Amphenol Corp. CI A (APH): Price and Financial Metrics

APH Price/Volume Stats

| Current price | $63.86 | 52-week high | $70.84 |

| Prev. close | $61.76 | 52-week low | $39.34 |

| Day low | $63.06 | Volume | 11,995,400 |

| Day high | $64.78 | Avg. volume | 6,505,558 |

| 50-day MA | $67.11 | Dividend yield | 0.66% |

| 200-day MA | $54.89 | Market Cap | 76.71B |

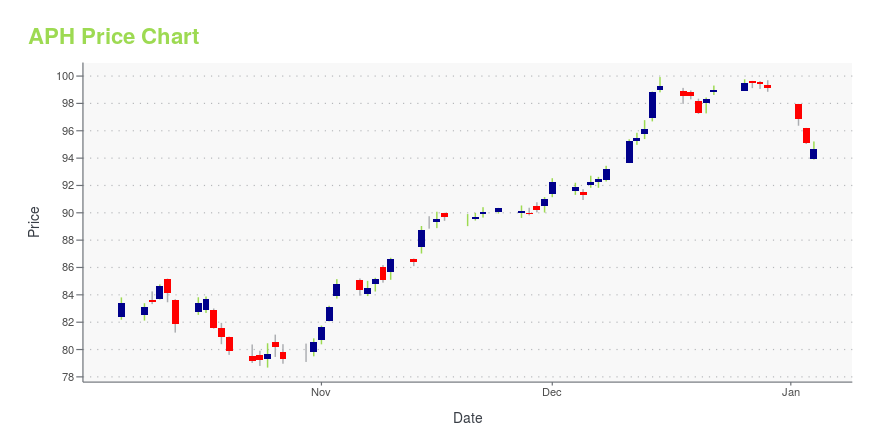

APH Stock Price Chart Interactive Chart >

Amphenol Corp. CI A (APH) Company Bio

Amphenol Corporation is a major producer of electronic and fiber optic connectors, cable and interconnect systems such as coaxial cables. Amphenol is a portmanteau from the corporation's original name, American Phenolic Corp. (Source:Wikipedia)

Latest APH News From Around the Web

Below are the latest news stories about AMPHENOL CORP that investors may wish to consider to help them evaluate APH as an investment opportunity.

1 Boring Stock Investors Need to Know About in 2024 -- It's Crushed the Market for DecadesAmphenol is an underfollowed dividend giant, one also integral to the advance of numerous tech trends. |

PCTEL Announces Closing of its Acquisition by Amphenol CorporationBLOOMINGDALE, Ill., December 15, 2023--PCTEL, Inc. (Nasdaq: PCTI) ("PCTEL" or the "Company"), a leading global provider of wireless technology solutions, today announced that it has been acquired by Amphenol Corporation (NYSE: APH) ("Amphenol"), one of the world’s largest providers of high-technology interconnect, sensor and antenna solutions. Under the terms of the previously announced agreement, PCTEL stockholders are receiving $7.00 in cash for each share of common stock they own. Following t |

Amphenol's (NYSE:APH) Upcoming Dividend Will Be Larger Than Last Year'sAmphenol Corporation ( NYSE:APH ) will increase its dividend from last year's comparable payment on the 10th of January... |

Insiders Are Buying These 3 Tech StocksInsiders have a more extended holding period than most, a critical aspect that investors should be aware of. |

Amphenol Corporation's (NYSE:APH) Stock's On An Uptrend: Are Strong Financials Guiding The Market?Most readers would already be aware that Amphenol's (NYSE:APH) stock increased significantly by 13% over the past... |

APH Price Returns

| 1-mo | -4.91% |

| 3-mo | 6.17% |

| 6-mo | 27.02% |

| 1-year | 44.78% |

| 3-year | 86.45% |

| 5-year | 181.00% |

| YTD | 29.05% |

| 2023 | 31.50% |

| 2022 | -11.96% |

| 2021 | 34.94% |

| 2020 | 22.09% |

| 2019 | 34.91% |

APH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching APH

Want to do more research on Amphenol Corp's stock and its price? Try the links below:Amphenol Corp (APH) Stock Price | Nasdaq

Amphenol Corp (APH) Stock Quote, History and News - Yahoo Finance

Amphenol Corp (APH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...