Ambarella Inc. (AMBA): Price and Financial Metrics

AMBA Price/Volume Stats

| Current price | $53.04 | 52-week high | $84.71 |

| Prev. close | $52.68 | 52-week low | $40.31 |

| Day low | $52.57 | Volume | 552,000 |

| Day high | $54.60 | Avg. volume | 590,102 |

| 50-day MA | $55.38 | Dividend yield | N/A |

| 200-day MA | $53.45 | Market Cap | 2.17B |

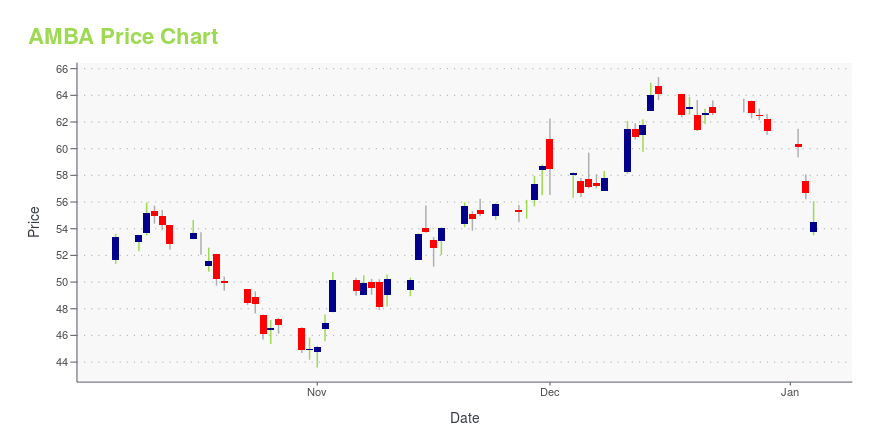

AMBA Stock Price Chart Interactive Chart >

Ambarella Inc. (AMBA) Company Bio

Ambarella Inc. is a developer of low-power, high-definition (HD) and Ultra HD video compression and image processing solutions. The company's products are used in a variety of HD cameras including security IP-cameras, sports cameras, wearable cameras, flying cameras and automotive video camera recorders. The company was founded in 2004 and is based in Santa Clara, California.

Latest AMBA News From Around the Web

Below are the latest news stories about AMBARELLA INC that investors may wish to consider to help them evaluate AMBA as an investment opportunity.

Ambarella Inc CFO Brian White Sells 3,357 SharesBrian White, the Chief Financial Officer of Ambarella Inc (NASDAQ:AMBA), executed a sale of 3,357 shares in the company on December 19, 2023, according to a SEC Filing. |

12 Best Undervalued Stocks to Buy According to RedditIn this article, we discuss the 12 best undervalued stocks to buy according to Reddit. If you want to read about some more undervalued stocks, go directly to 5 Best Undervalued Stocks to Buy According to Reddit. Retail investors who often discuss their investment strategies on platforms like Reddit have become a dominant market force […] |

Insider Sell: Ambarella Inc CTO Leslie Kohn Sells 1,713 SharesAmbarella Inc (NASDAQ:AMBA), a technology company that specializes in the design and development of high-definition video compression and image processing semiconductors, has reported an insider selling event. |

14 Best Automation Stocks To Buy NowIn this article, we discuss the 14 best automation stocks to buy now. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Automation Stocks To Buy Now. Automation is a trend that has been sweeping across the business world for the past few decades, making headlines every now […] |

Ambarella (AMBA) Launches Autonomous Driving Software StackAmbarella (AMBA) introduces an autonomous driving software stack with environmental perception, sensor fusion and vehicle path planning capabilities. |

AMBA Price Returns

| 1-mo | -0.34% |

| 3-mo | 23.09% |

| 6-mo | -3.16% |

| 1-year | -33.51% |

| 3-year | -41.97% |

| 5-year | 6.96% |

| YTD | -13.46% |

| 2023 | -25.47% |

| 2022 | -59.47% |

| 2021 | 120.96% |

| 2020 | 51.62% |

| 2019 | 73.13% |

Continue Researching AMBA

Want to see what other sources are saying about Ambarella Inc's financials and stock price? Try the links below:Ambarella Inc (AMBA) Stock Price | Nasdaq

Ambarella Inc (AMBA) Stock Quote, History and News - Yahoo Finance

Ambarella Inc (AMBA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...