Air Industries Group (AIRI): Price and Financial Metrics

AIRI Price/Volume Stats

| Current price | $3.55 | 52-week high | $7.77 |

| Prev. close | $3.60 | 52-week low | $2.60 |

| Day low | $3.53 | Volume | 6,400 |

| Day high | $3.63 | Avg. volume | 30,029 |

| 50-day MA | $3.69 | Dividend yield | N/A |

| 200-day MA | $3.97 | Market Cap | 11.80M |

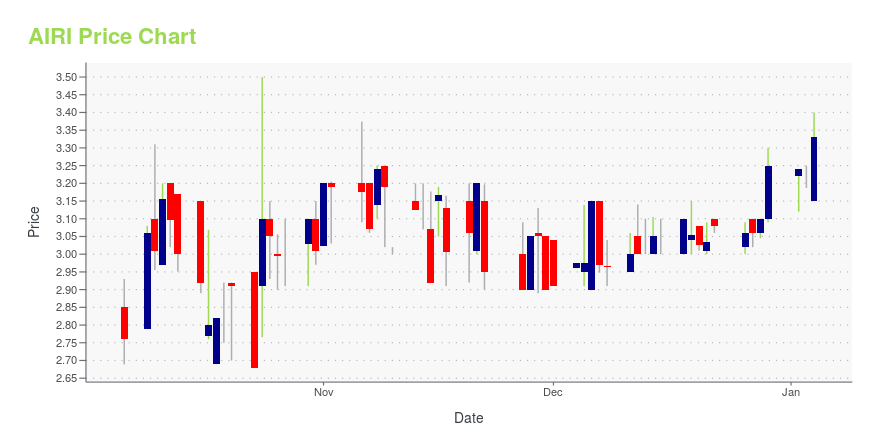

AIRI Stock Price Chart Interactive Chart >

Air Industries Group (AIRI) Company Bio

Air Industries Group, an aerospace and defense company, designs, manufactures, and sells structural parts and assemblies that focus on flight safety. The company operates through two segments, Complex Machining and Turbine Engine Components. The Complex Machining segment offers landing gear, arresting gear, engine mounts, flight controls, throttle quadrants, and other components. Its products are deployed on a range of military and commercial aircraft, including Sikorsky's UH-60 Black Hawk, Lockheed Martin's F-35 Joint Strike Fighter, Northrop Grumman's E2 Hawkeye, Boeing's 777, Airbus' 380 commercial airliners, and the U.S. Navy F-18 and USAF F-16 fighter aircraft. The Turbine Engine Components segment makes components and provides services for jet engines and ground-power turbines. Its jet engines components are used on the USAF F-15 and F-16, the Airbus A-330 and A-380, and the Boeing 777, as well as ground-power turbine applications. Air Industries Group was founded in 1979 and is based in Bay Shore, New York

Latest AIRI News From Around the Web

Below are the latest news stories about AIR INDUSTRIES GROUP that investors may wish to consider to help them evaluate AIRI as an investment opportunity.

Air Industries Group (AIRI) Q3 2023 Earnings Call TranscriptAir Industries Group (AIRI) Q3 2023 Earnings Conference Call December 07, 2023, 4:30 PM ET Company Participants Luciano Melluzzo - President and Chief Executive Officer Scott Glassman - Chief Financial Officer Conference Call Participants Howard Halpern - Taglich Brothers Presentation Operator Hello and welcome to the Air Industries Group Third Quarter 2023 Earnings Call. At this time all participants are in listen-only mode. [Operator Instructions] As a reminder, this conference is being recorded. This call and the accompanying webcast may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933 as amended, including ... |

Air Industries Group Announces Results for Third Quarter Ended September 30, 2023 and Comments on Business OutlookBAY SHORE, N.Y., December 06, 2023--Air Industries Group (NYSE American: AIRI), an integrated Tier 1 manufacturer of precision assemblies and components for mission-critical aerospace and defense applications, and a prime contractor to the U.S. Department of Defense, today announced its financial results for the third quarter ended September 30, 2023. |

Air Industries Group Receives Notice from NYSE American Regarding Late Filing of Quarterly Report on Form 10-QBAY SHORE, N.Y., November 29, 2023--Air Industries Group (NYSE American: AIRI) ("Air Industries" or the "Company") announced that on November 21, 2023, it received a notice from NYSE Regulation stating that the Company is not in compliance with the continued listing standards of the NYSE American (the "Exchange") under the timely filing criteria set forth in Section 1007 of the NYSE American Company Guide (the "Company Guide"). The non-compliance results from the Company’s failure to timely file |

Air Industries Group Announces CFO TransitionBAY SHORE, N.Y., October 19, 2023--Air Industries Group (NYSE American: AIRI) today announced the promotion of Scott Glassman to Chief Financial Officer, Principal Accounting Officer and Secretary of the Company and its subsidiaries. Mr. Glassman, age 46, has served as the Company’s Chief Accounting Officer since 2019. |

Air Industries Group Adds Important Arresting Gear Welding Capability to Support U.S. Navy E-2D Aircraft ProgramBAY SHORE, N.Y., September 08, 2023--Air Industries Group (NYSE American: AIRI) today announced that, in conjunction with a major OEM customer, it has secured the welding equipment, related tooling and peripheral equipment used to weld the arresting gear that secures the E-2D aircraft’s tail hook, which is essential for landing on aircraft carriers. The Company noted that this machinery is the only equipment currently certified to weld the arresting gear. |

AIRI Price Returns

| 1-mo | 5.97% |

| 3-mo | -42.28% |

| 6-mo | -17.63% |

| 1-year | 9.75% |

| 3-year | -71.37% |

| 5-year | -67.13% |

| YTD | 9.23% |

| 2023 | -23.53% |

| 2022 | -53.14% |

| 2021 | -26.26% |

| 2020 | -46.52% |

| 2019 | 221.68% |

Continue Researching AIRI

Here are a few links from around the web to help you further your research on Air Industries Group's stock as an investment opportunity:Air Industries Group (AIRI) Stock Price | Nasdaq

Air Industries Group (AIRI) Stock Quote, History and News - Yahoo Finance

Air Industries Group (AIRI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...