Amkor Technology, Inc. (AMKR): Price and Financial Metrics

AMKR Price/Volume Stats

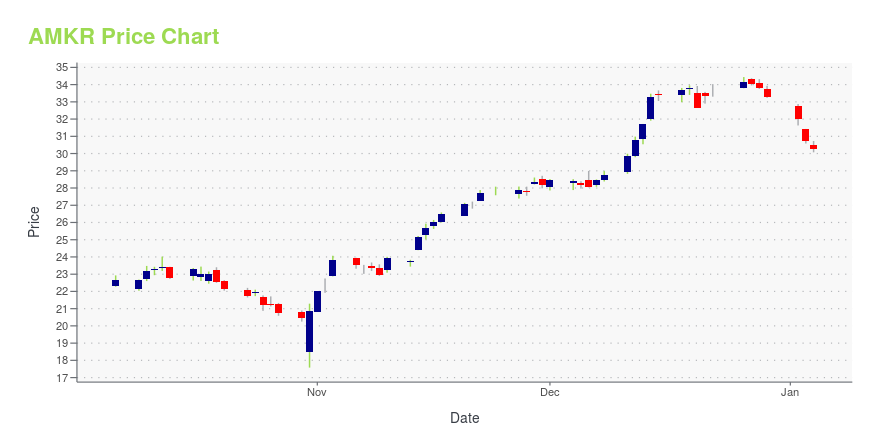

| Current price | $38.15 | 52-week high | $44.86 |

| Prev. close | $38.18 | 52-week low | $17.58 |

| Day low | $37.67 | Volume | 1,128,825 |

| Day high | $39.15 | Avg. volume | 1,178,424 |

| 50-day MA | $37.19 | Dividend yield | 0.77% |

| 200-day MA | $31.60 | Market Cap | 9.38B |

AMKR Stock Price Chart Interactive Chart >

Amkor Technology, Inc. (AMKR) Company Bio

Amkor Technology is a provider of semiconductor packaging and test services to semiconductor companies and electronics OEMs. The company was founded in 1968 and is based in Tempe, Arizona.

Latest AMKR News From Around the Web

Below are the latest news stories about AMKOR TECHNOLOGY INC that investors may wish to consider to help them evaluate AMKR as an investment opportunity.

The Chip Wars Are MetastasizingThe fight for chip tech supremacy has begun to migrate into a new area: how to package chips together to achieve better performance. |

Amkor Technology's (NASDAQ:AMKR) Returns Have Hit A WallIf you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'll want to see a proven... |

Amkor Technology Submits Net Zero Goal to Science Based Targets initiative (SBTi)TEMPE, Ariz., December 12, 2023--Amkor Technology Submits Net Zero Goal to Science Based Targets initiative (SBTi) |

Insider Sell Alert: Director Roger Carolin Sells 20,000 Shares of Amkor Technology Inc (AMKR)In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. |

What TSMC, Amkor, and Samsung Investors Should Know About Recent Semiconductor Manufacturing UpdatesIn today's video, I discuss recent updates impacting Taiwan Semiconductor Manufacturing (NYSE: TSM), Amkor Technology (NASDAQ: AMKR), and Samsung. Check out the short video to learn more, consider subscribing, and click the special offer link below. |

AMKR Price Returns

| 1-mo | -2.40% |

| 3-mo | 24.90% |

| 6-mo | 17.51% |

| 1-year | 32.62% |

| 3-year | 67.28% |

| 5-year | 382.14% |

| YTD | 15.21% |

| 2023 | 40.32% |

| 2022 | -2.31% |

| 2021 | 65.57% |

| 2020 | 16.30% |

| 2019 | 98.17% |

AMKR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AMKR

Want to see what other sources are saying about Amkor Technology Inc's financials and stock price? Try the links below:Amkor Technology Inc (AMKR) Stock Price | Nasdaq

Amkor Technology Inc (AMKR) Stock Quote, History and News - Yahoo Finance

Amkor Technology Inc (AMKR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...