TD Ameritrade Holding Corporation (AMTD): Price and Financial Metrics

AMTD Price/Volume Stats

| Current price | $1.55 | 52-week high | $4.70 |

| Prev. close | $1.56 | 52-week low | $1.50 |

| Day low | $1.54 | Volume | 8,554 |

| Day high | $1.59 | Avg. volume | 36,592 |

| 50-day MA | $1.67 | Dividend yield | N/A |

| 200-day MA | $1.86 | Market Cap | 120.80M |

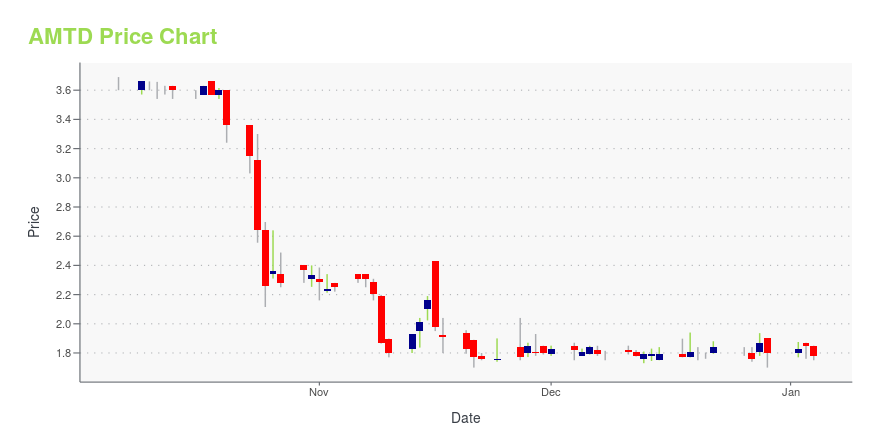

AMTD Stock Price Chart Interactive Chart >

TD Ameritrade Holding Corporation (AMTD) Company Bio

TD Ameritrade provides securities brokerage services and related technology-based financial services to retail investors, traders, and independent registered investment advisors (RIAs) in the United States. The company was founded in 1971 and is based in Omaha, Nebraska.

Latest AMTD News From Around the Web

Below are the latest news stories about AMTD IDEA GROUP that investors may wish to consider to help them evaluate AMTD as an investment opportunity.

AMTD International GAAP EPS of $0.33, revenue of $128MMore on AMTD International... |

AMTD IDEA Recorded Solid Performance With 47.4% Increase In Net Assets to US$1.5 Billion; A 8.6% Increase In Total Revenue to US$128.0 MillionPARIS & NEW YORK & SINGAPORE, December 28, 2023--AMTD IDEA Group ("AMTD IDEA" or the "Company", NYSE: AMTD;SGX: HKB), a NYSE and SGX-ST dual listed company and a controlling shareholder of AMTD Digital, today announced its unaudited financial results for the six months ended June 30, 2023. Coinciding with the announcement, AMTD IDEA also announced the migration of its headquarters and principal executive office to Paris, France. |

The Most Popular Barron’s Advisor Articles of 2023Our most-read articles this year covered Covid-related IRS tax relief programs, Schwab’s TD Ameritrade integration, and former Republican Congressman George Santos’ consulting company, among other topics. |

Charles Schwab’s New Assets Rebound From October’s Slump. The Stock Jumps.The company had suffered some attrition of retail investors and advisors related to the TD Ameritrade integration. |

Schwab’s Stock Rebounds. Why It Could Gain More Next Year.The company has suffered from the attrition of some TD Ameritrade customers and falling deposits. Those woes may soon be behind it, according to two analysts. |

AMTD Price Returns

| 1-mo | -5.49% |

| 3-mo | -9.36% |

| 6-mo | -10.92% |

| 1-year | -65.78% |

| 3-year | -95.55% |

| 5-year | N/A |

| YTD | -13.89% |

| 2023 | -66.66% |

| 2022 | -71.61% |

| 2021 | -51.97% |

| 2020 | -15.53% |

| 2019 | N/A |

Continue Researching AMTD

Want to do more research on Td Ameritrade Holding Corp's stock and its price? Try the links below:Td Ameritrade Holding Corp (AMTD) Stock Price | Nasdaq

Td Ameritrade Holding Corp (AMTD) Stock Quote, History and News - Yahoo Finance

Td Ameritrade Holding Corp (AMTD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...