Amarin Corp. PLC ADR (AMRN): Price and Financial Metrics

AMRN Price/Volume Stats

| Current price | $0.80 | 52-week high | $1.37 |

| Prev. close | $0.79 | 52-week low | $0.63 |

| Day low | $0.77 | Volume | 702,843 |

| Day high | $0.82 | Avg. volume | 1,748,948 |

| 50-day MA | $0.77 | Dividend yield | N/A |

| 200-day MA | $0.89 | Market Cap | 327.02M |

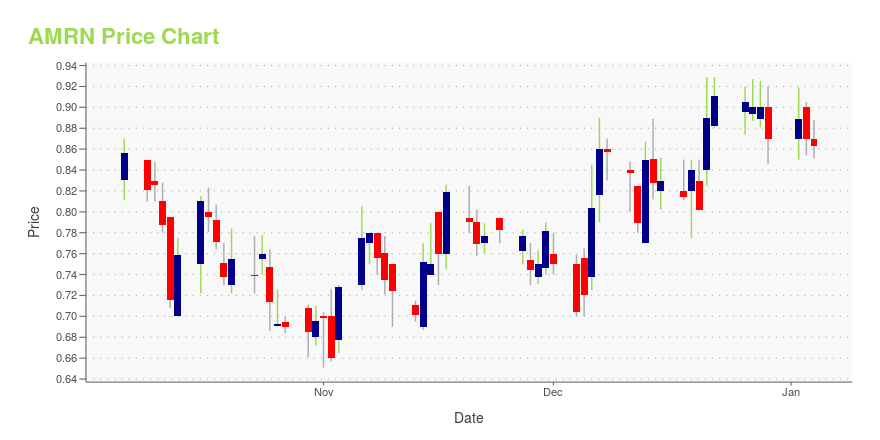

AMRN Stock Price Chart Interactive Chart >

Amarin Corp. PLC ADR (AMRN) Company Bio

Amarin Corporation plc, a biopharmaceutical company, focuses on developing and commercializing therapeutics for the treatment of cardiovascular diseases in the United States. The company was founded in 1989 and is based in Dublin, Ireland.

Latest AMRN News From Around the Web

Below are the latest news stories about AMARIN CORP PLC that investors may wish to consider to help them evaluate AMRN as an investment opportunity.

13 Most Promising Small-Cap Stocks According to AnalystsIn this piece, we will take a look at the 13 most promising small-cap stocks according to analysts. If you want to skip our overview of small cap investing and the latest stock market news, then you can take a look at the 5 Most Promising Small-Cap Stocks To Buy. Within the broader world of […] |

Amarin to Present at the 42nd Annual J.P. Morgan Healthcare ConferenceDUBLIN, Ireland and BRIDGEWATER, N.J., Dec. 11, 2023 (GLOBE NEWSWIRE) -- Amarin Corporation plc (NASDAQ:AMRN) today announced its participation in the 42nd Annual JP Morgan Healthcare Conference. Amarin’s president and chief executive officer, Patrick Holt, is scheduled to present at the conference on January 10, 2024. 42nd Annual J.P. Morgan Healthcare Conference (January 8th-11th, 2024; San Francisco, California) Date/Time: January 10, 2024, 4:30 p.m. ET/ 1:30 p.m. PST Webcast: https://jpmorga |

Why Is Amicus Therapeutics (FOLD) Up 15% Since Last Earnings Report?Amicus Therapeutics (FOLD) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

What Makes Amarin (AMRN) a New Buy StockAmarin (AMRN) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

New REDUCE-IT® Analyses Show VASCEPA® (icosapent ethyl) Associated with 29 Percent Relative Risk Reduction Compared with Placebo in Prespecified Subgroup of Patients with Metabolic Syndrome, but Without Diabetes at Baseline-- Analysis Also Found IPE Was Associated with a 41% Reduction in Total Events Compared with Placebo -- -- Subgroup Almost Exclusively Comprised of Patients with Established Cardiovascular Disease -- -- Findings Continue to Reinforce the Scientific Data and Clinical Use of VASCEPA®/VAZKEPA® to Reduce Cardiovascular Risk -- -- Results Presented Today at the American Heart Association (AHA) Scientific Sessions 2023 and Simultaneously Published in the European Heart Journal Open -- DUBLIN, Ireland |

AMRN Price Returns

| 1-mo | 14.58% |

| 3-mo | -8.56% |

| 6-mo | -39.39% |

| 1-year | -28.57% |

| 3-year | -80.00% |

| 5-year | -95.63% |

| YTD | -8.05% |

| 2023 | -28.10% |

| 2022 | -64.09% |

| 2021 | -31.08% |

| 2020 | -77.19% |

| 2019 | 57.53% |

Continue Researching AMRN

Want to do more research on Amarin Corp Plc's stock and its price? Try the links below:Amarin Corp Plc (AMRN) Stock Price | Nasdaq

Amarin Corp Plc (AMRN) Stock Quote, History and News - Yahoo Finance

Amarin Corp Plc (AMRN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...