American International Group, Inc. New (AIG): Price and Financial Metrics

AIG Price/Volume Stats

| Current price | $77.24 | 52-week high | $80.83 |

| Prev. close | $75.25 | 52-week low | $57.02 |

| Day low | $75.63 | Volume | 3,681,487 |

| Day high | $77.70 | Avg. volume | 4,156,463 |

| 50-day MA | $76.33 | Dividend yield | 2.08% |

| 200-day MA | $71.35 | Market Cap | 51.26B |

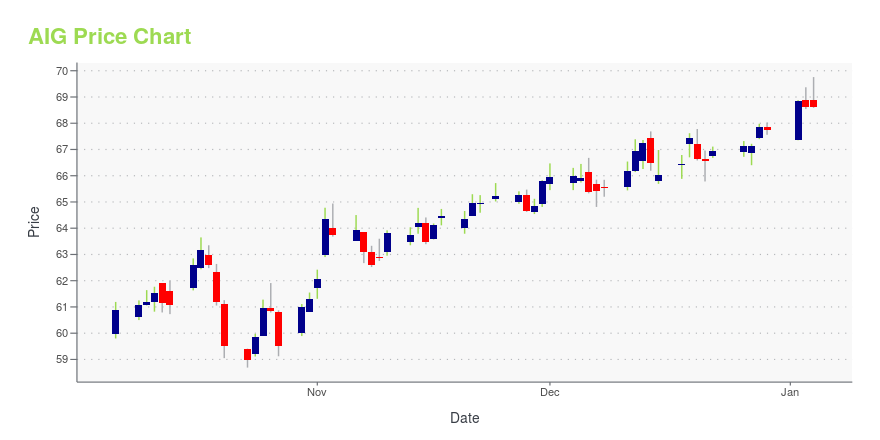

AIG Stock Price Chart Interactive Chart >

American International Group, Inc. New (AIG) Company Bio

American International Group Inc is an insurance company. AIG traces its beginnings to the Americans Asiatic Underwritings company, established by Cornelius Vander Starr while in Shanghai in 1919. The company, through its subsidiaries, provides property casualty insurance, life insurance, retirement products, mortgage insurance and other financial services in the United States and in 80 countries abroad. Peter Zaffino was appointed President of AIG in early 2020 and became the Chief Executive Officer of the company a year later. The company is headquartered in New York City and it employs a workforce of over 46,000 people worldwide. In FY 2020, AIG had total sales of $51 billion U.S. dollars.

Latest AIG News From Around the Web

Below are the latest news stories about AMERICAN INTERNATIONAL GROUP INC that investors may wish to consider to help them evaluate AIG as an investment opportunity.

Top Performers: 7 High-Efficiency Stocks With Stellar Profit Per Employee RatiosInundated with myriad ways of assessing publicly traded companies, one unique metric could intrigue investors seeking opportunities in 2024 and that would be high-efficiency stocks. |

Midday movers: Microsoft, AMD, Boeing, and more(Updated - December 28, 2023 11:58 AM EST) |

AIG Rises 9.6% in Three Months: What Lies Ahead for Investors?American International (AIG) continues to streamline its operations by axing non-core businesses, focusing on core insurance to improve profitability. |

15 Best Mortgage Insurance Companies Heading into 2024In this article, we will look into the 15 best mortgage insurance companies heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Best Mortgage Insurance Companies Heading into 2024. Mortgage Insurance Market Shift According to an article by National Mortgage News, published on August 7, 2023, […] |

15 Best Term Life Insurance Companies Heading into 2024In this article, we will look into the 15 best term life insurance companies heading into 2024. If you want to skip our detailed analysis, you can go directly to 5 Best Term Life Insurance Companies Heading into 2024. Term Life Insurance Industry: A Market Analysis According to a report by Grand View Research, the […] |

AIG Price Returns

| 1-mo | 3.69% |

| 3-mo | 4.20% |

| 6-mo | 12.22% |

| 1-year | 30.14% |

| 3-year | 74.53% |

| 5-year | 54.47% |

| YTD | 15.17% |

| 2023 | 9.79% |

| 2022 | 13.77% |

| 2021 | 53.92% |

| 2020 | -23.08% |

| 2019 | 33.58% |

AIG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AIG

Want to see what other sources are saying about American International Group Inc's financials and stock price? Try the links below:American International Group Inc (AIG) Stock Price | Nasdaq

American International Group Inc (AIG) Stock Quote, History and News - Yahoo Finance

American International Group Inc (AIG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...