Arcturus Therapeutics Holdings Inc. (ARCT): Price and Financial Metrics

ARCT Price/Volume Stats

| Current price | $24.07 | 52-week high | $45.00 |

| Prev. close | $22.98 | 52-week low | $17.52 |

| Day low | $23.26 | Volume | 398,716 |

| Day high | $25.17 | Avg. volume | 521,283 |

| 50-day MA | $28.57 | Dividend yield | N/A |

| 200-day MA | $29.29 | Market Cap | 648.25M |

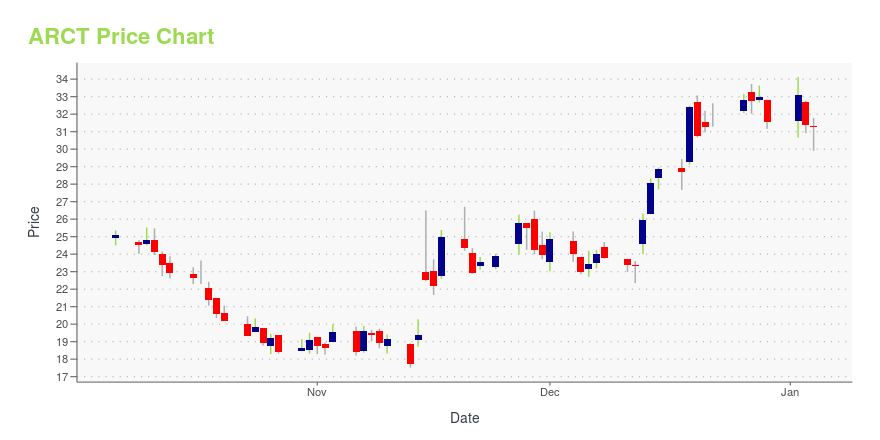

ARCT Stock Price Chart Interactive Chart >

Arcturus Therapeutics Holdings Inc. (ARCT) Company Bio

Arcturus Therapeutics Ltd a biopharmaceutical company, focuses on the development and commercialization of oral drug candidates. The company was founded in 2008 and is based in Tel Aviv, Israel.

Latest ARCT News From Around the Web

Below are the latest news stories about ARCTURUS THERAPEUTICS HOLDINGS INC that investors may wish to consider to help them evaluate ARCT as an investment opportunity.

CSL and Arcturus Therapeutics’ ARCT-154 Demonstrates Non-Inferiority to Original Strain and Superior Immunogenicity to Omicron BA.4/5 Variant Compared to First-Generation mRNA Vaccine BoosterKING OF PRUSSIA, Pa. & SAN DIEGO, December 21, 2023--Global biotechnology leader CSL (ASX:CSL; USOTC:CSLLY) and Arcturus Therapeutics (Nasdaq: ARCT) today announced the publication in Lancet Infectious Diseases of a Phase 3 study showing that a booster dose of ARCT-154, a novel, self-amplifying messenger RNA (sa-mRNA) vaccine, elicited a numerically higher immune response (meeting the non-inferiority criteria) against the original Wuhan-Hu-1 virus strain, and a superior immune response against O |

7 Undervalued Biotech Stocks That are Flying Under the Clinical RadarWith so many innovative firms skyrocketing this year, astute investors seeking compelling discounts may want to turn their attention to undervalued biotech picks. |

3 Biotech Stocks With Promising Pipelines and Big Growth Potential in 2024These biotech stocks with promising pipelines are showing some major promise and growth potential for the new year. |

Is There An Opportunity With Arcturus Therapeutics Holdings Inc.'s (NASDAQ:ARCT) 46% Undervaluation?Key Insights The projected fair value for Arcturus Therapeutics Holdings is US$47.95 based on 2 Stage Free Cash Flow to... |

12 Best Healthcare Stocks For the Long-TermIn this piece, we will take a look at the 12 best healthcare stocks for the long term. If you want to skip our overview of the healthcare industry, then you can take a look at 5 Best Healthcare Stocks For the Long-Term. The healthcare industry is one of the biggest industries in the world. […] |

ARCT Price Returns

| 1-mo | -1.67% |

| 3-mo | -9.34% |

| 6-mo | -24.12% |

| 1-year | -28.17% |

| 3-year | -22.58% |

| 5-year | 108.22% |

| YTD | -23.66% |

| 2023 | 85.91% |

| 2022 | -54.17% |

| 2021 | -14.68% |

| 2020 | 299.08% |

| 2019 | 139.96% |

Loading social stream, please wait...