Aris Water Solutions Inc. (ARIS): Price and Financial Metrics

ARIS Price/Volume Stats

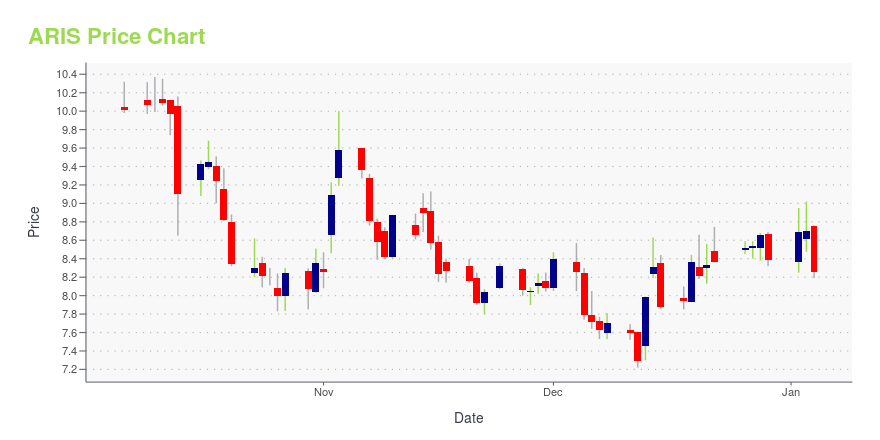

| Current price | $16.23 | 52-week high | $17.27 |

| Prev. close | $16.15 | 52-week low | $7.22 |

| Day low | $16.03 | Volume | 198,427 |

| Day high | $16.47 | Avg. volume | 327,262 |

| 50-day MA | $15.49 | Dividend yield | 2.5% |

| 200-day MA | $11.75 | Market Cap | 942.82M |

ARIS Stock Price Chart Interactive Chart >

Aris Water Solutions Inc. (ARIS) Company Bio

Aris Water Solutions, Inc. is an environmental infrastructure and solutions company which engages in the reduction of water and carbon footprints. It delivers full-cycle water handling and recycling solutions that increase the sustainability of energy company operations. It carries out its operations through its Produced Water Handling and Water Solutions businesses. The Produced Water Handling business gathers, transports, and, unless recycled, handles produced water generated from oil and natural gas production. The Water Solutions business develops and operates recycling facilities to treat, store, and recycle produced water. The company was founded by William A. Zartler in May 2021 and is headquartered in Houston, TX.

Latest ARIS News From Around the Web

Below are the latest news stories about ARIS WATER SOLUTIONS INC that investors may wish to consider to help them evaluate ARIS as an investment opportunity.

Returns On Capital Are Showing Encouraging Signs At Aris Water Solutions (NYSE:ARIS)Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key... |

Aris Water Solutions, Inc. Selected for Research Grant by the Department of EnergyHOUSTON, December 14, 2023--Aris Water Solutions, Inc. (NYSE: ARIS) ("Aris," "Aris Water," or the "Company") announced today that the Company was selected by the Department of Energy ("DOE") to receive a research grant related to the treatment and desalination of produced water as an irrigation source for non-consumptive agriculture. Building on Aris’s ongoing efforts to further beneficial reuse of treated produced water outside of the oil and gas industry, the grant is recognition of Aris’s con |

ARIS MINING INCREASES SEGOVIA GOLD MINERAL RESERVES BY +75% TO 1.3 MOZ AND ANNOUNCES PLANT EXPANSION TO INCREASE PRODUCTION RATEAris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces updated mineral reserve estimates for its Segovia Operations in Colombia effective September 30, 2023 (the "2023 Mineral Reserve"). This updated mineral reserve estimate follows the updated mineral resource estimate announced on November 2, 2023 (See News Release from November 2, 2023). Aris Mining is also increasing the capacity of the Maria Dama processing plant within the Segovia Operations from 2,000 to |

Wall Street Analysts See a 74.13% Upside in Aris Water Solutions, Inc. (ARIS): Can the Stock Really Move This High?The average of price targets set by Wall Street analysts indicates a potential upside of 74.1% in Aris Water Solutions, Inc. (ARIS). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock. |

Aris Mining (TSE:ARIS) investors are sitting on a loss of 42% if they invested three years agoAris Mining Corporation ( TSE:ARIS ) shareholders should be happy to see the share price up 19% in the last quarter... |

ARIS Price Returns

| 1-mo | 8.63% |

| 3-mo | 10.35% |

| 6-mo | 89.08% |

| 1-year | 58.45% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 96.29% |

| 2023 | -39.34% |

| 2022 | 14.20% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

ARIS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...