Applied DNA Sciences Inc (APDN): Price and Financial Metrics

APDN Price/Volume Stats

| Current price | $5.04 | 52-week high | $2,655.00 |

| Prev. close | $5.15 | 52-week low | $4.37 |

| Day low | $4.98 | Volume | 83,100 |

| Day high | $5.42 | Avg. volume | 89,115 |

| 50-day MA | $6.64 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 2.19M |

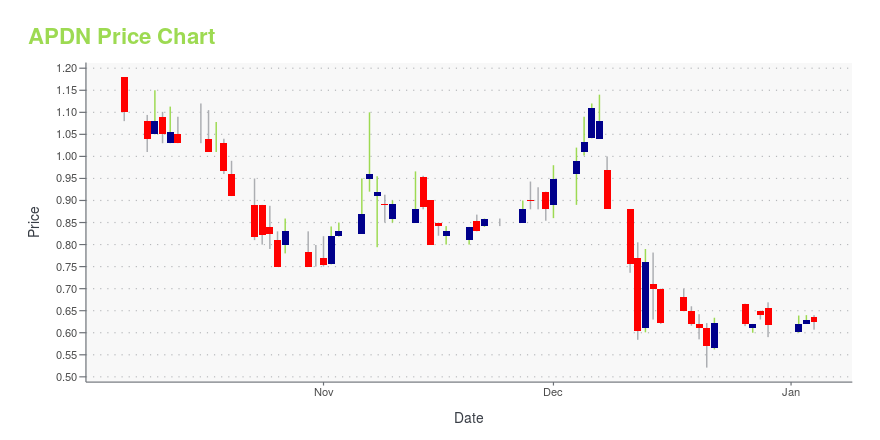

APDN Stock Price Chart Interactive Chart >

Applied DNA Sciences Inc (APDN) Company Bio

Applied DNA Sciences, Inc. develops and markets DNA-based technology solutions for use in the nucleic acid-based in vitro diagnostics and preclinical nucleic-acid based drug development and manufacturing markets; and for supply chain security, anti-counterfeiting, and anti-theft technology purposes applications in the United States, Europe, and Asia. The company's supply chain security and product authentication solutions include SigNature molecular tags that provide forensic power and protection for various applications and can be used to fortify brand protection efforts, and strengthen supply chain security, as well as mark, track, and convict criminals; SigNify IF portable DNA readers and SigNify consumable reagent test kits that provide definitive real-time authentication of molecular tags in the field; and CertainT Supply Chain Platform that provides proof of product claims for materials, items, or products. It also manufactures and sells COVID-19 PCR-based molecular diagnostic test kit under the LineaTM COVID-19 Assay Kit trademark; and non-diagnostic COVID-19 pooled surveillance testing to detect instances of COVID-19 in defined populations under the safeCircle trademark. In addition, the company provides preclinical contract research and manufacturing services for the nucleic acid-based therapeutic markets; and contract research services to RNA based drug and biologic customers for preclinical studies. The company was formerly known as Datalink Systems, Inc. and changed its name to Applied DNA Sciences, Inc. in 2002. Applied DNA Sciences, Inc. was founded in 1983 and is headquartered in Stony Brook, New York.

APDN Price Returns

| 1-mo | -4.73% |

| 3-mo | -58.52% |

| 6-mo | -96.27% |

| 1-year | -98.33% |

| 3-year | -99.95% |

| 5-year | -100.00% |

| YTD | -96.71% |

| 2024 | -98.35% |

| 2023 | -62.84% |

| 2022 | -58.71% |

| 2021 | -21.18% |

| 2020 | 21.72% |

Continue Researching APDN

Want to see what other sources are saying about Applied Dna Sciences Inc's financials and stock price? Try the links below:Applied Dna Sciences Inc (APDN) Stock Price | Nasdaq

Applied Dna Sciences Inc (APDN) Stock Quote, History and News - Yahoo Finance

Applied Dna Sciences Inc (APDN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...