Airgain, Inc. (AIRG): Price and Financial Metrics

AIRG Price/Volume Stats

| Current price | $4.80 | 52-week high | $10.34 |

| Prev. close | $4.30 | 52-week low | $3.17 |

| Day low | $4.37 | Volume | 417,200 |

| Day high | $5.85 | Avg. volume | 23,904 |

| 50-day MA | $4.13 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 56.61M |

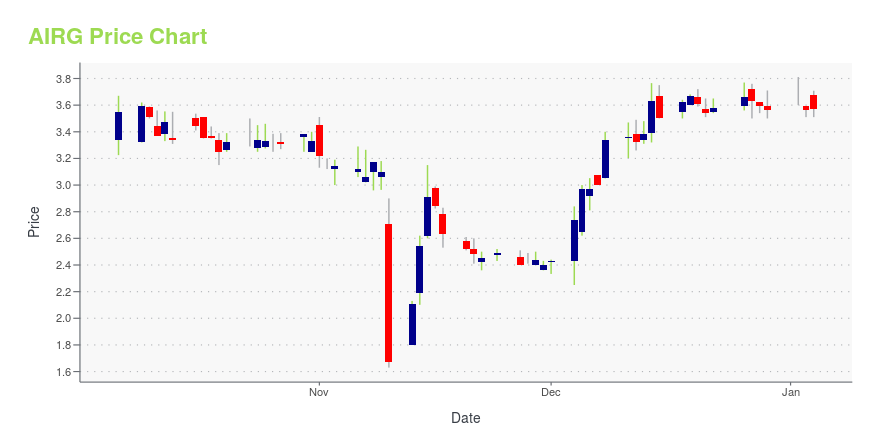

AIRG Stock Price Chart Interactive Chart >

Airgain, Inc. (AIRG) Company Bio

AirGain Inc. designs, develops, and engineers antenna products for original equipment and design manufacturers, chipset vendors, and service providers worldwide. The company was founded in 1995 and is based in San Diego, California.

AIRG Price Returns

| 1-mo | 20.60% |

| 3-mo | 25.65% |

| 6-mo | -42.99% |

| 1-year | -30.33% |

| 3-year | -42.10% |

| 5-year | -60.91% |

| YTD | -32.01% |

| 2024 | 98.31% |

| 2023 | -45.31% |

| 2022 | -38.76% |

| 2021 | -40.21% |

| 2020 | 66.32% |

Continue Researching AIRG

Want to do more research on Airgain Inc's stock and its price? Try the links below:Airgain Inc (AIRG) Stock Price | Nasdaq

Airgain Inc (AIRG) Stock Quote, History and News - Yahoo Finance

Airgain Inc (AIRG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...