Arlo Technologies, Inc. (ARLO): Price and Financial Metrics

ARLO Price/Volume Stats

| Current price | $15.49 | 52-week high | $17.64 |

| Prev. close | $15.68 | 52-week low | $7.77 |

| Day low | $15.41 | Volume | 560,129 |

| Day high | $16.03 | Avg. volume | 1,015,213 |

| 50-day MA | $14.04 | Dividend yield | N/A |

| 200-day MA | $11.04 | Market Cap | 1.51B |

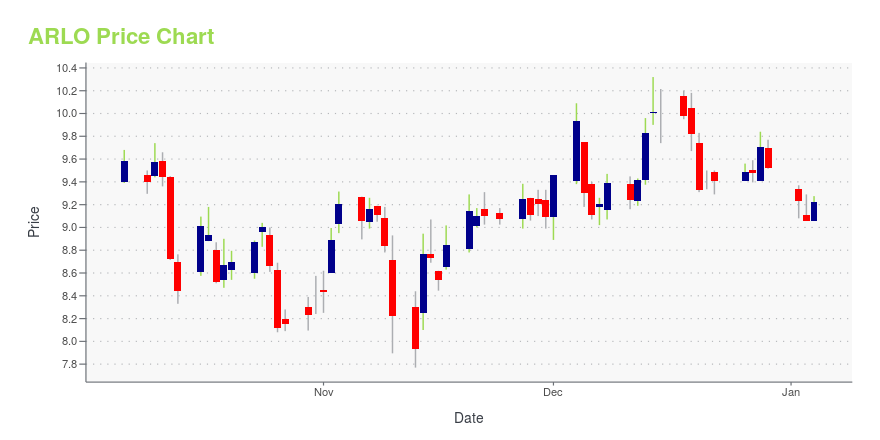

ARLO Stock Price Chart Interactive Chart >

Arlo Technologies, Inc. (ARLO) Company Bio

Arlo Technologies, Inc. provides software solutions. The Company offers cloud-based platform with a variety of connected devices such as security cameras. The company is being spun out of Netgear. The company was founded in 2014.

Latest ARLO News From Around the Web

Below are the latest news stories about ARLO TECHNOLOGIES INC that investors may wish to consider to help them evaluate ARLO as an investment opportunity.

Are Computer and Technology Stocks Lagging Arlo Technologies (ARLO) This Year?Here is how Arlo Technologies (ARLO) and Cadence Design Systems (CDNS) have performed compared to their sector so far this year. |

5 Tech Stocks That Have Returned More Than 100% in 2023Here's a sneak peek into five technology stocks that have surged more than 100% in 2023 and hold strong fundamentals for investment in 2024. |

Application Software Segment Aids Roper (ROP) Amid Cost WoesRoper (ROP) stands to benefit from the solid momentum in the Application Software unit, driven by strength across its Deltek and Aderant businesses. However, cost inflation remains a concern. |

3 Tech Stocks Under $10 to Boost Your Portfolio in 2024Here we discuss three tech stocks, AEYE, ARLO and CXDO, which are trading for less than $10 a share with the potential to continue growth in 2024. |

Is Arlo Technologies, Inc. (NYSE:ARLO) Potentially Undervalued?While Arlo Technologies, Inc. ( NYSE:ARLO ) might not be the most widely known stock at the moment, it saw a... |

ARLO Price Returns

| 1-mo | 19.25% |

| 3-mo | 31.27% |

| 6-mo | 72.88% |

| 1-year | 43.03% |

| 3-year | 152.69% |

| 5-year | 257.74% |

| YTD | 62.71% |

| 2023 | 171.23% |

| 2022 | -66.54% |

| 2021 | 34.66% |

| 2020 | 85.04% |

| 2019 | -57.82% |

Continue Researching ARLO

Want to see what other sources are saying about Arlo Technologies Inc's financials and stock price? Try the links below:Arlo Technologies Inc (ARLO) Stock Price | Nasdaq

Arlo Technologies Inc (ARLO) Stock Quote, History and News - Yahoo Finance

Arlo Technologies Inc (ARLO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...