Alpine 4 Technologies, Ltd. (ALPP): Price and Financial Metrics

ALPP Price/Volume Stats

| Current price | $0.48 | 52-week high | $2.12 |

| Prev. close | $0.50 | 52-week low | $0.35 |

| Day low | $0.47 | Volume | 70,600 |

| Day high | $0.53 | Avg. volume | 115,210 |

| 50-day MA | $0.52 | Dividend yield | N/A |

| 200-day MA | $0.70 | Market Cap | 13.05M |

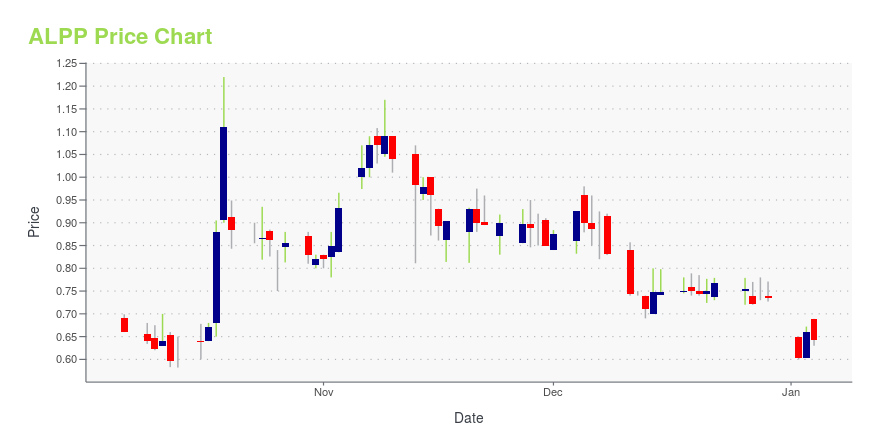

ALPP Stock Price Chart Interactive Chart >

Alpine 4 Technologies, Ltd. (ALPP) Company Bio

Alpine 4 Technologies, Ltd., a technology holding company, provides electronic contract manufacturing solutions in the United States. The company also offers automotive technologies, including 6th Sense Auto, a connected car technology that provides various advantages to management, sales, finance, and service departments in the automotive dealership industry to enhance productivity, profitability, and customer retention; and BrakeActive, a safety device that enhances vehicle's third brake light's ability to reduce or prevent a rear end collision. In addition, it provides fabricated metal parts, assemblies, and sub-assemblies to original equipment manufacturers; and designs, fabricates, and installs dust collectors, commercial ductwork, kitchen hoods, industrial ventilation systems, machine guards, architectural work, water furnaces, and others, as well as specialized spiral duct work. The company was formerly known as Alpine 4 Automotive Technologies Ltd. and changed its name to Alpine 4 Technologies Ltd. in June 2015. Alpine 4 Technologies, Ltd. was founded in 2014 and is based in Phoenix, Arizona.

Latest ALPP News From Around the Web

Below are the latest news stories about ALPINE 4 HOLDINGS INC that investors may wish to consider to help them evaluate ALPP as an investment opportunity.

Alpine 4 Holdings (ALPP) Announces Receipt of Nasdaq Notice of Additional Staff DeterminationPHOENIX, AZ / ACCESSWIRE / November 22, 2023 / Alpine 4 Holdings, Inc. (NASDAQ:ALPP), a leading operator and owner of small market businesses, announced that on November 16, 2023, it received a staff determination notice from the Listing Qualifications ... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start the day with a breakdown of the biggest pre-market stock movers worth keeping an eye on for Thursday! |

Alpine 4 Holdings Subsidiaries, Vayu Aerospace Corporation and Global Autonomous Corporation to Embark on the Next Phase of the BVLOS Certification Process in Dubai, UAEPHOENIX, AZ / ACCESSWIRE / November 1, 2023 / Alpine 4 Holdings, Inc. (NASDAQ:ALPP), a leading operator and owner of small market businesses, is pleased to announce that subsidiaries, Vayu Aerospace Corporation (Vayu) and Global Autonomous Corporation ... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're closing out the trading week with a breakdown of the biggest pre-market stock movers worth watching on Friday morning! |

Alpine 4 Holdings Subsidiary, Identified Technologies, Secures Ariel 3D Mapping Work with Vulcan Materials CompanyAlpine 4 Holdings, Inc. (NASDAQ:ALPP), a leading operator and owner of small market businesses, is pleased to announce that over the last 90 days its subsidiary, Identified Technologies (IDT), has been awarded new 3D Mapping work at 85 locations across the United States for Vulcan Materials Company (Vulcan) (NYSE:VMC). |

ALPP Price Returns

| 1-mo | -0.91% |

| 3-mo | -36.00% |

| 6-mo | -17.03% |

| 1-year | -74.33% |

| 3-year | -97.67% |

| 5-year | 259.28% |

| YTD | -34.69% |

| 2023 | -82.62% |

| 2022 | -72.47% |

| 2021 | -47.25% |

| 2020 | 1,759.04% |

| 2019 | N/A |

Continue Researching ALPP

Here are a few links from around the web to help you further your research on Alpine 4 Technologies Ltd's stock as an investment opportunity:Alpine 4 Technologies Ltd (ALPP) Stock Price | Nasdaq

Alpine 4 Technologies Ltd (ALPP) Stock Quote, History and News - Yahoo Finance

Alpine 4 Technologies Ltd (ALPP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...