Arvinas, Inc. (ARVN): Price and Financial Metrics

ARVN Price/Volume Stats

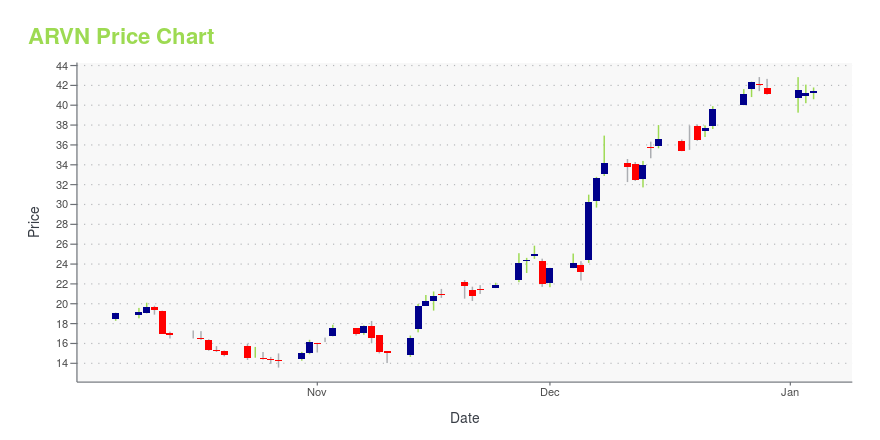

| Current price | $29.65 | 52-week high | $53.08 |

| Prev. close | $29.52 | 52-week low | $13.57 |

| Day low | $29.21 | Volume | 393,000 |

| Day high | $30.24 | Avg. volume | 774,356 |

| 50-day MA | $28.79 | Dividend yield | N/A |

| 200-day MA | $32.83 | Market Cap | 2.03B |

ARVN Stock Price Chart Interactive Chart >

Arvinas, Inc. (ARVN) Company Bio

Arvinas Inc., a biopharmaceutical company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins. Its lead products include ARV-110, proteolysis targeting chimeras (PROTAC) targeting the androgen receptor (AR) protein for the treatment of men with metastatic castration-resistant prostate cancer; and ARV-471, a PROTAC targeting the estrogen receptor protein for the treatment of women with metastatic ER+ breast cancer. The company is also developing other PROTACs for degrading AR and other clinically relevant AR point mutations; and various other products for the treatment of neurodegenerative diseases, including tauopathies. Arvinas Holding Company, LLC was founded in 2015 and is based in New Haven, Connecticut.

Latest ARVN News From Around the Web

Below are the latest news stories about ARVINAS INC that investors may wish to consider to help them evaluate ARVN as an investment opportunity.

TipRanks’ ‘Perfect 10’ List: These 3 Top-Scoring Stocks Are Poised to Perform in 2024In just a few days, we’ll celebrate a new year, with a short break to watch the Old Year out and the New Year in, ending a marathon run of holidays that started with Thanksgiving. It’s a time to gather with family, catch our breath, and get ready to plunge back into the day-to-day business of ordinary life. And for stock traders, that means finding the best stocks to add to a profitable investment portfolio. The markets put up a massive wall of raw data, all the information generated by thousand |

Wall Street Analysts Believe Arvinas, Inc. (ARVN) Could Rally 42.05%: Here's is How to TradeThe consensus price target hints at a 42.1% upside potential for Arvinas, Inc. (ARVN). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term. |

12 Most Promising Cancer Stocks According to AnalystsIn this piece, we will take a look at the 12 most promising cancer stocks according to analysts. If you want to skip our overview of the latest trends in the cancer treatment sector, then you can take a look at the 5 Most Promising Cancer Stocks According to Analysts. The advent of technology and […] |

Has Arvinas (ARVN) Outpaced Other Medical Stocks This Year?Here is how Arvinas, Inc. (ARVN) and Novo Nordisk (NVO) have performed compared to their sector so far this year. |

Pfizer (PFE), Arvinas Post Upbeat Data From Breast Cancer StudyInterim data from an early-stage study shows that treatment with Pfizer (PFE)/Arvinas' (ARVN) breast cancer combination therapy demonstrates encouraging clinical activity in heavily pre-treated patients. |

ARVN Price Returns

| 1-mo | 14.70% |

| 3-mo | -8.40% |

| 6-mo | -25.01% |

| 1-year | 32.25% |

| 3-year | -71.45% |

| 5-year | 11.55% |

| YTD | -27.96% |

| 2023 | 20.32% |

| 2022 | -58.35% |

| 2021 | -3.29% |

| 2020 | 106.69% |

| 2019 | 219.77% |

Continue Researching ARVN

Here are a few links from around the web to help you further your research on Arvinas Inc's stock as an investment opportunity:Arvinas Inc (ARVN) Stock Price | Nasdaq

Arvinas Inc (ARVN) Stock Quote, History and News - Yahoo Finance

Arvinas Inc (ARVN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...