American Shared Hospital Services (AMS): Price and Financial Metrics

AMS Price/Volume Stats

| Current price | $3.17 | 52-week high | $3.69 |

| Prev. close | $3.20 | 52-week low | $2.16 |

| Day low | $3.17 | Volume | 8,830 |

| Day high | $3.23 | Avg. volume | 10,485 |

| 50-day MA | $3.25 | Dividend yield | N/A |

| 200-day MA | $2.80 | Market Cap | 20.07M |

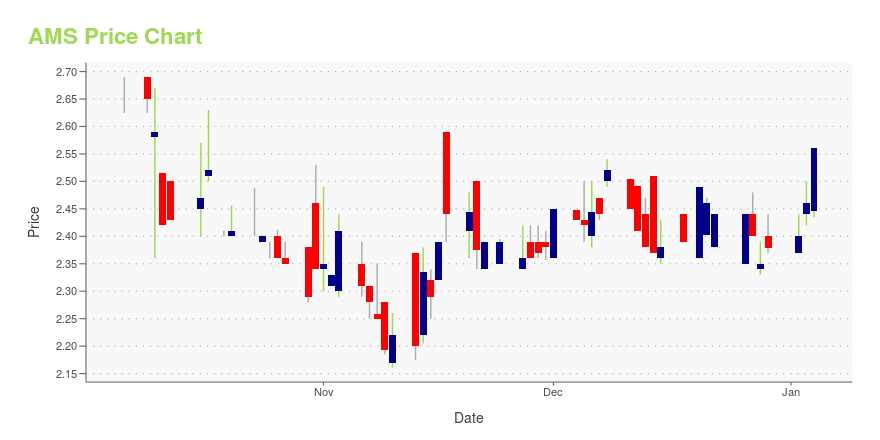

AMS Stock Price Chart Interactive Chart >

American Shared Hospital Services (AMS) Company Bio

American Shared Hospital Services engages in leasing radiosurgery and radiation therapy equipment to healthcare providers. Its equipment includes Gamma Knife, PBRT, and IGRT. The Gamma Knife radiosurgery equipment is a non-invasive treatment for malignant and benign brain tumors, vascular malformations and trigeminal neuralgia. The company was founded by Ernest A. Bates in 1977 and is headquartered in San Francisco, CA.

Latest AMS News From Around the Web

Below are the latest news stories about AMERICAN SHARED HOSPITAL SERVICES that investors may wish to consider to help them evaluate AMS as an investment opportunity.

GK Financing LLC, a Subsidiary of American Shared Hospital Services, Announces Agreement to Reload Lovelace Medical Center with New Cobalt Sources and Software UpgradeInstallation expected to be Completed in Mid-2024SAN FRANCISCO, Dec. 13, 2023 (GLOBE NEWSWIRE) -- GK Financing LLC (GKF), a subsidiary of American Shared Hospital Services (NYSE American: AMS), and a leading provider of creative financial and turnkey technology solutions for advanced radiosurgery and radiation oncology services, announced today that it has entered into an agreement with Lovelace Medical Center (LMC), Albuquerque, NM, to reload its Gamma Knife Icon with new Cobalt Sources, as wel |

GK Financing LLC, a Subsidiary of American Shared Hospital Services, Announces Upgrading at Ecuador Center (GKCE) with State-of-the-Art Gamma Knife ICONUpgrade of Gamma Knife® 4C with NEW Elekta ICON for most precise and accurate treatment of Intracranial cancers and other indicationsSAN FRANCISCO, Nov. 28, 2023 (GLOBE NEWSWIRE) -- GK Financing LLC (GKF), a subsidiary of American Shared Hospital Services (NYSE American: AMS), a leading provider of creative financial and turnkey technology solutions for advanced radiosurgery and radiation oncology services, announced today that it has demonstrated its continued commitment in Ecuador by completin |

American Shared Hospital Services Enters Into Agreement to Acquire 60% Majority Interest in Three Radiation Therapy Cancer Centers in Rhode Island- Accretive Transaction to Expand U.S. Footprint - SAN FRANCISCO, CA, Nov. 20, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire -- American Shared Hospital Services (NYSE American: AMS) (“ASHS” or the "Company"), a leading provider of turnkey technology solutions for stereotactic radiosurgery and advanced radiation therapy cancer treatment systems and services, today announced that it has entered into an Investment Purchase Agreement (the “IPA”) to purchase a 60% majority equity interest in the South |

American Shared Hospital Services (AMEX:AMS) Q3 2023 Earnings Call TranscriptAmerican Shared Hospital Services (AMEX:AMS) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Good day, and welcome to the American Shared Hospital Services Third Quarter 2023 Earnings Conference Call. All participants will be in listen-only mode. [Operator instructions] After today’s presentation, there will be an opportunity to ask questions. Please note this event is […] |

American Shared Hospital Services Reports Third Quarter 2023 Financial Results- Sales Pipeline Continues to Increase, including 2 Existing Lease Extensions- - International Cancer Center Equipment Upgrades Advancing, Expect Start-up of 2 Systems within 90 Days- -Conference Call Monday, November 13th at 4:30 pm ET / 1:30 pm PT- SAN FRANCISCO, CA, Nov. 13, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire -- American Shared Hospital Services (NYSE American: AMS) (the "Company"), a leading provider of turnkey technology solutions for stereotactic radiosurgery and advanced radiation |

AMS Price Returns

| 1-mo | -2.98% |

| 3-mo | 0.00% |

| 6-mo | 16.97% |

| 1-year | 20.46% |

| 3-year | 12.41% |

| 5-year | 5.32% |

| YTD | 33.23% |

| 2023 | -18.79% |

| 2022 | 23.63% |

| 2021 | 6.76% |

| 2020 | -9.02% |

| 2019 | 2.52% |

Continue Researching AMS

Want to do more research on American Shared Hospital Services's stock and its price? Try the links below:American Shared Hospital Services (AMS) Stock Price | Nasdaq

American Shared Hospital Services (AMS) Stock Quote, History and News - Yahoo Finance

American Shared Hospital Services (AMS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...