American Well Corp. (AMWL): Price and Financial Metrics

AMWL Price/Volume Stats

| Current price | $8.84 | 52-week high | $49.40 |

| Prev. close | $8.35 | 52-week low | $5.00 |

| Day low | $8.35 | Volume | 83,349 |

| Day high | $8.84 | Avg. volume | 124,739 |

| 50-day MA | $8.03 | Dividend yield | N/A |

| 200-day MA | $17.50 | Market Cap | 131.04M |

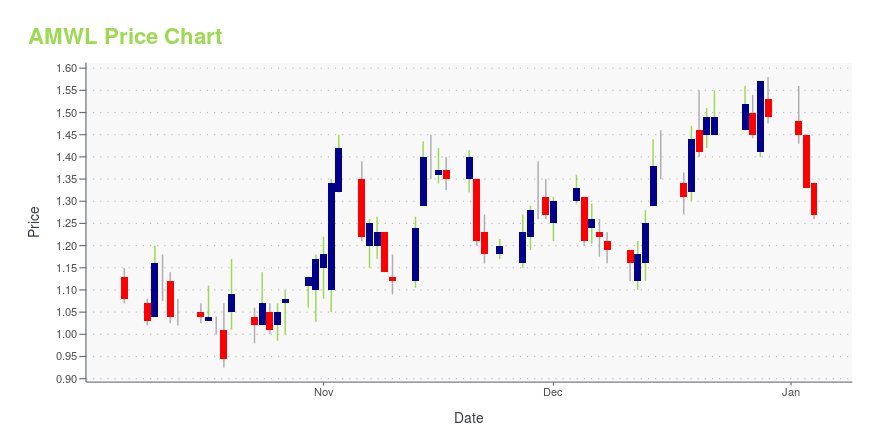

AMWL Stock Price Chart Interactive Chart >

American Well Corp. (AMWL) Company Bio

American Well Corp. engages in the provision of online healthcare services. It offers a single platform to support all telehealth needs from urgent to acute and post-acute care, chronic care management and healthy living. The company's services include urgent care, behavioral health, breastfeeding support, chronic care, nutrition counseling, pediatrics, telestroke and virtual primary care. American Well was founded by Ido Schoenberg and Roy Schoenberg in June 2006 and is headquartered in Boston, MA.

Latest AMWL News From Around the Web

Below are the latest news stories about AMERICAN WELL CORP that investors may wish to consider to help them evaluate AMWL as an investment opportunity.

Axogen, Inc. Appoints Kathy Weiler to its Board of DirectorsWeiler brings 20+ years of strategic and commercial leadership experience to the Axogen, Inc. Board of DirectorsALACHUA, Fla. and TAMPA, Fla., Dec. 26, 2023 (GLOBE NEWSWIRE) -- Axogen, Inc. (NASDAQ: AXGN), a global leader in developing and marketing innovative surgical solutions for peripheral nerve injuries, is pleased to announce today the appointment of Mrs. Kathy Weiler to its Board of Directors, effective December 20, 2023. Weiler, a senior executive with 20+ years of experience and proven |

3 Healthcare Technology Stocks to Improve Lives in 2024Healthcare technology is one of 2024's top investment trends, and investors looking for long-term upside should check out these top stocks. |

Investors Don't See Light At End Of American Well Corporation's (NYSE:AMWL) TunnelWhen you see that almost half of the companies in the Healthcare Services industry in the United States have... |

20 Most Medically Advanced Countries in the World Heading into 2024In this article, we’ll take a look at the 20 Most Medically Advanced Countries in the World Heading into 2024. We’ll also deep diver into the medical industry market insights and some key players in the industry. To skip the detailed analysis and see the top 5 countries, read 5 Most Medically Advanced Countries in […] |

5 Telehealth Stocks That Have Nothing But UpsideNavigate the exciting world of telehealth with our curated list of top telehealth stocks. |

AMWL Price Returns

| 1-mo | 21.73% |

| 3-mo | -16.29% |

| 6-mo | -60.54% |

| 1-year | -81.11% |

| 3-year | -96.09% |

| 5-year | N/A |

| YTD | -70.34% |

| 2023 | -47.35% |

| 2022 | -53.15% |

| 2021 | -76.15% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...