Apyx Medical Corporation (APYX): Price and Financial Metrics

APYX Price/Volume Stats

| Current price | $1.34 | 52-week high | $5.82 |

| Prev. close | $1.41 | 52-week low | $1.21 |

| Day low | $1.32 | Volume | 35,400 |

| Day high | $1.39 | Avg. volume | 102,815 |

| 50-day MA | $1.46 | Dividend yield | N/A |

| 200-day MA | $1.91 | Market Cap | 46.42M |

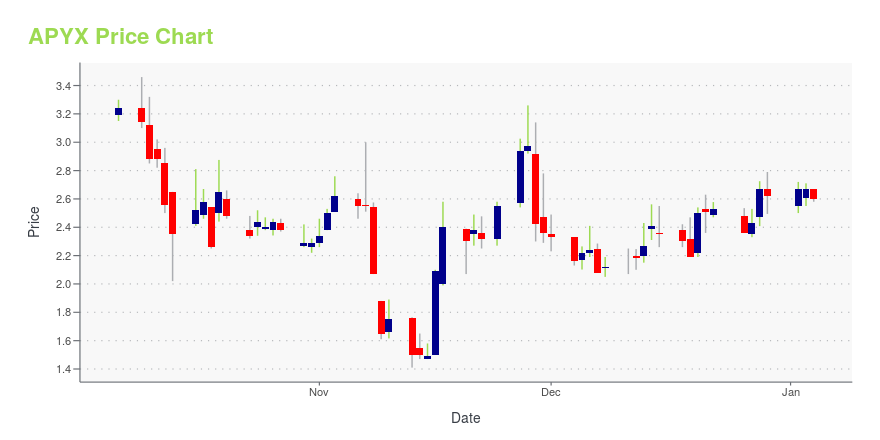

APYX Stock Price Chart Interactive Chart >

Apyx Medical Corporation (APYX) Company Bio

Apyx Medical Corporation, a energy technology company, manufactures and sells medical devices in the cosmetic and surgical markets worldwide. It operates in two segments, Advanced Energy and Original Equipment Manufacturing (OEM). The company develops J-Plasma, a patented plasma-based surgical product for cutting, coagulation, and ablation of soft tissue. It markets and sells Helium Plasma Technology under the Renuvion brand name in the cosmetic surgery market and under the J-Plasma brand name in the hospital surgical market. The company's Renuvion cosmetic technology enables plastic surgeons, fascial plastic surgeons, and cosmetic physicians to provide controlled heat to the tissue; and the J-Plasma system allows surgeons to operate in eliminating unintended tissue trauma. It also designs, develops, manufactures, and sells electrosurgical and OEM generators and related accessories for medical device manufacturers. The company was formerly known as Bovie Medical Corporation and changed its name to Apyx Medical Corporation in January 2019. Apyx Medical Corporation was incorporated in 1982 and is based in Clearwater, Florida.

Latest APYX News From Around the Web

Below are the latest news stories about APYX MEDICAL CORP that investors may wish to consider to help them evaluate APYX as an investment opportunity.

Apyx Medical Corporation Appoints Matthew Hill as Chief Financial OfficerCLEARWATER, Fla., November 28, 2023--Apyx Medical Corporation (Nasdaq:APYX) ("Apyx Medical;" the "Company"), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today announced the appointment of Matthew Hill to the position of Chief Financial Officer, effective December 4, 2023. Mr. Hill succeeds Tara Semb, whose departure was announced by the Company on November 9, 2023. |

Apyx Medical Corporation (NASDAQ:APYX) Q3 2023 Earnings Call TranscriptApyx Medical Corporation (NASDAQ:APYX) Q3 2023 Earnings Call Transcript November 9, 2023 Apyx Medical Corporation misses on earnings expectations. Reported EPS is $-0.13 EPS, expectations were $-0.1. Operator: Please stand by. Hello, and welcome, ladies and gentlemen, to the Third Quarter of Fiscal Year 2023 Earnings Conference Call for Apyx Medical Corporation. At this time, […] |

Apyx Medical Corp (APYX) Reports 31% Revenue Growth in Q3; Updates Full Year OutlookAdvanced Energy Sales Surge as Company Adjusts Annual Guidance |

Apyx Medical Corporation Announces New Debt Facility with Perceptive AdvisorsCLEARWATER, Fla., November 09, 2023--Apyx Medical Corporation (NASDAQ:APYX) (the "Company"), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today announced that the Company and its subsidiaries have entered into a new, five-year credit agreement with Perceptive Credit Holdings IV, LP ("Perceptive"), an affiliate of Perceptive Advisors. The Perceptive Credit Agreement provides for a facility of up to $45 million in senior secured term |

Apyx Medical Corporation Reports Third Quarter 2023 Financial Results and Updates Full Year 2023 Financial OutlookCLEARWATER, Fla., November 09, 2023--Apyx Medical Corporation (NASDAQ:APYX) (the "Company"), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today reported financial results for its third quarter ended September 30, 2023, and updated its financial expectations for the full year ending December 31, 2023. |

APYX Price Returns

| 1-mo | -0.74% |

| 3-mo | -7.59% |

| 6-mo | -40.97% |

| 1-year | -71.67% |

| 3-year | -85.39% |

| 5-year | -80.55% |

| YTD | -48.85% |

| 2023 | 11.97% |

| 2022 | -81.75% |

| 2021 | 78.06% |

| 2020 | -14.89% |

| 2019 | 30.56% |

Continue Researching APYX

Want to do more research on Apyx Medical Corp's stock and its price? Try the links below:Apyx Medical Corp (APYX) Stock Price | Nasdaq

Apyx Medical Corp (APYX) Stock Quote, History and News - Yahoo Finance

Apyx Medical Corp (APYX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...