Art's-Way Manufacturing Co., Inc. (ARTW): Price and Financial Metrics

ARTW Price/Volume Stats

| Current price | $1.52 | 52-week high | $2.76 |

| Prev. close | $1.55 | 52-week low | $1.33 |

| Day low | $1.52 | Volume | 200 |

| Day high | $1.52 | Avg. volume | 9,520 |

| 50-day MA | $1.64 | Dividend yield | N/A |

| 200-day MA | $1.94 | Market Cap | 7.70M |

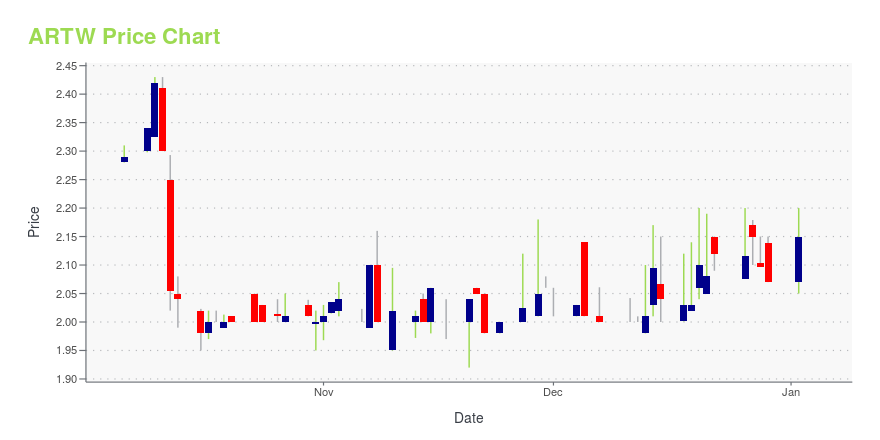

ARTW Stock Price Chart Interactive Chart >

Art's-Way Manufacturing Co., Inc. (ARTW) Company Bio

Art's-Way Manufacturing Co., Inc. manufactures and sells agricultural equipment, specialized modular science buildings, and steel cutting tools in the United States and internationally. The company operates through three segments: Agricultural Products, Modular Buildings, and Tools. The Agricultural Products segment offers specialized farm machinery, including portable and stationary animal feed processing equipment and related attachments; hay and forage equipment consisting of forage boxes, blowers, running gear, and dump boxes; portable grain augers; manure spreaders; sugar beet harvesting equipment; land maintenance equipment; moldboard plows; reels for combines and swathers; potato harvesters; grinder mixers; silage blowers and reels; land management equipment; and after-market service parts under the Art's-Way, Miller Pro, Roda, M&W, Badger, and UHC by Art's-Way brands. The Modular Buildings segment produces and sells swine buildings, complex containment research laboratories, and research facilities for academic research institutions, government research and diagnostic centers, public health institutions, and private research and pharmaceutical companies. This segment also provides services relating to the design, manufacturing, delivering, installation, and renting of the building units. The Tools segment offers standard single point brazed carbide tipped tools, and polycrystalline diamond and cubic boron nitride inserts and tools to the automotive, aerospace, oil and gas piping, and appliances industries. The company markets and sells its products through independent farm equipment dealers, manufacturers' representatives, direct sales, and original equipment manufacturer sales channels. Art's-Way Manufacturing Co., Inc. was founded in 1956 and is based in Armstrong, Iowa.

Latest ARTW News From Around the Web

Below are the latest news stories about ARTS WAY MANUFACTURING CO INC that investors may wish to consider to help them evaluate ARTW as an investment opportunity.

Here's Why We Think Art's-Way Manufacturing (NASDAQ:ARTW) Is Well Worth WatchingThe excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even... |

There's Been No Shortage Of Growth Recently For Art's-Way Manufacturing's (NASDAQ:ARTW) Returns On CapitalIf we want to find a potential multi-bagger, often there are underlying trends that can provide clues. In a perfect... |

Art’s Way Announces Revenue Growth for Q3 and First Nine Months of Fiscal 2023, Earnings Growth for the Nine Months Ended August 31, 2023ARMSTRONG, IA / ACCESSWIRE / October 11, 2023 / Art's Way Manufacturing Co., Inc. (Nasdaq:ARTW) (the "Company"), a diversified, international manufacturer and distributor of equipment serving agricultural and research industries, announces its financial ... |

Should Weakness in Art's-Way Manufacturing Co., Inc.'s (NASDAQ:ARTW) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?With its stock down 11% over the past month, it is easy to disregard Art's-Way Manufacturing (NASDAQ:ARTW). But if you... |

The Market Doesn't Like What It Sees From Art's-Way Manufacturing Co., Inc.'s (NASDAQ:ARTW) Earnings YetWhen close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 16x, you may... |

ARTW Price Returns

| 1-mo | -2.38% |

| 3-mo | -21.65% |

| 6-mo | -25.49% |

| 1-year | -42.02% |

| 3-year | -56.82% |

| 5-year | -27.96% |

| YTD | -26.57% |

| 2023 | 7.25% |

| 2022 | -45.48% |

| 2021 | 22.92% |

| 2020 | 62.71% |

| 2019 | -11.50% |

Continue Researching ARTW

Want to do more research on Arts Way Manufacturing Co Inc's stock and its price? Try the links below:Arts Way Manufacturing Co Inc (ARTW) Stock Price | Nasdaq

Arts Way Manufacturing Co Inc (ARTW) Stock Quote, History and News - Yahoo Finance

Arts Way Manufacturing Co Inc (ARTW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...