Apollo Investment Corporation - Closed End Fund (AINV): Price and Financial Metrics

AINV Price/Volume Stats

| Current price | $13.65 | 52-week high | $14.00 |

| Prev. close | $13.57 | 52-week low | $10.01 |

| Day low | $13.56 | Volume | 225,600 |

| Day high | $13.69 | Avg. volume | 332,057 |

| 50-day MA | $11.58 | Dividend yield | 9.08% |

| 200-day MA | $12.68 | Market Cap | 867.03M |

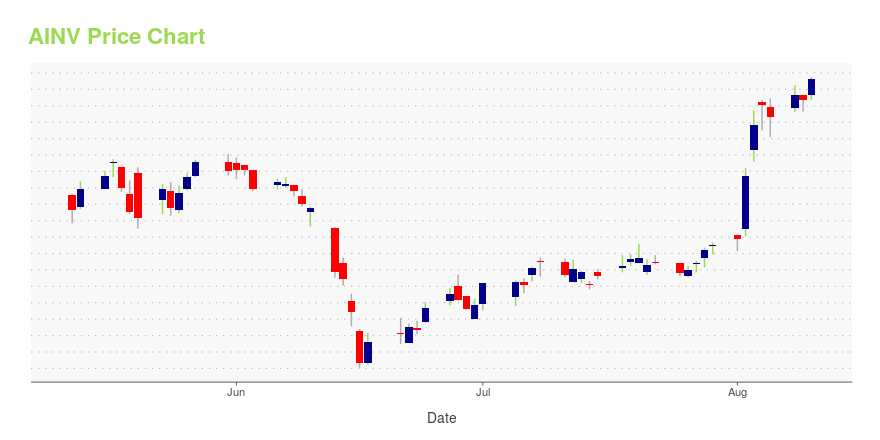

AINV Stock Price Chart Interactive Chart >

Apollo Investment Corporation - Closed End Fund (AINV) Company Bio

Apollo Investment Corporation invests primarily in various forms of debt investments, including secured and unsecured debt, loan investments, and/or equity in private middle-market companies. The company was founded in 2004 and is based in New York, New York.

Latest AINV News From Around the Web

Below are the latest news stories about APOLLO INVESTMENT CORP that investors may wish to consider to help them evaluate AINV as an investment opportunity.

Has Apollo Investment (AINV) Outpaced Other Finance Stocks This Year?Here is how Apollo Investment (AINV) and BancFirst (BANF) have performed compared to their sector so far this year. |

Apollo Investment (AINV) Q1 Earnings Top EstimatesApollo Investment (AINV) delivered earnings and revenue surprises of 8.82% and 0.78%, respectively, for the quarter ended June 2022. Do the numbers hold clues to what lies ahead for the stock? |

Apollo Investment shares climb on new fee structure, rebranding announcementsApollo Investment Corp. shares rose 3.6% in premarket trading on Tuesday, fueled by a raft of announcements from the company, which include a new fee structure and a rebranding. Apollo's stock closed Monday's session up 0.7% at $11.58. In a statement, the Business Development Corporation said that the new fee structure includes "substantial permanent reductions to management and incentive fees." The new fee structure will boost Apollo's work with MidCap Financial, which it manages, according to |

Apollo Investment Corporation Announces Transformative Changes to Reinforce Position as a Pure Play Senior Secured Middle Market BDC Providing Public Shareholder Access to Institutional-Quality Private CreditNew Industry-Leading Fee Structure Supports Senior Secured Investment Strategy MidCap Financial 1, one of the World’s Leading Middle Market Origination Businesses, Makes Aligning Primary Equity Investment in BDC at NAV BDC to Rebrand as ‘MidCap Financial Investment Corporation’ Increases Quarterly Base Distribution from $0.31 to $0.32 Per Share2 Senior Leadership Promotions to Align with Enhanced Strategy NEW YORK, Aug. 02, 2022 (GLOBE NEWSWIRE) -- Apollo Investment Corporation (NASDAQ: AINV), ( |

Apollo Investment Corporation Reports Financial Results for the Quarter Ended June 30, 2022, Makes Strategic Announcements, and Increases Quarterly Base DistributionStrategic Announcements Reinforce Position as a Pure Play Senior Secured Middle Market BDC(1) Established New Industry-Leading Fee Structure to Support Senior Secured Investment Strategy(2)MidCap Financial,(3) one of the World’s Leading Middle Market Origination Businesses, Makes Aligning Primary Equity Investment in BDC at NAVBDC to Rebrand as ‘MidCap Financial Investment Corporation’(4)Senior Leadership Promotions to Align with Enhanced Strategy(5) Fiscal First Quarter and Other Recent Highlig |

AINV Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 10.97% |

| 5-year | 20.54% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 33.67% |

| 2020 | -28.54% |

| 2019 | 56.97% |

AINV Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AINV

Here are a few links from around the web to help you further your research on Apollo Investment Corp's stock as an investment opportunity:Apollo Investment Corp (AINV) Stock Price | Nasdaq

Apollo Investment Corp (AINV) Stock Quote, History and News - Yahoo Finance

Apollo Investment Corp (AINV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...