Amplitech Group Inc. (AMPG): Price and Financial Metrics

AMPG Price/Volume Stats

| Current price | $1.17 | 52-week high | $2.55 |

| Prev. close | $1.18 | 52-week low | $1.00 |

| Day low | $1.17 | Volume | 14,400 |

| Day high | $1.20 | Avg. volume | 34,444 |

| 50-day MA | $1.19 | Dividend yield | N/A |

| 200-day MA | $1.76 | Market Cap | 11.37M |

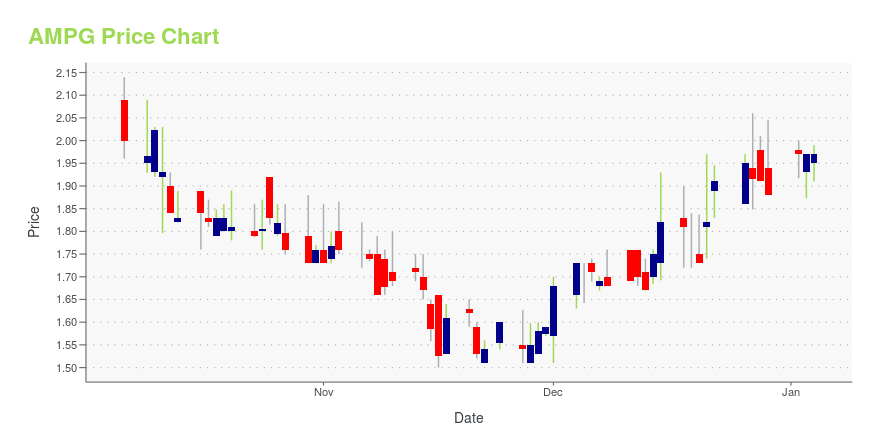

AMPG Stock Price Chart Interactive Chart >

Amplitech Group Inc. (AMPG) Company Bio

AmpliTech Group, Inc. engages in the design, development, and manufacture of microwave amplifiers. It also offers passive components including rectangular adapters and power dividers. Its radio-frequency components are used for domestic and international, satellite communication (SATCOM), space, defense, and military markets. The company was founded by Fawad Maqbool on October 18, 2002 and is headquartered in Bohemia, NY.

Latest AMPG News From Around the Web

Below are the latest news stories about AMPLITECH GROUP INC that investors may wish to consider to help them evaluate AMPG as an investment opportunity.

AmpliTech Group, Inc. Discusses 2023 Revenue Projections and 2024 Technology Applications with The Stock Day PodcastPHOENIX, AZ / ACCESSWIRE / November 28, 2023 / The Stock Day Podcast welcomed AmpliTech Group, Inc. (AMPG)("the Company"), a company that designs, develops, manufactures, and distributes state-of-the-art radio frequency (RF) microwave components for ... |

AmpliTech Reports Third Quarter 2023 Financial Results-Q3 Sales of $3.4 Million, $1.5 Million Gross Profit--Multiple New LNA Products Now Available--Conference Call Tuesday, November 14th at 4:30 PM ETHAUPPAUGE, NY / ACCESSWIRE / November 14, 2023 / AmpliTech Group, Inc (Nasdaq:AMPG), a designer, developer, ... |

AmpliTech to Host Quarterly Investor Call to Review Q3 2023 Earnings on Tuesday November 14, 4:30 PM ET; Dial-in # 1-833-630-0019 or 1-412-317-1807HAUPPAUGE, NY / ACCESSWIRE / November 13, 2023 / AmpliTech Group, Inc (NASDAQ:AMPG), a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks and a worldwide distributor ... |

AmpliTech Group Announces New Product Lines; Adds E-Commerce Capabilities to WebsiteHAUPPAUGE, NY / ACCESSWIRE / November 2, 2023 / AmpliTech Group, Inc (Nasdaq:AMPG), a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks and a worldwide distributor ... |

AmpliTech Group’s Division, AGMDC (AmpliTech Group Microwave Design Center), Inks Distribution Deal with Component Distributors Inc (CDI), a Global Value-Added Distributor of Electronic ComponentsHAUPPAUGE, NY / ACCESSWIRE / November 1, 2023 / AmpliTech Group, Inc. (NASDAQ:AMPG), a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks and a worldwide distributor ... |

AMPG Price Returns

| 1-mo | 11.43% |

| 3-mo | -48.91% |

| 6-mo | -49.13% |

| 1-year | -46.08% |

| 3-year | -68.72% |

| 5-year | -11.50% |

| YTD | -37.77% |

| 2023 | -11.32% |

| 2022 | -46.19% |

| 2021 | 7.42% |

| 2020 | 170.50% |

| 2019 | 139.58% |

Loading social stream, please wait...