American Superconductor Corporation (AMSC): Price and Financial Metrics

AMSC Price/Volume Stats

| Current price | $25.44 | 52-week high | $32.70 |

| Prev. close | $25.04 | 52-week low | $5.78 |

| Day low | $24.97 | Volume | 601,818 |

| Day high | $26.00 | Avg. volume | 980,085 |

| 50-day MA | $23.03 | Dividend yield | N/A |

| 200-day MA | $14.04 | Market Cap | 941.23M |

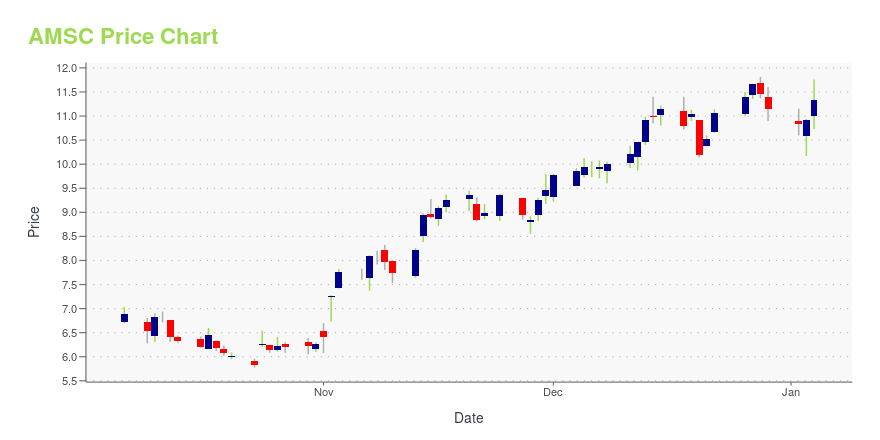

AMSC Stock Price Chart Interactive Chart >

American Superconductor Corporation (AMSC) Company Bio

American Superconductor Corporation provides megawatt-scale solutions worldwide. It operates through two segments, Wind and Grid. The company was founded in 1987 and is based in Devens, Massachusetts.

Latest AMSC News From Around the Web

Below are the latest news stories about AMERICAN SUPERCONDUCTOR CORP that investors may wish to consider to help them evaluate AMSC as an investment opportunity.

Is American Superconductor (AMSC) Outperforming Other Computer and Technology Stocks This Year?Here is how American Superconductor (AMSC) and CrowdStrike Holdings (CRWD) have performed compared to their sector so far this year. |

3 Stocks to Watch for Major Upcoming CatalystsMajor, positive catalysts can cause stocks to soar. |

Are Computer and Technology Stocks Lagging American Superconductor (AMSC) This Year?Here is how American Superconductor (AMSC) and Arlo Technologies (ARLO) have performed compared to their sector so far this year. |

Do You Believe in the Upside Potential of American Superconductor Corporation (AMSC)?Meridian Funds, managed by ArrowMark Partners, released its “Meridian Contrarian Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, the fund returned -6.16% (net) compared to a -4.78% return for the Russell 2500 Index. Furthermore, the fund underperformed its secondary benchmark, the Russell 2500 Value Index, […] |

Wall Street Analysts Believe American Superconductor (AMSC) Could Rally 25.28%: Here's is How to TradeThe average of price targets set by Wall Street analysts indicates a potential upside of 25.3% in American Superconductor (AMSC). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock. |

AMSC Price Returns

| 1-mo | 7.80% |

| 3-mo | 107.33% |

| 6-mo | 84.75% |

| 1-year | 201.07% |

| 3-year | 85.69% |

| 5-year | 188.76% |

| YTD | 128.37% |

| 2023 | 202.72% |

| 2022 | -66.18% |

| 2021 | -53.54% |

| 2020 | 198.34% |

| 2019 | -29.60% |

Continue Researching AMSC

Want to do more research on American Superconductor Corp's stock and its price? Try the links below:American Superconductor Corp (AMSC) Stock Price | Nasdaq

American Superconductor Corp (AMSC) Stock Quote, History and News - Yahoo Finance

American Superconductor Corp (AMSC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...