AutoNation, Inc. (AN): Price and Financial Metrics

AN Price/Volume Stats

| Current price | $178.12 | 52-week high | $182.81 |

| Prev. close | $174.96 | 52-week low | $123.81 |

| Day low | $175.10 | Volume | 375,033 |

| Day high | $178.91 | Avg. volume | 431,030 |

| 50-day MA | $167.14 | Dividend yield | N/A |

| 200-day MA | $151.60 | Market Cap | 7.17B |

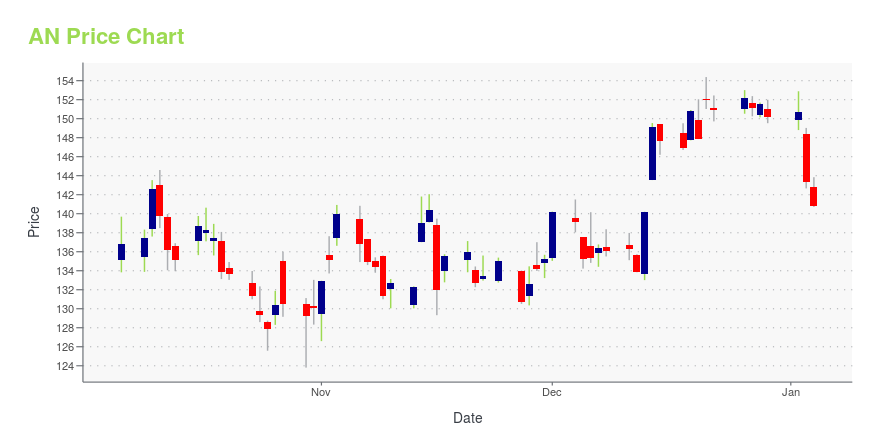

AN Stock Price Chart Interactive Chart >

AutoNation, Inc. (AN) Company Bio

AutoNation provides new and used automotive and spare parts retail services in the United States. The company operates in three segments: Domestic, Import, and Premium Luxury. The company is based in Fort Lauderdale, Florida.

Latest AN News From Around the Web

Below are the latest news stories about AUTONATION INC that investors may wish to consider to help them evaluate AN as an investment opportunity.

7 Mid-Cap Stocks to Buy for Steady Gains in 2024You can go small or you can go big, but ahead of market ambiguities, investors may be best served with mid-cap stocks. |

Zacks Industry Outlook Highlights Lithia Motors, AutoNation and Group 1 AutomotiveLithia Motors, AutoNation and Group 1 Automotive have been highlighted in this Industry Outlook article. |

12 Most Promising Car Stocks According to AnalystsIn this article, we discuss the 12 most promising car stocks according to analysts. To skip the detailed analysis of the automotive industry, go directly to the 5 Most Promising Car Stocks According to Analysts. The car industry has been one of the most important industries in the world since Henry Ford installed the first […] |

3 Auto Retailers to Watch Despite Subdued Industry ProspectsWhile the Zacks Auto Retail & Whole Sales industry's rank paints a lackluster picture, companies like LAD, GPI and AN seem better positioned to navigate the challenges presented by the current market conditions. |

Used-Car Dealer Sinks Below Key Level As Subprime Auto Loans WorsenAmerica's Car-Mart reported a stunning loss for its fiscal second quarter amid subprime auto loan woes. CRMT stock plunged. |

AN Price Returns

| 1-mo | 14.17% |

| 3-mo | 4.85% |

| 6-mo | 27.05% |

| 1-year | 13.87% |

| 3-year | 51.39% |

| 5-year | 264.25% |

| YTD | 18.60% |

| 2023 | 39.96% |

| 2022 | -8.17% |

| 2021 | 67.43% |

| 2020 | 43.51% |

| 2019 | 36.22% |

Continue Researching AN

Want to see what other sources are saying about Autonation Inc's financials and stock price? Try the links below:Autonation Inc (AN) Stock Price | Nasdaq

Autonation Inc (AN) Stock Quote, History and News - Yahoo Finance

Autonation Inc (AN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...