Argo Group International Holdings, Ltd. (ARGO): Price and Financial Metrics

ARGO Price/Volume Stats

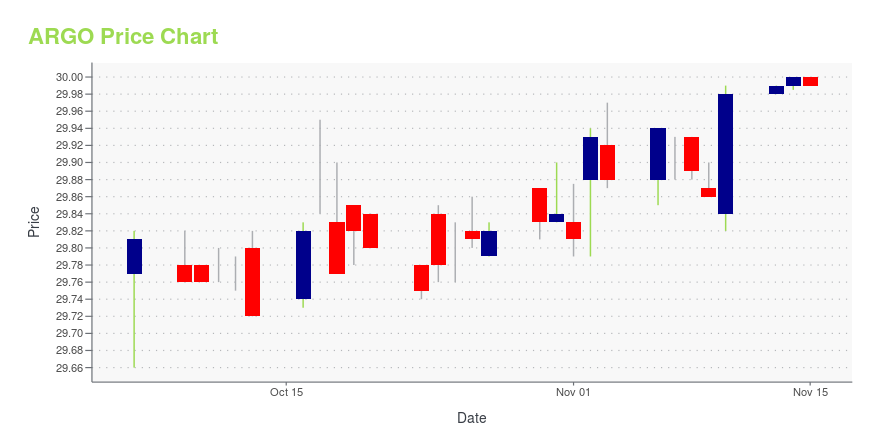

| Current price | $29.99 | 52-week high | $30.13 |

| Prev. close | $30.00 | 52-week low | $24.35 |

| Day low | $29.99 | Volume | 881,700 |

| Day high | $30.00 | Avg. volume | 443,261 |

| 50-day MA | $29.82 | Dividend yield | N/A |

| 200-day MA | $29.49 | Market Cap | 1.06B |

ARGO Stock Price Chart Interactive Chart >

Argo Group International Holdings, Ltd. (ARGO) Company Bio

Argo Group International Holdings is an international underwriter of specialty insurance and reinsurance products in the property and casualty market. The company was founded in 1986 and is based in Pembroke, Bermuda.

Latest ARGO News From Around the Web

Below are the latest news stories about ARGO GROUP INTERNATIONAL HOLDINGS LTD that investors may wish to consider to help them evaluate ARGO as an investment opportunity.

Argo Group Reports Third Quarter 2023 ResultsHAMILTON, Bermuda, November 08, 2023--Argo Group Reports Third Quarter 2023 Results |

United Fire Group (UFCS) Q3 Earnings Surpass EstimatesUnited Fire (UFCS) delivered earnings and revenue surprises of 293.75% and 0.42%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

First American Financial (FAF) Q3 Earnings Top EstimatesFirst American Financial (FAF) delivered earnings and revenue surprises of 11.93% and 5.98%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Argo Group International Holdings (NYSE:ARGO) investors are sitting on a loss of 44% if they invested five years agoThe main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have... |

Argo Group (ARGO) Banks on Segmental Growth Amid Cost WoesArgo Group (ARGO) stands to gain from highly profitable business, growth efforts, expense initiative program, investment in technology and a solid capital position. |

ARGO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 0.98% |

| 3-year | -37.64% |

| 5-year | -51.28% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -53.62% |

| 2021 | 36.11% |

| 2020 | -31.48% |

| 2019 | -0.42% |

Continue Researching ARGO

Want to do more research on Argo Group International Holdings Ltd's stock and its price? Try the links below:Argo Group International Holdings Ltd (ARGO) Stock Price | Nasdaq

Argo Group International Holdings Ltd (ARGO) Stock Quote, History and News - Yahoo Finance

Argo Group International Holdings Ltd (ARGO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...