AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LTD (AIH): Price and Financial Metrics

AIH Price/Volume Stats

| Current price | $0.33 | 52-week high | $1.43 |

| Prev. close | $0.50 | 52-week low | $0.29 |

| Day low | $0.31 | Volume | 184,300 |

| Day high | $0.44 | Avg. volume | 173,623 |

| 50-day MA | $0.42 | Dividend yield | N/A |

| 200-day MA | $0.61 | Market Cap | 15.93M |

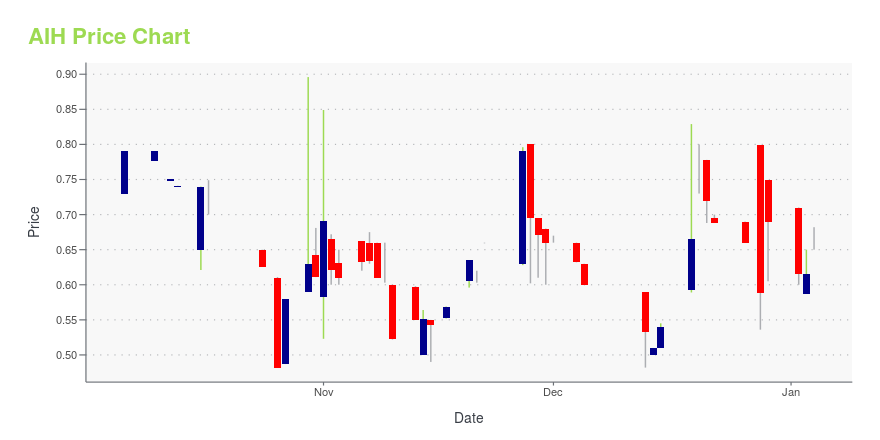

AIH Stock Price Chart Interactive Chart >

AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LTD (AIH) Company Bio

Aesthetic Medical International Holdings Group Ltd. engages in the provision of aesthetic medical services. It offers surgical and non-surgical treatments, cosmetic dentistry, and general healthcare services. Its treatments include eye surgery, rhinoplasty, breast augmentation, liposuction, laser, ultrasound, and ultraviolet light treatments. The company was founded by Zhou Peng Wu and Ding Wen Ting in 1997 and is headquartered in Shenzhen, China.

Latest AIH News From Around the Web

Below are the latest news stories about AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LTD that investors may wish to consider to help them evaluate AIH as an investment opportunity.

Aesthetic Medical International Announces Receipt of Nasdaq Notification Letter Regarding Minimum Bid Price DeficiencySHENZHEN, China, Sept. 08, 2023 (GLOBE NEWSWIRE) -- Aesthetic Medical International Holdings Group Limited (Nasdaq: AIH) (the “Company” or “AIH”), a leading provider of aesthetic medical services in China, announced that it has received a notification letter (the “Notification Letter”) from the Nasdaq Stock Market LLC (the “Nasdaq”) dated September 6, 2023, notifying the Company that it is not in compliance with the minimum bid price requirement as set forth under Nasdaq Listing Rule 5550(a)(2) |

Aesthetic Medical International Reports First Half of 2023 Unaudited Financial ResultsSHENZHEN, China, Sept. 05, 2023 (GLOBE NEWSWIRE) -- Aesthetic Medical International Holdings Group Limited (Nasdaq: AIH) (the “Company” or “AIH”), a leading provider of aesthetic medical services in China, announced its unaudited financial results for the six months ended June 30, 2023. Mr. ZHANG Chen, the Chairman of the Company, commented, “On August 16, 2023, I was honored to be elected as the Chairman of AIH. This was a significant date for us as it marked the successful closure of a series |

10 Best Cosmetic Surgery and Aesthetics Stocks to BuyIn this article, we discuss 10 best cosmetic surgery and aesthetics stocks to buy. If you want to skip our detailed discussion on the cosmetics and aesthetics sector, head directly to 5 Best Cosmetic Surgery and Aesthetics Stocks to Buy. The American Society of Plastic Surgeons noted that numerous celebrities adopted a perspective favoring larger […] |

Aesthetic Medical International Announces (i) Closing of Share Transfer, Issue of Conversion Shares, and Issue of Warrants, (ii) Resignations and Appointment of Directors, (iii) Release of Share Pledge, and (iv) Entry into certain Contractual Arrangements with respect to Equity InterestsClosing of Share Transfer, Issue of Conversion Shares, and Issue of Warrants Reference is made to the press release of the Company filed with the Securities and Exchange Commission (the “SEC”) on July 20, 2022 and form 6-K of the Company filed with the SEC on February 16, 2023 (collectively, “Previous Disclosure”) in relation to, among other, entry into a share purchase agreement, a subscription agreement, a shareholders’ agreement and a cooperation agreement. All capitalized terms not otherwise |

Aesthetic Medical International Holdings Group First Quarter 2023 Earnings: EPS: CN¥0.012 (vs CN¥0.15 loss in 1Q 2022)Aesthetic Medical International Holdings Group ( NASDAQ:AIH ) First Quarter 2023 Results Key Financial Results Revenue... |

AIH Price Returns

| 1-mo | N/A |

| 3-mo | -23.27% |

| 6-mo | -44.99% |

| 1-year | -65.62% |

| 3-year | -92.73% |

| 5-year | N/A |

| YTD | -52.15% |

| 2023 | -46.54% |

| 2022 | -62.93% |

| 2021 | -33.97% |

| 2020 | -17.91% |

| 2019 | N/A |

Loading social stream, please wait...