a.k.a. Brands Holding Corp. (AKA): Price and Financial Metrics

AKA Price/Volume Stats

| Current price | $16.39 | 52-week high | $33.73 |

| Prev. close | $15.62 | 52-week low | $3.81 |

| Day low | $15.68 | Volume | 3,527 |

| Day high | $16.39 | Avg. volume | 8,441 |

| 50-day MA | $16.61 | Dividend yield | N/A |

| 200-day MA | $11.90 | Market Cap | 171.85M |

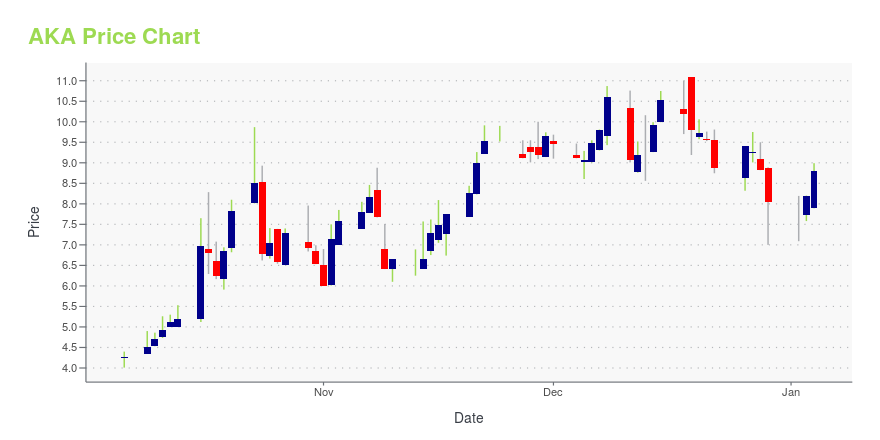

AKA Stock Price Chart Interactive Chart >

a.k.a. Brands Holding Corp. (AKA) Company Bio

a.k.a. Brands Holding Corp. operates a portfolio of online fashion brands. It offers apparel, footwear, and accessories through its online stores under the Princess Polly, Culture Kings, Petal & Pup, and Rebdolls brands, as well as seven physical stores under the Culture Kings brand name. The company was founded in 2018 and is based in San Francisco, California.

Latest AKA News From Around the Web

Below are the latest news stories about AKA BRANDS HOLDING CORP that investors may wish to consider to help them evaluate AKA as an investment opportunity.

a.k.a. Brands Holding Corp. (NYSE:AKA) Q3 2023 Earnings Call Transcripta.k.a. Brands Holding Corp. (NYSE:AKA) Q3 2023 Earnings Call Transcript November 12, 2023 Operator: Greetings and welcome to the a.k.a. Brands Holding Corp. Third Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions]. As a reminder, this conference is […] |

There's Reason For Concern Over a.k.a. Brands Holding Corp.'s (NYSE:AKA) Massive 36% Price Jumpa.k.a. Brands Holding Corp. ( NYSE:AKA ) shares have had a really impressive month, gaining 36% after a shaky period... |

a.k.a. Brands (AKA) Q3 Earnings: Taking a Look at Key Metrics Versus EstimatesAlthough the revenue and EPS for a.k.a. Brands (AKA) give a sense of how its business performed in the quarter ended September 2023, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers. |

a.k.a. Brands Holding Corp. Reports Third Quarter 2023 Financial ResultsSAN FRANCISCO, November 08, 2023--a.k.a. Brands Holding Corp. (NYSE: AKA), a brand accelerator of next generation fashion brands, today announced financial results for the third quarter ended September 30, 2023. |

a.k.a. Brands Holding Corp. to Report Third Quarter 2023 Financial Results on November 8, 2023SAN FRANCISCO, October 25, 2023--a.k.a. Brands Holding Corp. (NYSE: AKA) (the "Company"), a brand accelerator of next generation fashion brands, today announced that it will report its third quarter 2023 financial results after the market close on Wednesday, November 8, 2023. The company will webcast a call with management that day at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time). |

AKA Price Returns

| 1-mo | 23.33% |

| 3-mo | 28.55% |

| 6-mo | 67.07% |

| 1-year | 184.55% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 103.60% |

| 2023 | -47.18% |

| 2022 | -86.27% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...