Alliance Resource Partners L.P. (ARLP): Price and Financial Metrics

ARLP Price/Volume Stats

| Current price | $25.79 | 52-week high | $26.21 |

| Prev. close | $25.42 | 52-week low | $18.32 |

| Day low | $25.40 | Volume | 284,067 |

| Day high | $25.99 | Avg. volume | 431,531 |

| 50-day MA | $24.33 | Dividend yield | 10.92% |

| 200-day MA | $21.90 | Market Cap | 3.30B |

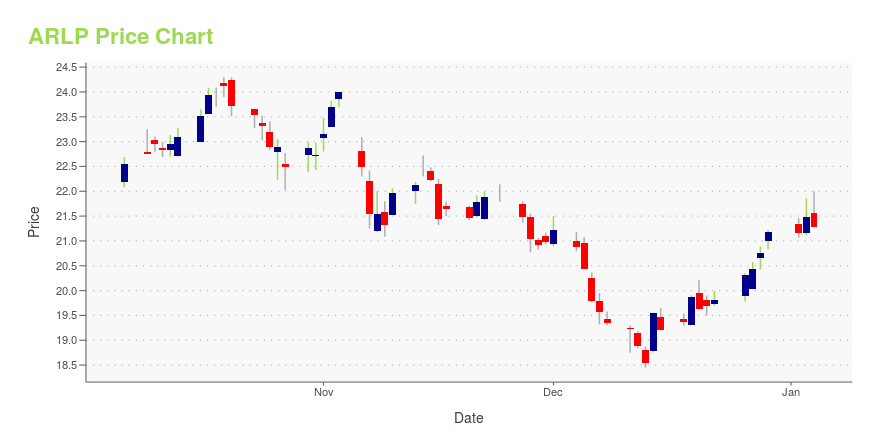

ARLP Stock Price Chart Interactive Chart >

Alliance Resource Partners L.P. (ARLP) Company Bio

Alliance Resource Partners LP is a diversified producer and marketer of coal to major United States utilities and industrial users. The company's mines are in Illinois, Indiana, Kentucky, Maryland and West Virginia. The company was founded in 1971 and is based in Tulsa, Oklahoma.

Latest ARLP News From Around the Web

Below are the latest news stories about ALLIANCE RESOURCE PARTNERS LP that investors may wish to consider to help them evaluate ARLP as an investment opportunity.

7 Mid-Cap Stocks to Buy for Steady Gains in 2024You can go small or you can go big, but ahead of market ambiguities, investors may be best served with mid-cap stocks. |

Financial Freedom: 7 Exceptional High-Yield Stocks for Lasting Passive GainsThe pursuit of financial freedom often conjures up images of dynamic markets, strategic maneuvers, and the allure of high-yield stocks. |

Want $500 in Super-Safe Dividend Income in 2024? Invest $4,850 Into the Following 3 Ultra-High-Yield Stocks.These three high-octane income stocks, which sport an average yield of 10.33%, have the tools and intangibles needed to make their patient shareholders notably richer. |

Alliance Resource Partners, L.P. (ARLP) Stock Moves -1.31%: What You Should KnowIn the latest trading session, Alliance Resource Partners, L.P. (ARLP) closed at $19.62, marking a -1.31% move from the previous day. |

Do Options Traders Know Something About Alliance Resource (ARLP) Stock We Don't?Investors need to pay close attention to Alliance Resource (ARLP) stock based on the movements in the options market lately. |

ARLP Price Returns

| 1-mo | 6.48% |

| 3-mo | 25.65% |

| 6-mo | 26.24% |

| 1-year | 55.45% |

| 3-year | 345.76% |

| 5-year | 132.61% |

| YTD | 29.75% |

| 2023 | 18.83% |

| 2022 | 73.34% |

| 2021 | 195.76% |

| 2020 | -56.80% |

| 2019 | -28.90% |

ARLP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ARLP

Here are a few links from around the web to help you further your research on Alliance Resource Partners Lp's stock as an investment opportunity:Alliance Resource Partners Lp (ARLP) Stock Price | Nasdaq

Alliance Resource Partners Lp (ARLP) Stock Quote, History and News - Yahoo Finance

Alliance Resource Partners Lp (ARLP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...