Embotelladora Andina S.A. (AKO.B): Price and Financial Metrics

AKO.B Price/Volume Stats

| Current price | $18.21 | 52-week high | $19.60 |

| Prev. close | $18.90 | 52-week low | $11.49 |

| Day low | $18.21 | Volume | 4,900 |

| Day high | $19.09 | Avg. volume | 17,429 |

| 50-day MA | $18.32 | Dividend yield | 3.77% |

| 200-day MA | $15.78 | Market Cap | 2.87B |

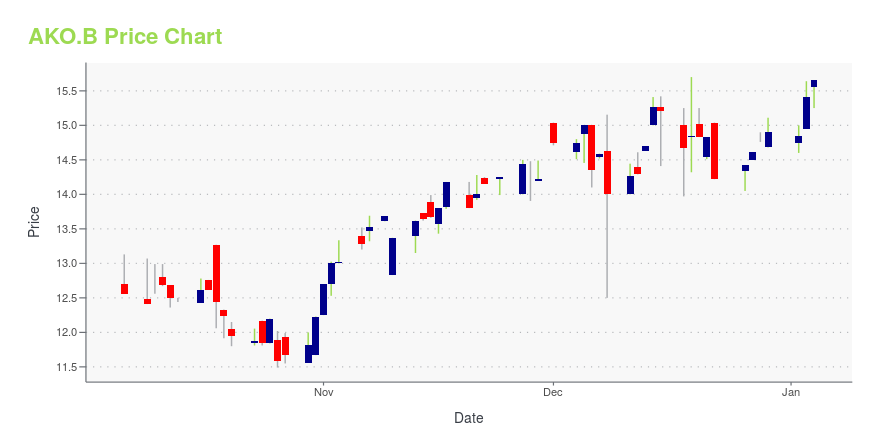

AKO.B Stock Price Chart Interactive Chart >

Embotelladora Andina S.A. (AKO.B) Company Bio

Embotelladora Andina S.A., produces, markets, and distributes Coca-Cola soft drinks in Chile, Brazil, Argentina, and Paraguay. It also offers fruit juices, ready-to-drink tea, other fruit-flavored beverages, and mineral and purified water; and flavored waters and other carbonated beverages. In addition, the company distributes non-carbonated beverages, such as tea, fruit juices, energy and sport drinks, and waters; beer under the Amstel, Bavaria, Birra Moretti, Desperados, Dos Equis (XX), Edelweiss, Heineken, Kaiser, Sol, and Xingú brands; and spirits. Further, it manufactures glass and polyethylene terephthalate bottles, cases, and plastic caps. The company offers its products primarily through small retailers, restaurants and bars, supermarkets, and third party distributors. Embotelladora Andina S.A. was founded in 1946 and is based in Santiago, Chile.

Latest AKO.B News From Around the Web

Below are the latest news stories about ANDINA BOTTLING CO INC that investors may wish to consider to help them evaluate AKO.B as an investment opportunity.

Ben Graham's Formula Finds 22 Ideal Value Dogs For MarchForeword About the Ben Graham Formula The Ben Graham Formula strategy contains ultra-stable stocks that will infrequently lose money if held over a long period of time. It was developed based on a screen in Graham's book, The Intelligent Investor. For those who have read the book, it is the... |

AKO.B Price Returns

| 1-mo | 5.57% |

| 3-mo | 10.72% |

| 6-mo | 29.76% |

| 1-year | 12.23% |

| 3-year | 72.51% |

| 5-year | 16.40% |

| YTD | 25.22% |

| 2023 | 9.36% |

| 2022 | 26.17% |

| 2021 | -9.82% |

| 2020 | -11.16% |

| 2019 | -21.29% |

AKO.B Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AKO.B

Here are a few links from around the web to help you further your research on Andina Bottling Co Inc's stock as an investment opportunity:Andina Bottling Co Inc (AKO.B) Stock Price | Nasdaq

Andina Bottling Co Inc (AKO.B) Stock Quote, History and News - Yahoo Finance

Andina Bottling Co Inc (AKO.B) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...