Altus Midstream Company (ALTM): Price and Financial Metrics

ALTM Price/Volume Stats

| Current price | $3.42 | 52-week high | $25.86 |

| Prev. close | $3.31 | 52-week low | $3.10 |

| Day low | $3.32 | Volume | 6,090,321 |

| Day high | $3.47 | Avg. volume | 12,405,782 |

| 50-day MA | $3.83 | Dividend yield | N/A |

| 200-day MA | $7.69 | Market Cap | 3.68B |

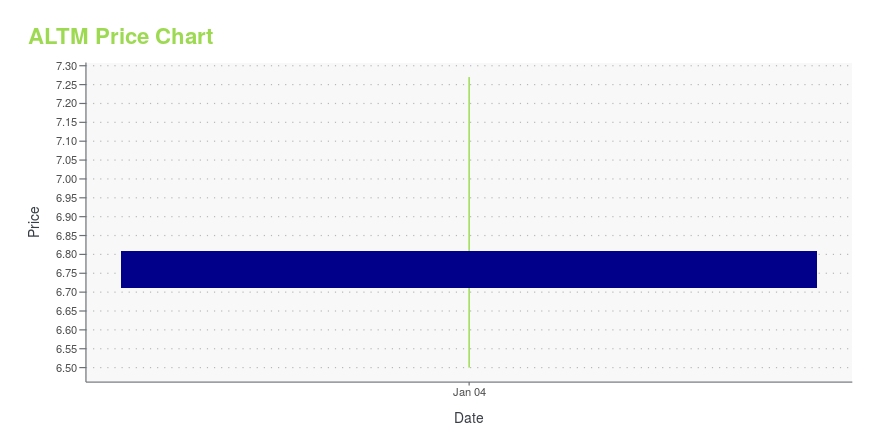

ALTM Stock Price Chart Interactive Chart >

Altus Midstream Company (ALTM) Company Bio

Altus Midstream Company owns gas gathering, processing, and transmission assets in the Permian Basin of West Texas. As of December 31, 2019, its assets included approximately 178 miles of in-service natural gas gathering, 55 miles of residue gas, and 38 miles of natural gas liquids (NGL) pipelines; three cryogenic processing trains; and an NGL truck loading terminal with six lease automatic custody transfer units and eight NGL bullet tanks. The company is based in Houston, Texas. Altus Midstream Company is a subsidiary of Apache Midstream LLC.

Latest ALTM News From Around the Web

Below are the latest news stories about Altus Midstream Co that investors may wish to consider to help them evaluate ALTM as an investment opportunity.

Kinetik Issues 2022 Guidance and Announces Capital Allocation UpdateMIDLAND, Texas and HOUSTON, Feb. 23, 2022 (GLOBE NEWSWIRE) -- Kinetik Holdings Inc. (NASDAQ: KNTK) (“Kinetik”, the “Company” or “we”) today provided full year 2022 Guidance. Highlights Super-system interconnect to be completed in June 2022 allowing for 500 Mmcfpd of bi-directional capacity flow between the legacy Altus Midstream and BCP Raptor systemsUpside to original $50 million run-rate EBITDA synergy estimate, including a new gathering and processing agreement with ApacheFull redemption of t |

Altus Midstream is now KinetikKNTK will start trading on the NASDAQ effective tomorrow Kinetik also updates details on Independent Board Members MIDLAND, Texas and HOUSTON, Feb. 22, 2022 (GLOBE NEWSWIRE) -- Kinetik Holdings Inc. (“Kinetik”, the “Company” or “we”) today announced the completion of the business combination of Altus Midstream Company (Nasdaq: ALTM) (“Altus”) and BCP Raptor Holdco LP (“BCP”), creating a unique, fully integrated midstream company. Kinetik is the only pure-play midstream company in the Texas Delaw |

Altus Midstream Announces Fourth-Quarter and Full-Year 2021 ResultsHOUSTON, Feb. 21, 2022 (GLOBE NEWSWIRE) -- Altus Midstream Company (Nasdaq: ALTM) today announced its fourth-quarter and full-year 2021 results. Results can be found on the company’s website at www.altusmidstream.com/investors. About Altus Midstream Company Altus Midstream Company is a pure-play, Permian-to-Gulf Coast midstream C-corporation. Through its consolidated subsidiaries, Altus owns gas gathering, processing and transmission assets servicing production in the Delaware Basin and owns equ |

Altus Midstream: This Unconventional Midstream Play Has Great Long And Short-Term PotentialNo summary available. |

Altus Midstream Shareholders Approve Combination With BCP Raptor HoldcoNewly Combined Company to be renamed Kinetik at Closing with the New Ticker Symbol “KNTK”HOUSTON, Feb. 10, 2022 (GLOBE NEWSWIRE) -- Altus Midstream Company (Nasdaq: ALTM) today announced that its shareholders voted in favor of the previously announced business combination with BCP Raptor Holdco, LP (“BCP”), the parent company of the EagleClaw Midstream business. The all-stock business combination is expected to close on or around Feb. 22, 2022 (“Closing”). New Company Name Altus also announced t |

ALTM Price Returns

| 1-mo | -4.47% |

| 3-mo | -11.86% |

| 6-mo | -32.81% |

| 1-year | -86.20% |

| 3-year | -79.23% |

| 5-year | -96.65% |

| YTD | -80.98% |

| 2023 | -9.51% |

| 2022 | -18.50% |

| 2021 | 70.06% |

| 2020 | -88.98% |

| 2019 | -38.04% |

Continue Researching ALTM

Want to do more research on Altus Midstream Co's stock and its price? Try the links below:Altus Midstream Co (ALTM) Stock Price | Nasdaq

Altus Midstream Co (ALTM) Stock Quote, History and News - Yahoo Finance

Altus Midstream Co (ALTM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...