AdaptHealth Corp. (AHCO): Price and Financial Metrics

AHCO Price/Volume Stats

| Current price | $11.22 | 52-week high | $15.37 |

| Prev. close | $11.53 | 52-week low | $6.37 |

| Day low | $11.09 | Volume | 832,400 |

| Day high | $11.66 | Avg. volume | 1,050,472 |

| 50-day MA | $10.41 | Dividend yield | N/A |

| 200-day MA | $9.03 | Market Cap | 1.49B |

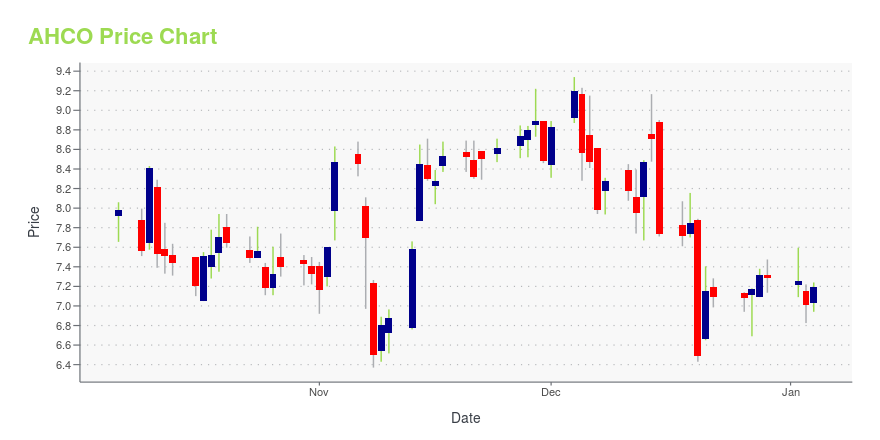

AHCO Stock Price Chart Interactive Chart >

AdaptHealth Corp. (AHCO) Company Bio

AdaptHealth Corp., together with its subsidiaries, provides home healthcare equipment, medical supplies, and home and related services in the United States. The company provides sleep therapy equipment, supplies, and related services, including CPAP and bi-PAP services to individuals suffering from obstructive sleep apnea; home medical equipment (HME) to patients discharged from acute care and other facilities; oxygen and related chronic therapy services in the home; and other HME medical devices and supplies on behalf of chronically ill patients with diabetes care, wound care, urological, ostomy, and nutritional supply needs. It serves beneficiaries of Medicare, Medicaid, and commercial payors. The company is headquartered in Plymouth Meeting, Pennsylvania.

Latest AHCO News From Around the Web

Below are the latest news stories about ADAPTHEALTH CORP that investors may wish to consider to help them evaluate AHCO as an investment opportunity.

AdaptHealth Corp. to Participate in Upcoming Investor ConferencesPLYMOUTH MEETING, Pa., November 10, 2023--AdaptHealth Corp. (NASDAQ: AHCO) ("AdaptHealth" or the "Company"), a national leader in providing patient-centered, healthcare-at-home solutions including home medical equipment, medical supplies, and related services, announced today that they will participate in the following upcoming investor conferences: |

AdaptHealth Corp. (NASDAQ:AHCO) Q3 2023 Earnings Call TranscriptAdaptHealth Corp. (NASDAQ:AHCO) Q3 2023 Earnings Call Transcript November 7, 2023 AdaptHealth Corp. beats earnings expectations. Reported EPS is $0.42, expectations were $0.19. Operator: Good day, everyone, and welcome to today’s AdaptHealth Third Quarter 2023 Earnings Release Call. At this time, all participants are in a listen-only mode. Later you will have an opportunity to […] |

Q3 2023 Adapthealth Corp Earnings CallQ3 2023 Adapthealth Corp Earnings Call |

AdaptHealth Corp (AHCO) Reports 6.3% Increase in Q3 Net Revenue Despite Net LossCompany's cash flow from operations also sees a significant increase year-to-date |

AdaptHealth Corp. Announces Third Quarter 2023 ResultsPLYMOUTH MEETING, Pa., November 07, 2023--AdaptHealth Corp. (NASDAQ: AHCO) ("AdaptHealth" or the "Company"), a national leader in providing patient-centered, healthcare-at-home solutions including home medical equipment, medical supplies, and related services, announced today financial results for the third quarter ended September 30, 2023. |

AHCO Price Returns

| 1-mo | 14.26% |

| 3-mo | 12.65% |

| 6-mo | 58.25% |

| 1-year | -15.58% |

| 3-year | -49.48% |

| 5-year | 9.46% |

| YTD | 53.91% |

| 2023 | -62.07% |

| 2022 | -21.42% |

| 2021 | -34.88% |

| 2020 | 242.08% |

| 2019 | N/A |

Loading social stream, please wait...