Appian Corporation - (APPN): Price and Financial Metrics

APPN Price/Volume Stats

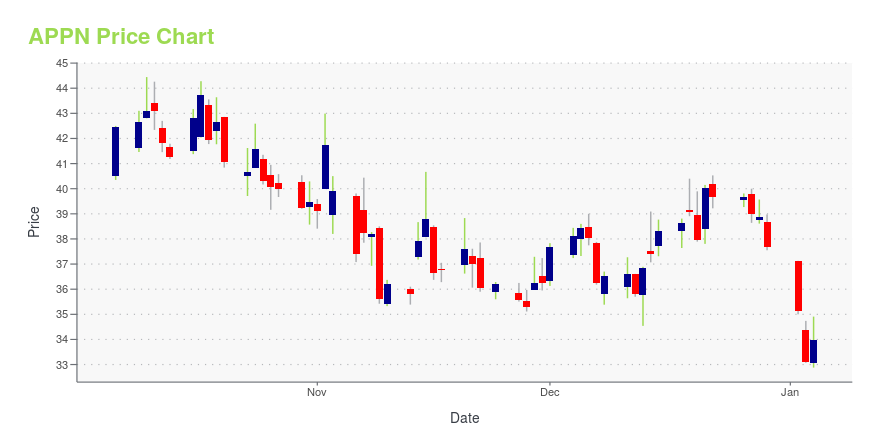

| Current price | $37.75 | 52-week high | $52.99 |

| Prev. close | $37.49 | 52-week low | $26.28 |

| Day low | $37.02 | Volume | 457,675 |

| Day high | $38.18 | Avg. volume | 530,429 |

| 50-day MA | $31.18 | Dividend yield | N/A |

| 200-day MA | $35.15 | Market Cap | 2.73B |

APPN Stock Price Chart Interactive Chart >

Appian Corporation - (APPN) Company Bio

Appian Corporation provides low-code software development platform that enables organizations to develop various applications in the United States and internationally. The company’s platform automates the creation of forms, data flows, records, reports, and other software elements that are needed to be manually coded or configured. Its principal software markets include the markets for low-code development platforms, case management software, business process management, and platform-as-a-service. The company was founded in 1999 and is based in Reston, Virginia.

Latest APPN News From Around the Web

Below are the latest news stories about APPIAN CORP that investors may wish to consider to help them evaluate APPN as an investment opportunity.

Why These 3 Machine Learning Stocks Should Be On Your Radar in 2024Adding machine learning stocks for 2024 can be a great way to add diversification. |

Appian Named a 2023 Tech100 Honoree by the Northern Virginia Technology CouncilAppian (Nasdaq: APPN) today announced its recognition as a 2023 NVTC Tech100 honoree by the Northern Virginia Technology Council (NVTC). The NVTC Tech100 awards celebrate forward-thinking companies, top executives, and emerging leaders who are making significant contributions to innovation, implementing breakthrough technologies, and driving economic growth in the National Capital Region. |

Appian Named a Leader in Digital Process Automation Software Report by Independent Research FirmAppian (Nasdaq: APPN) announced today that it is named a Leader in the new report, The Forrester Wave™: Digital Process Automation Software, Q4 2023. In the 26-criterion evaluation of 15 digital process automation (DPA) providers, Appian scored the highest of any vendor in the Current Offering category. |

Appian to Participate in Upcoming Investor ConferencesMCLEAN, Va., Dec. 01, 2023 (GLOBE NEWSWIRE) -- Appian (Nasdaq: APPN) announced today that management will be presenting and hosting meetings with institutional investors at Barclays Global Technology Conference. The presentation/fireside chat is scheduled for Wednesday, December 6, 2023 at 2:35 p.m., Eastern Standard Time. The presentations will be webcast live, and replays will be available for a limited time under the "News and Events " section of the Company's investor relations website at ht |

3 Tech Stocks to Pick Up BEFORE the Year-End RallyTech stocks are poised to quickly catalyze in value near the end of the year, and these three could surge even higher. |

APPN Price Returns

| 1-mo | 26.85% |

| 3-mo | 0.51% |

| 6-mo | 11.98% |

| 1-year | -20.56% |

| 3-year | -67.14% |

| 5-year | -5.36% |

| YTD | 0.24% |

| 2023 | 15.66% |

| 2022 | -50.07% |

| 2021 | -59.77% |

| 2020 | 324.21% |

| 2019 | 43.06% |

Continue Researching APPN

Here are a few links from around the web to help you further your research on Appian Corp's stock as an investment opportunity:Appian Corp (APPN) Stock Price | Nasdaq

Appian Corp (APPN) Stock Quote, History and News - Yahoo Finance

Appian Corp (APPN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...