American Superconductor Corporation (AMSC): Price and Financial Metrics

AMSC Price/Volume Stats

| Current price | $18.93 | 52-week high | $38.02 |

| Prev. close | $19.40 | 52-week low | $11.36 |

| Day low | $18.79 | Volume | 111,918 |

| Day high | $19.57 | Avg. volume | 1,080,946 |

| 50-day MA | $24.63 | Dividend yield | N/A |

| 200-day MA | $25.17 | Market Cap | 746.98M |

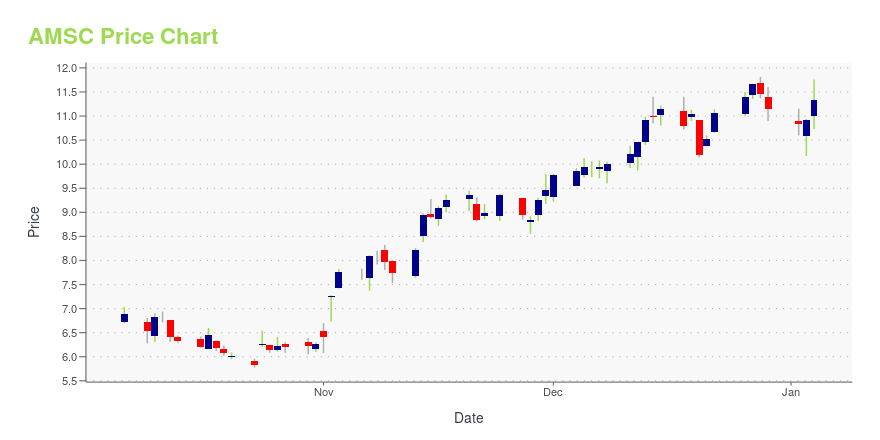

AMSC Stock Price Chart Interactive Chart >

American Superconductor Corporation (AMSC) Company Bio

American Superconductor Corporation provides megawatt-scale solutions worldwide. It operates through two segments, Wind and Grid. The company was founded in 1987 and is based in Devens, Massachusetts.

AMSC Price Returns

| 1-mo | -20.26% |

| 3-mo | -24.46% |

| 6-mo | -17.62% |

| 1-year | 40.12% |

| 3-year | 131.70% |

| 5-year | 262.64% |

| YTD | -23.14% |

| 2024 | 121.10% |

| 2023 | 202.72% |

| 2022 | -66.18% |

| 2021 | -53.54% |

| 2020 | 198.34% |

Continue Researching AMSC

Want to do more research on American Superconductor Corp's stock and its price? Try the links below:American Superconductor Corp (AMSC) Stock Price | Nasdaq

American Superconductor Corp (AMSC) Stock Quote, History and News - Yahoo Finance

American Superconductor Corp (AMSC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...