMH) Stock Price | Nasdaq

Agm Group Holdings Inc (AGMH) Stock Quote, History and News - Yahoo Finance

Agm Group Holdings Inc (AGMH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...