Allegro MicroSystems Inc. (ALGM): Price and Financial Metrics

ALGM Price/Volume Stats

| Current price | $24.15 | 52-week high | $52.26 |

| Prev. close | $24.31 | 52-week low | $23.64 |

| Day low | $23.99 | Volume | 8,853,600 |

| Day high | $24.82 | Avg. volume | 1,749,589 |

| 50-day MA | $29.32 | Dividend yield | N/A |

| 200-day MA | $28.66 | Market Cap | 4.68B |

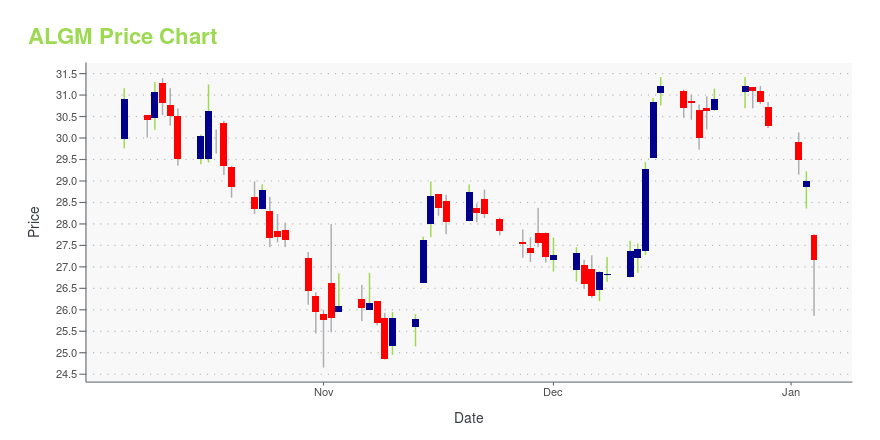

ALGM Stock Price Chart Interactive Chart >

Allegro MicroSystems Inc. (ALGM) Company Bio

Allegro MicroSystems, Inc. develops semiconductor technology and application-specific algorithms. It provides current sensors, switches and latches, linear and angular position, and magnetic speed sensors. The firm designs, develops, fabless manufactures and markets of sensor ICs and application-specific analog power ICs enabling the emerging technologies in the automotive and industrial markets. The company was founded on March 30, 2013 and is headquartered in Manchester, NH.

Latest ALGM News From Around the Web

Below are the latest news stories about ALLEGRO MICROSYSTEMS INC that investors may wish to consider to help them evaluate ALGM as an investment opportunity.

Allegro MicroSystems (ALGM) Affected by United Auto Workers StrikeChartwell Investment Partners, LLC, an affiliate of Carillon Tower Advisers, Inc., released the “Carillon Chartwell Small Cap Value Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Information technology and industrials were the top-performing sectors in the Carillon Chartwell Small Cap Growth Fund, with alpha production coming from well-chosen stocks. […] |

New Strong Sell Stocks for December 26thALGM, ASHTY and GIB have been added to the Zacks Rank #5 (Strong Sell) List on December 26, 2023. |

12 High Growth Semiconductor Stocks That Are ProfitableIn this article, we discuss the 12 high-growth semiconductor stocks that are profitable. To skip the detailed analysis of the semiconductor industry, go directly to the 5 High Growth Semiconductor Stocks That Are Profitable. Semiconductors are a global need and their supply is required by every sector of the market. The industry has been facing […] |

Allegro MicroSystems, Inc. (ALGM) Stock Slides as Market Rises: Facts to Know Before You TradeAllegro MicroSystems, Inc. (ALGM) closed at $30.69 in the latest trading session, marking a -1.67% move from the prior day. |

Allegro MicroSystems, Inc. (ALGM) Increases Yet Falls Behind Market: What Investors Need to KnowAllegro MicroSystems, Inc. (ALGM) closed the most recent trading day at $27.41, moving +0.18% from the previous trading session. |

ALGM Price Returns

| 1-mo | -15.14% |

| 3-mo | -19.77% |

| 6-mo | -9.75% |

| 1-year | -51.01% |

| 3-year | -3.13% |

| 5-year | N/A |

| YTD | -20.22% |

| 2023 | 0.83% |

| 2022 | -17.03% |

| 2021 | 35.71% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...